Question: For five utility stocks, the table below provides the expected dividend for next year, the current market price, the expected dividend growth rate, and

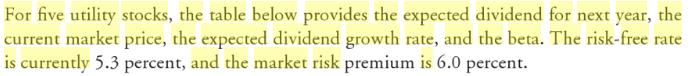

For five utility stocks, the table below provides the expected dividend for next year, the current market price, the expected dividend growth rate, and the beta. The risk-free rate is currently 5.3 percent, and the market risk premium is 6.0 percent. Dividend Price Dividend Growth Rate (g) Beta (B) Stock (Di) (Po) American Electric (NYSE: AEP) Consolidated Edison (NYSE: ED) 2.40 46.17 0.60 5.0% 0.60 2.20 39.80 5.0 64.12 Exelon Corp. (NYSE: EXC) Southern Co. (NYSE: SO) 1.69 7.0 0.80 1.34 23.25 5.5 0.65 60.13 0.65 Dominion Resources (NYSE: D) 2.58 5.5 A. Calculate the expected rate of return for each stock using the Gordon growth model. B. Calculate the required rate of return for each stock using the CAPM

Step by Step Solution

3.44 Rating (160 Votes )

There are 3 Steps involved in it

To solve this problem we will calculate the expected rate of return using the Gordon Growth Model an... View full answer

Get step-by-step solutions from verified subject matter experts