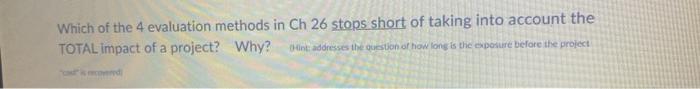

Question: For question #2, this is thw 4 eval methods in ch. 26: Payback Period Method Accounting Rate of Return (ARR) Method Net Present Value (NPV)

For question #2, this is thw 4 eval methods in ch. 26:

Payback Period Method

Accounting Rate of Return (ARR) Method

Net Present Value (NPV) Method

Internal Rate of Return (IRR) Method

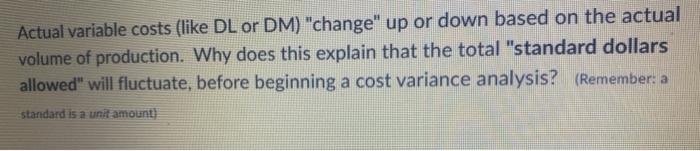

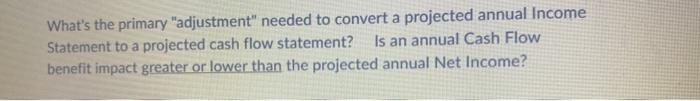

Actual variable costs (like DL or DM) "change" up or down based on the actual volume of production. Why does this explain that the total "standard dollars allowed" will fluctuate, before beginning a cost variance analysis? (Remember: a standard is a unit amount) Which of the 4 evaluation methods in Ch 26 stops short of taking into account the TOTAL impact of a project? Why? nadomesses the question of how long is the exposure before the project What's the primary "adjustment" needed to convert a projected annual Income Statement to a projected cash flow statement? Is an annual Cash Flow benefit impact greater or lower than the projected annual Net Income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts