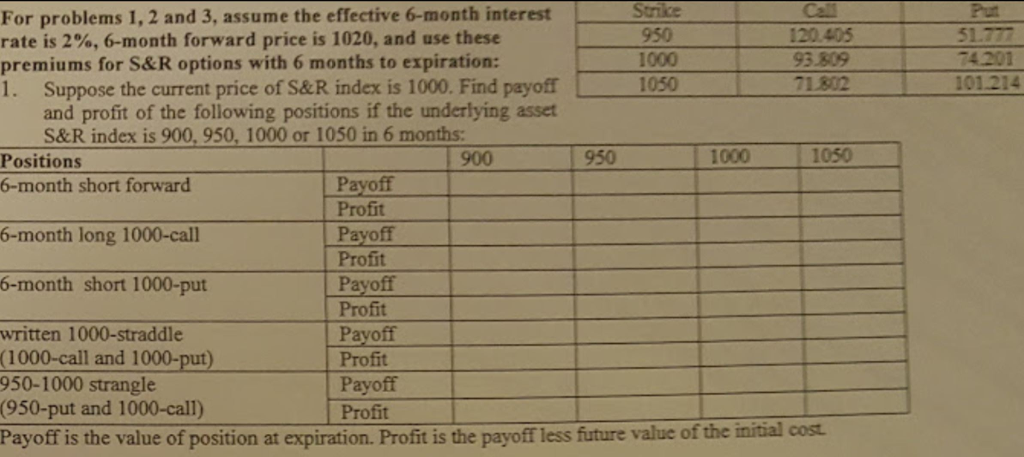

Question: For problems 1, 2 and 3. assume the effective 6-month interest rate is 2%, 6-month forward price is 1020, and use these premiums for S&R

For problems 1, 2 and 3. assume the effective 6-month interest rate is 2%, 6-month forward price is 1020, and use these premiums for S&R options with 6 months to expiration: Suppose the current price of S&R index is 1000. Find payoff and profit of the following positions if the underlying asset S&R index is 900, 950, 1000 or 1050 in 6 months: Payoff is the value of position at expiration. Profit is the payoff less future value of the initial cost. For problems 1, 2 and 3. assume the effective 6-month interest rate is 2%, 6-month forward price is 1020, and use these premiums for S&R options with 6 months to expiration: Suppose the current price of S&R index is 1000. Find payoff and profit of the following positions if the underlying asset S&R index is 900, 950, 1000 or 1050 in 6 months: Payoff is the value of position at expiration. Profit is the payoff less future value of the initial cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts