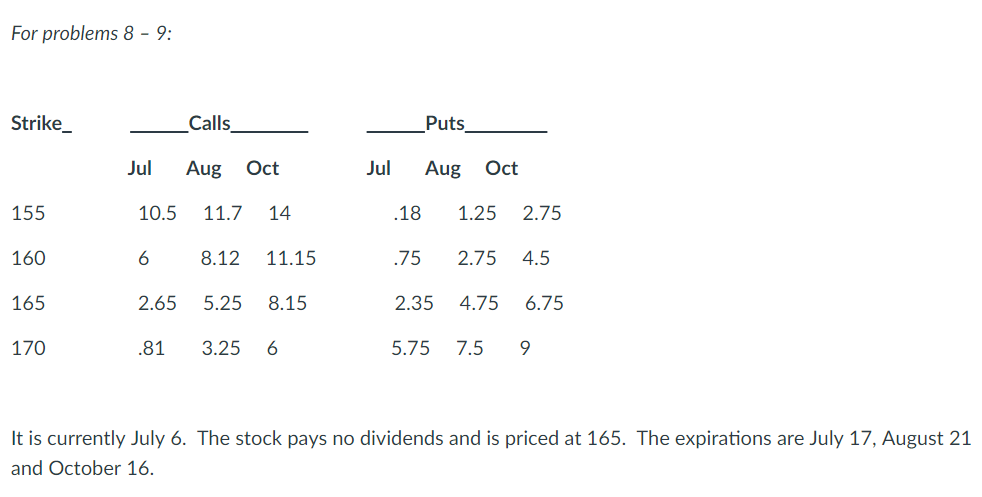

Question: For problems 8-9 Strike Calls Puts Jul Aug Oct Jul Aug Oct 155 160 165 170 10.5 11.7 14 6 8.12 11.15 2.65 5.25 8.15

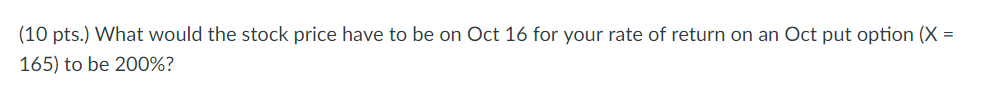

For problems 8-9 Strike Calls Puts Jul Aug Oct Jul Aug Oct 155 160 165 170 10.5 11.7 14 6 8.12 11.15 2.65 5.25 8.15 81 3.25 6 18 1.25 2.75 75 2.75 4.5 2.35 4.75 6.75 5.75 7.59 It is currently July 6. The stock pays no dividends and is priced at 165. The expirations are July 17, August 21 and October 16. 10 pts.) What would the stock price have to be on Oct 16 for your rate of return on an Oct put option (X 165) to be 200%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts