Question: Question 2 Question text Stock As expected dividend for next year is :- a. $0.378 b. $0.360 c. $0.432 d. $0.534 Question 3 Question text

Question 2

Question text

Stock As expected dividend for next year is :-

a.

$0.378

b.

$0.360

c.

$0.432

d.

$0.534

Question 3

Question text

Stock As price according to the Constant Growth Model (CGM) is:-

a.

$2.68

b.

$5.43

c.

$4.95

d.

$3.88

Question 4

Question text

Stock As systematic risk is:-

a.

1.90

b.

2.8

c.

1.60

d.

1.30

Question 5

Question text

Stock Bs price according to the P/E technique (use next-years EPS):-

a.

$14.82

b.

$13.65

c.

$12.70

d.

$15.90

Question 6

Question text

Stock Bs required return is:-

a.

15.70%

b.

14.0%

c.

18.80%

d.

17.60%

Question 7

Question text

Stock Bs total risk is:-

a.

2.12%

b.

1.86%

c.

1.50%

d.

3.70%

Question 8

Question text

The markets risk premium for stock A is:-

a.

6.0%

b.

7.0%

c.

5.0%

d.

8.0%

Question 9

Question text

The risk-free rate for stock A is:-

a.

5.0%

b.

3.0%

c.

4.0%

d.

6.0%

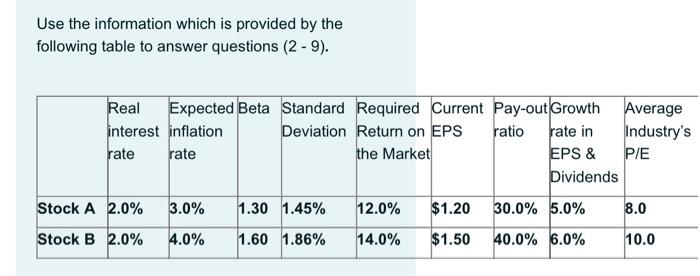

Use the information which is provided by the following table to answer questions (2-9). Real Expected Beta Standard Required Current Pay-out Growth Average interest inflation Deviation Return on EPS ratio rate in Industry's rate rate the Market EPS & P/E Dividends Stock A 2.0% 3.0% 1.30 1.45% 12.0% $1.20 30.0% 5.0% 8.0 Stock B 2.0% 4.0% 1.60 1.86% 14.0% $1.50 40.0% 6.0% 10.0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts