Question: For most of 2017, Uber has been disarray. Beyond having to give up on the China market, the company was cited for several counts of

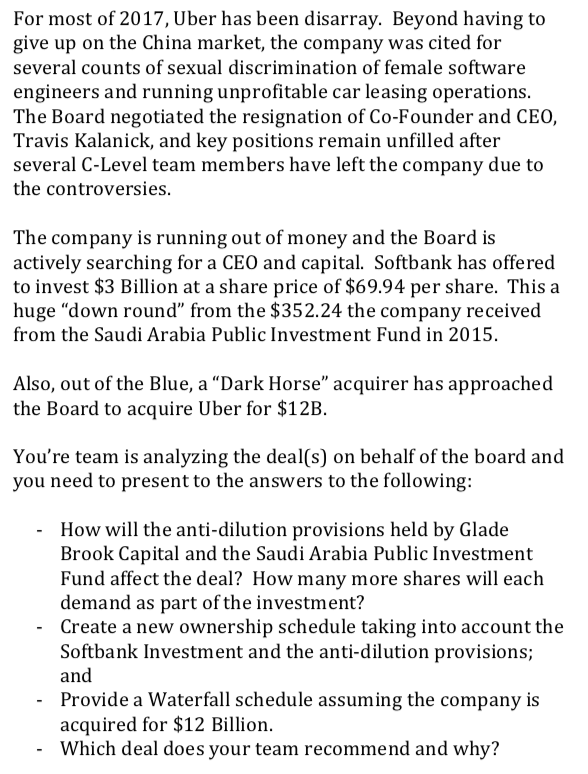

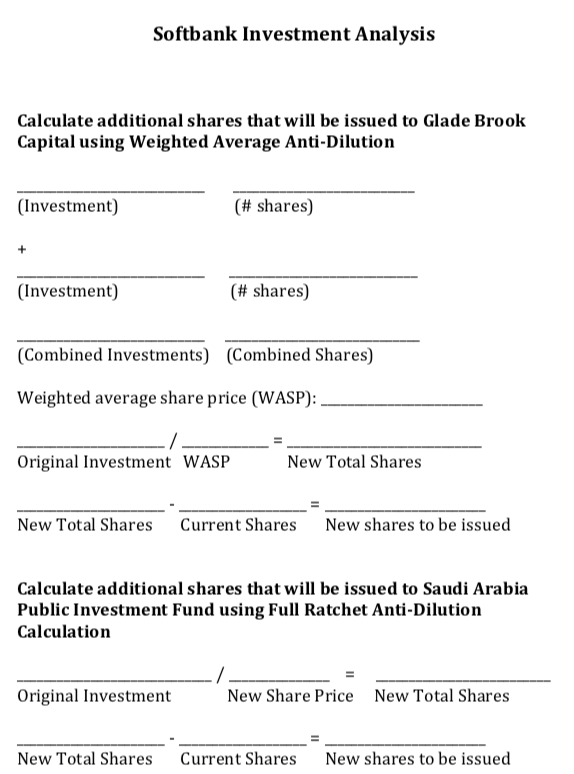

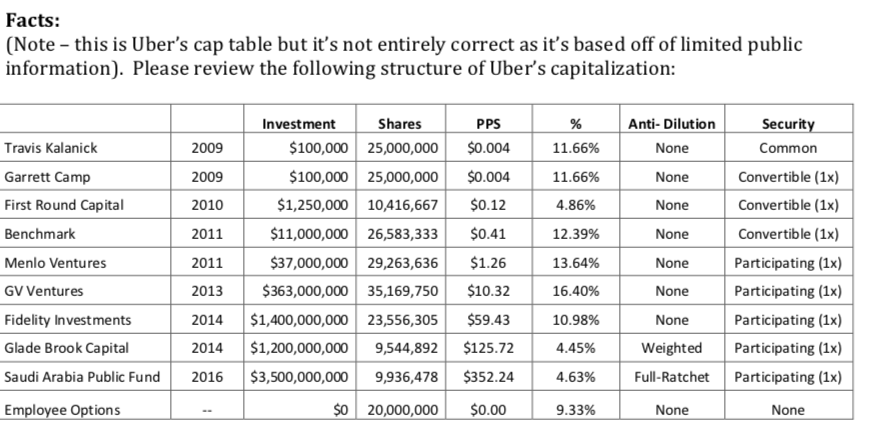

For most of 2017, Uber has been disarray. Beyond having to give up on the China market, the company was cited for several counts of sexual discrimination of female software engineers and running unprofitable car leasing operations. The Board negotiated the resignation of Co-Founder and CEO, Travis Kalanick, and key positions remain unfilled after several C-Level team members have left the company due to the controversies. The company is running out of money and the Board is actively searching for a CEO and capital. Softbank has offered to invest $3 Billion at a share price of $69.94 per share. This a huge "down round" from the $352.24 the company received from the Saudi Arabia Public Investment Fund in 2015. Also, out of the Blue, a Dark Horse acquirer has approached the Board to acquire Uber for $12B. You're team is analyzing the deal(s) on behalf of the board and you need to present to the answers to the following: How will the anti-dilution provisions held by Glade Brook Capital and the Saudi Arabia Public Investment Fund affect the deal? How many more shares will each demand as part of the investment? Create a new ownership schedule taking into account the Softbank Investment and the anti-dilution provisions; and Provide a Waterfall schedule assuming the company is acquired for $12 Billion. Which deal does your team recommend and why? Softbank Investment Analysis Calculate additional shares that will be issued to Glade Brook Capital using Weighted Average Anti-Dilution (Investment) (# shares) + (Investment) (# shares) (Combined Investments) (Combined Shares) Weighted average share price (WASP): Original Investment WASP New Total Shares New Total Shares Current Shares New shares to be issued Calculate additional shares that will be issued to Saudi Arabia Public Investment Fund using Full Ratchet Anti-Dilution Calculation Original Investment New Share Price New Total Shares New Total Shares Current Shares New shares to be issued Facts: (Note - this is Uber's cap table but it's not entirely correct as it's based off of limited public information). Please review the following structure of Uber's capitalization: 2009 2009 2010 % 11.66% 11.66% 4.86% Anti-Dilution None None None 12.39% None Travis Kalanick Garrett Camp First Round Capital Benchmark Menlo Ventures GV Ventures Fidelity Investments Glade Brook Capital Saudi Arabia Public Fund Employee Options 2011 2011 2013 Investment Shares PPS $100,000 25,000,000 $0.004 $100,000 25,000,000 $0.004 $1,250,000 10,416,667 $0.12 $11,000,000 26,583,333 $0.41 $37,000,000 29,263,636 $1.26 $363,000,000 35,169,750 $10.32 $1,400,000,000 23,556,305 $59.43 $1,200,000,000 9,544,892 $125.72 $3,500,000,000 9,936,478 $352.24 $0 20,000,000 $0.00 Security Common Convertible (1x) Convertible (1x) Convertible (1x) Participating (1x) Participating (1x) Participating (1x) Participating (1x) Participating (1x) None 13.64% 16.40% None 2014 10.98% 4.45% 2014 None Weighted Full-Ratchet 2016 4.63% 9.33% None None For most of 2017, Uber has been disarray. Beyond having to give up on the China market, the company was cited for several counts of sexual discrimination of female software engineers and running unprofitable car leasing operations. The Board negotiated the resignation of Co-Founder and CEO, Travis Kalanick, and key positions remain unfilled after several C-Level team members have left the company due to the controversies. The company is running out of money and the Board is actively searching for a CEO and capital. Softbank has offered to invest $3 Billion at a share price of $69.94 per share. This a huge "down round" from the $352.24 the company received from the Saudi Arabia Public Investment Fund in 2015. Also, out of the Blue, a Dark Horse acquirer has approached the Board to acquire Uber for $12B. You're team is analyzing the deal(s) on behalf of the board and you need to present to the answers to the following: How will the anti-dilution provisions held by Glade Brook Capital and the Saudi Arabia Public Investment Fund affect the deal? How many more shares will each demand as part of the investment? Create a new ownership schedule taking into account the Softbank Investment and the anti-dilution provisions; and Provide a Waterfall schedule assuming the company is acquired for $12 Billion. Which deal does your team recommend and why? Softbank Investment Analysis Calculate additional shares that will be issued to Glade Brook Capital using Weighted Average Anti-Dilution (Investment) (# shares) + (Investment) (# shares) (Combined Investments) (Combined Shares) Weighted average share price (WASP): Original Investment WASP New Total Shares New Total Shares Current Shares New shares to be issued Calculate additional shares that will be issued to Saudi Arabia Public Investment Fund using Full Ratchet Anti-Dilution Calculation Original Investment New Share Price New Total Shares New Total Shares Current Shares New shares to be issued Facts: (Note - this is Uber's cap table but it's not entirely correct as it's based off of limited public information). Please review the following structure of Uber's capitalization: 2009 2009 2010 % 11.66% 11.66% 4.86% Anti-Dilution None None None 12.39% None Travis Kalanick Garrett Camp First Round Capital Benchmark Menlo Ventures GV Ventures Fidelity Investments Glade Brook Capital Saudi Arabia Public Fund Employee Options 2011 2011 2013 Investment Shares PPS $100,000 25,000,000 $0.004 $100,000 25,000,000 $0.004 $1,250,000 10,416,667 $0.12 $11,000,000 26,583,333 $0.41 $37,000,000 29,263,636 $1.26 $363,000,000 35,169,750 $10.32 $1,400,000,000 23,556,305 $59.43 $1,200,000,000 9,544,892 $125.72 $3,500,000,000 9,936,478 $352.24 $0 20,000,000 $0.00 Security Common Convertible (1x) Convertible (1x) Convertible (1x) Participating (1x) Participating (1x) Participating (1x) Participating (1x) Participating (1x) None 13.64% 16.40% None 2014 10.98% 4.45% 2014 None Weighted Full-Ratchet 2016 4.63% 9.33% None None

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts