Question: no excel answer Your client, Bo Regard, holds a complete portfolio that consists of a portfolio of risky assets ( P) and T-Bills. The information

no excel answer

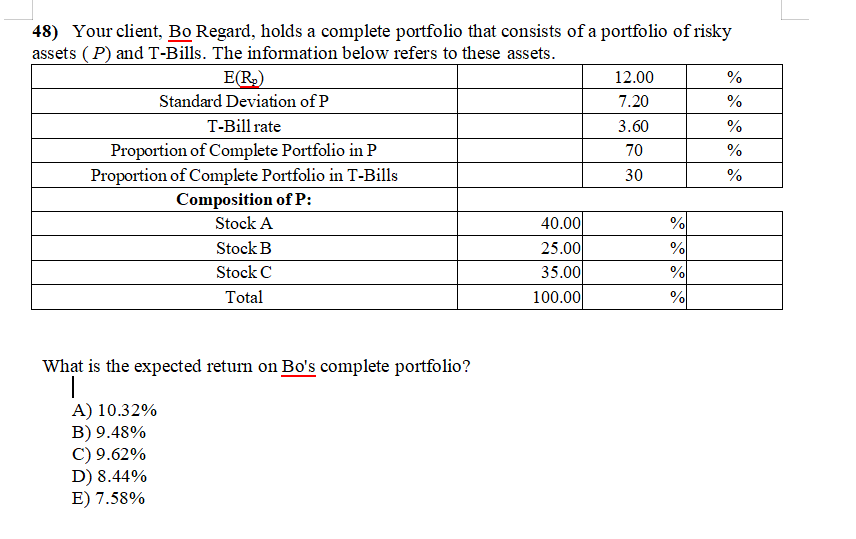

Your client, Bo Regard, holds a complete portfolio that consists of a portfolio of risky assets ( P) and T-Bills. The information below refers to these assets. E(Rp) 12.00 % Standard Deviation of P 7.20 % T-Bill rate 3.60 % Proportion of Complete Portfolio in P 70 % Proportion of Complete Portfolio in T-Bills 30 % Composition of P: Stock A 40.00 % Stock B 25.00 % Stock C 35.00 % Total 100.00 % What is the expected return on Bo's complete portfolio? A) 10.32% B) 9.48% C) 9.62% D) 8.44% E) 7.58%

48) Your client, Bo Regard, holds a complete portfolio that consists of a portfolio of risky assets (P) and T-Bills. The information below refers to these assets. What is the expected return on Bo's complete portfolio? A) 10.32% B) 9.48% C) 9.62% D) 8.44% E) 7.58% 48) Your client, Bo Regard, holds a complete portfolio that consists of a portfolio of risky assets (P) and T-Bills. The information below refers to these assets. What is the expected return on Bo's complete portfolio? A) 10.32% B) 9.48% C) 9.62% D) 8.44% E) 7.58%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts