Question: For part a pls answer 1-9 journal entry. During 20X8, the following transfers and transactions between funds took place in the City of Matthew 1.

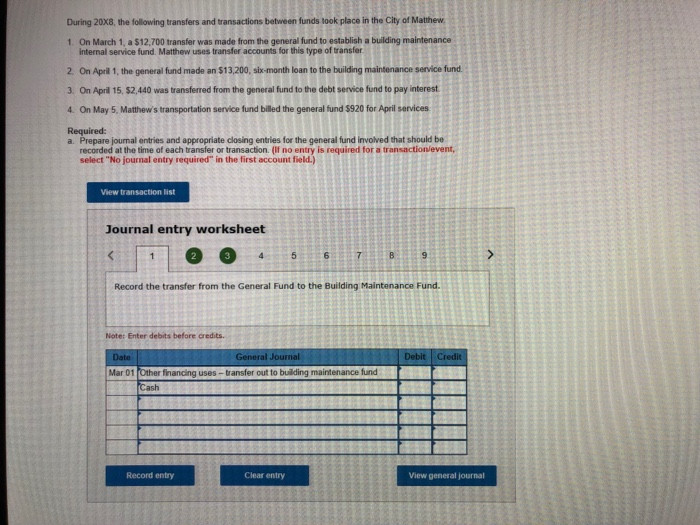

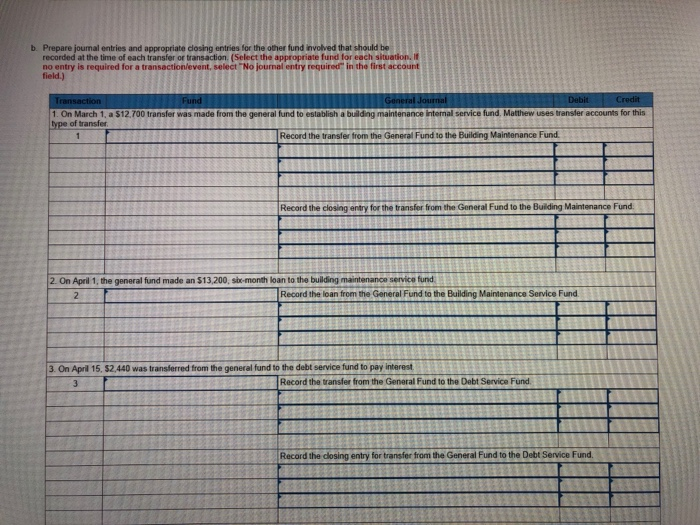

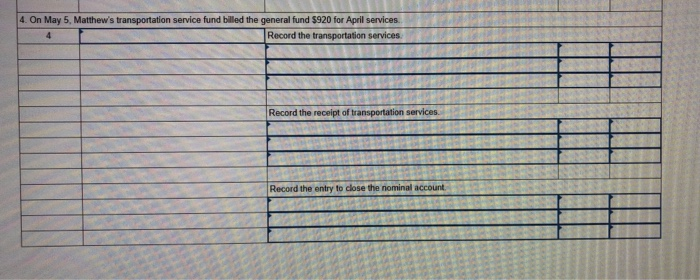

During 20X8, the following transfers and transactions between funds took place in the City of Matthew 1. On March 1, a $12.700 transfer was made from the general fund to establish a building maintenance internal service fund. Matthew uses transfer accounts for this type of transfer 2. On April 1, the general fund made an $13,200, six-month loan to the building maintenance service fund 3. On April 15, $2.440 was transferred from the general fund to the debt service fund to pay interest 4 On May 5, Matthew's transportation service fund billed the general fund $920 for April services Required: a. Prepare jourmal entries and appropriate closing entries for the general fund involved that should be recorded at the time of each transfer or transaction. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts