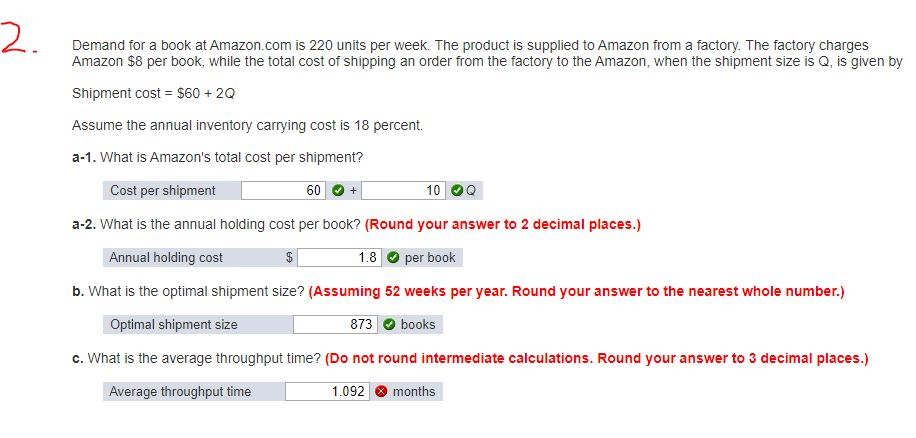

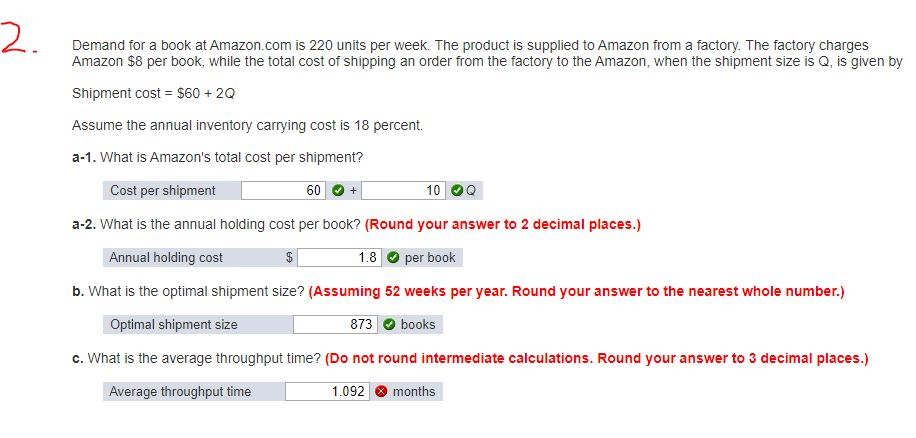

Question: For number 2, I need help with part C. BELOW THESE ARE WRONG ANSWERS FOR NUMBER 2. 1.092 30.876 17.575 41.425 Demand for a book

For number 2, I need help with part C.

BELOW THESE ARE WRONG ANSWERS FOR NUMBER 2.

1.092

30.876

17.575

41.425

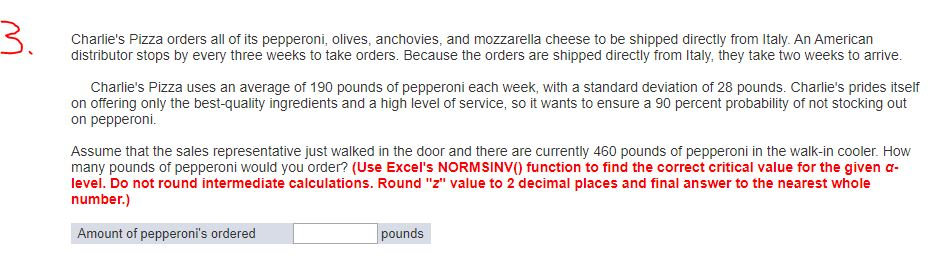

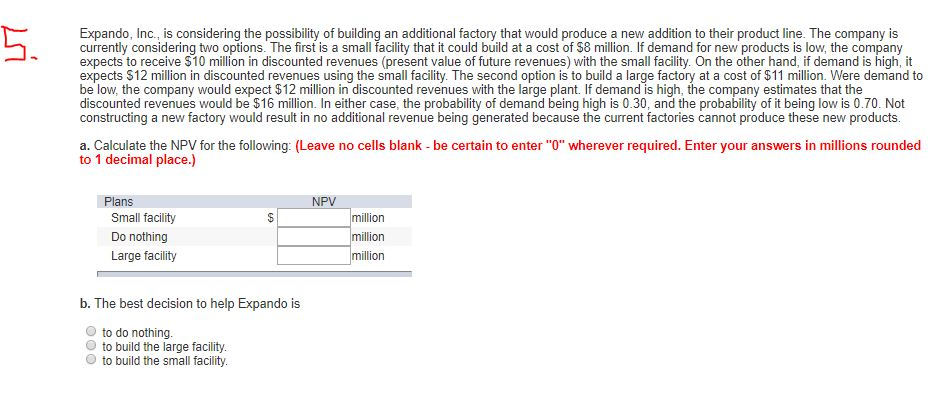

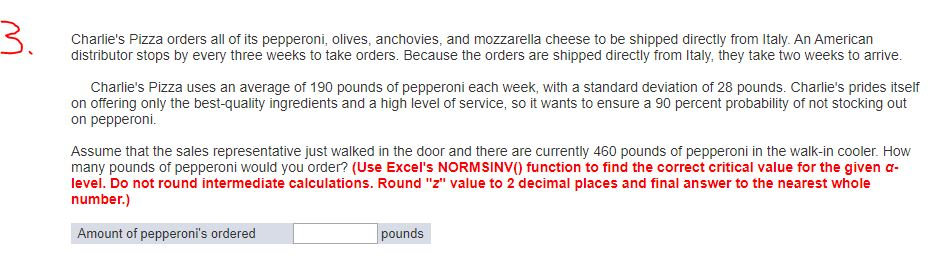

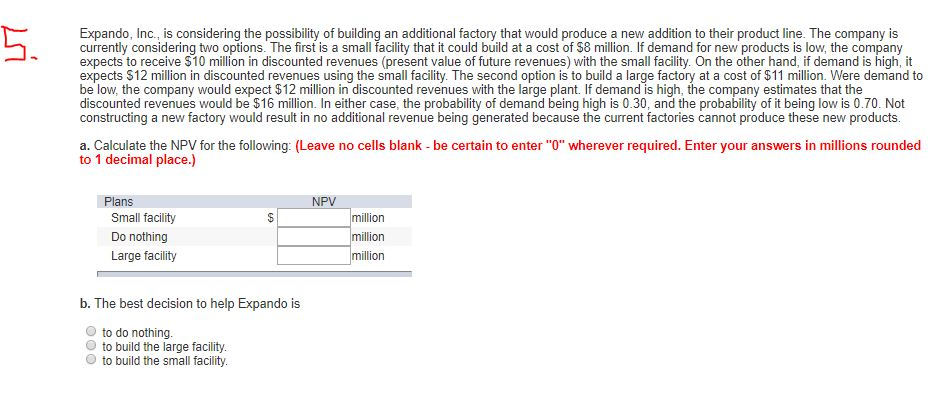

Demand for a book at Amazon.com is 220 units per week. The product is supplied to Amazon from a factory. The factory charges Amazon $8 per book, while the total cost of shipping an order from the factory to the Amazon, when the shipment size is Q, is given by Shipment cost = $60 + 20 Assume the annual inventory carrying cost is 18 percent a-1. What is Amazon's total cost per shipment? Cost per shipment 60 + 10 a-2. What is the annual holding cost per book? (Round your answer to 2 decimal places.) Annual holding cost 1.8 per book b. What is the optimal shipment size? (Assuming 52 weeks per year. Round your answer to the nearest whole number.) Optimal shipment size 873 books c. What is the average throughput time? (Do not round intermediate calculations. Round your answer to 3 decimal places.) Average throughput time 1.092 months Charlie's Pizza orders all of its pepperoni, olives, anchovies, and mozzarella cheese to be shipped directly from Italy. An American distributor stops by every three weeks to take orders. Because the orders are shipped directly from Italy, they take two weeks to arrive. Charlie's Pizza uses an average of 190 pounds of pepperoni each week, with a standard deviation of 28 pounds. Charlie's prides itself on offering only the best-quality ingredients and a high level of service, so it wants to ensure a 90 percent probability of not stocking out on pepperoni. Assume that the sales representative just walked in the door and there are currently 460 pounds of pepperoni in the walk-in cooler. How many pounds of pepperoni would you order? (Use Excel's NORMSINV() function to find the correct critical value for the given a- level. Do not round intermediate calculations. Round "z" value to 2 decimal places and final answer to the nearest whole number.) Amount of pepperoni's ordered pounds Expando, Inc., is considering the possibility of building an additional factory that would produce a new addition to their product line. The company is currently considering two options. The first is a small facility that it could build at a cost of $8 million. If demand for new products is low, the company expects to receive $10 million in discounted revenues (present value of future revenues) with the small facility. On the other hand, if demand is high, it expects $12 million in discounted revenues using the small facility. The second option is to build a large factory at a cost of $11 million. Were demand to be low, the company would expect $12 million in discounted revenues with the large plant. If demand is high, the company estimates that the discounted revenues would be $16 million. In either case, the probability of demand being high is 0.30, and the probability of it being low is 0.70. Not constructing a new factory would result in no additional revenue being generated because the current factories cannot produce these new products. a. Calculate the NPV for the following: (Leave no cells blank - be certain to enter "0" wherever required. Enter your answers in millions rounded to 1 decimal place.) NPV Plans Small facility Do nothing Large facility million million million b. The best decision to help Expando is to do nothing. to build the large facility. to build the small facility