Question: For example: A bond's refers to its face value and the amount of money that the issuing entity borrows and promises to repay on the

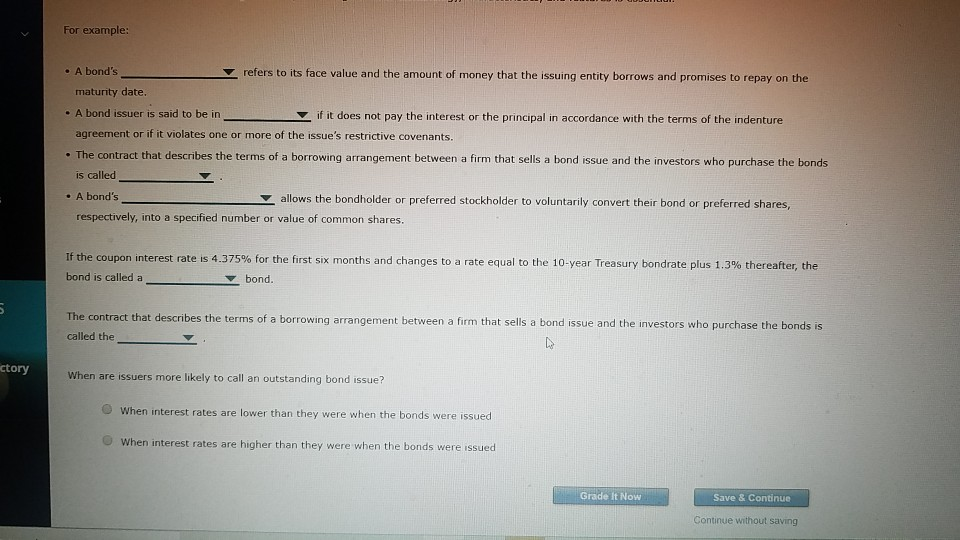

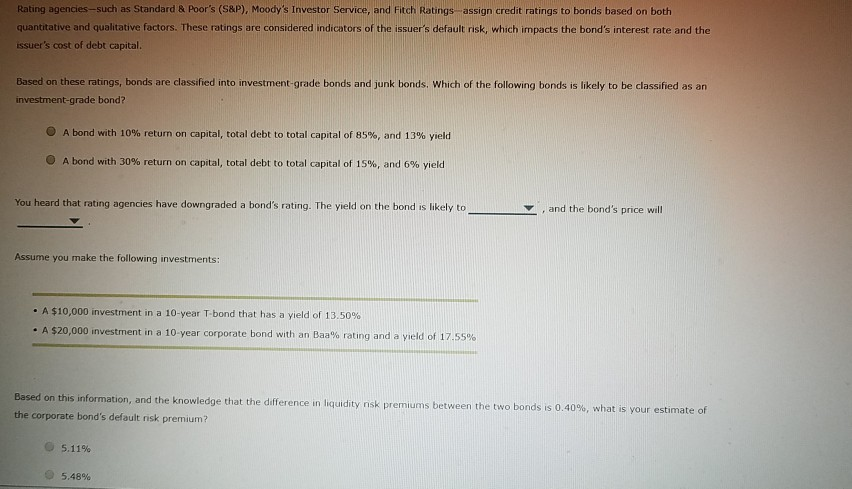

For example: A bond's refers to its face value and the amount of money that the issuing entity borrows and promises to repay on the maturity date. A bond issuer is said to be in if it does not pay the interest or the principal in accordance with the terms of the indenture agreement or if it violates one or more of the issue's restrictive covenants. The contract that describes the terms of a borrowing arrangement between a firm that sells a bond issue and the investors who purchase the bonds is called A bond's allows the bondholder or preferred stockholder to voluntarily convert their bond or preferred shares, respectively, into a specified number or value of common shares. If the coupon interest rate is 4.375% for the first six months and changes to a rate equal to the 10-year Treasury bondrate plus 1.3% thereafter, the bond is called a bond. The contract that describes the terms of a borrowing arrangement between a firm that sells a bond issue and the investors who purchase the bonds is called the ctory When are issuers more likely to call an outstanding bond issue? When interest rates are lower than they were when the bonds were issued When interest rates are higher than they were when the bonds were issued Grade It Now Save & Continue Continue without saving Rating agencies--such as Standard & Poor's (S&P), Moody's Investor Service, and Fitch Ratings assign credit ratings to bonds based on both quantitative and qualitative factors. These ratings are considered indicators of the issuer's default risk, which impacts the bond's interest rate and the issuer's cost of debt capital. Based on these ratings, bonds are classified into investment-grade bonds and junk bonds. Which of the following bonds is likely to be classified as an investment-grade bond? A bond with 10% return on capital, total debt to total capital of 85%, and 13% yield O A bond with 30% return on capital, total debt to total capital of 15%, and 6% yield You heard that rating agencies have downgraded a bond's rating. The yield on the bond is likely to , and the bond's price will Assume you make the following investments: A $10,000 investment in a 10-year T-bond that has a yield of 13.50% A $20,000 investment in a 10-year corporate bond with an Baa% rating and a yield of 17.55% Based on this information, and the knowledge that the difference in liquidity risk premiums between the two bonds is 0.40%, what is your estimate of the corporate bond's default risk premium? 5.11% 5.48%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts