Question: For problems 7 and 8. Your client, Bo Regard, holds a complete portfolio that consists of a portfolio of risky assets (P) and T-Bills. The

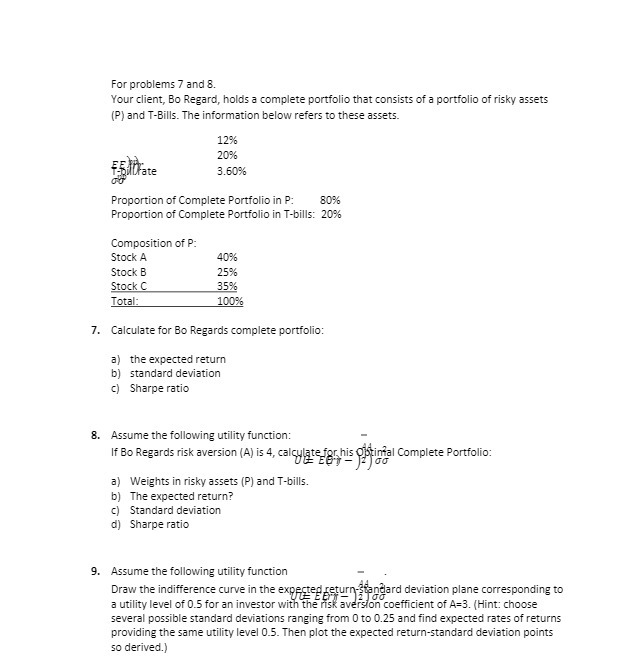

For problems 7 and 8. Your client, Bo Regard, holds a complete portfolio that consists of a portfolio of risky assets (P) and T-Bills. The information below refers to these assets. 12% 20% 3.60% Proportion of Complete Portfolio in P: 80% Proportion of Complete Portfolio in T-bills: 20% Composition of P: Stock A 40% Stock B 25% Stock C 35% Total 100% 7. Calculate for Bo Regards complete portfolio: a) the expected return bj standard deviation c) Sharpe ratio 8. Assume the following utility function: If Bo Regards risk aversion (A) is 4, calculate for his Optimal Complete Portfolio: a) Weights in risky assets (P) and T-bills. b) The expected return? c) Standard deviation d) Sharpe ratio 9. Assume the following utility function Draw the indifference curve in the expected return-standard deviation plane corresponding to a utility level of 0.5 for an investor with the risk aversion coefficient of A=3. (Hint: choose several possible standard deviations ranging from 0 to 0.25 and find expected rates of returns providing the same utility level 0.5. Then plot the expected return-standard deviation points so derived.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts