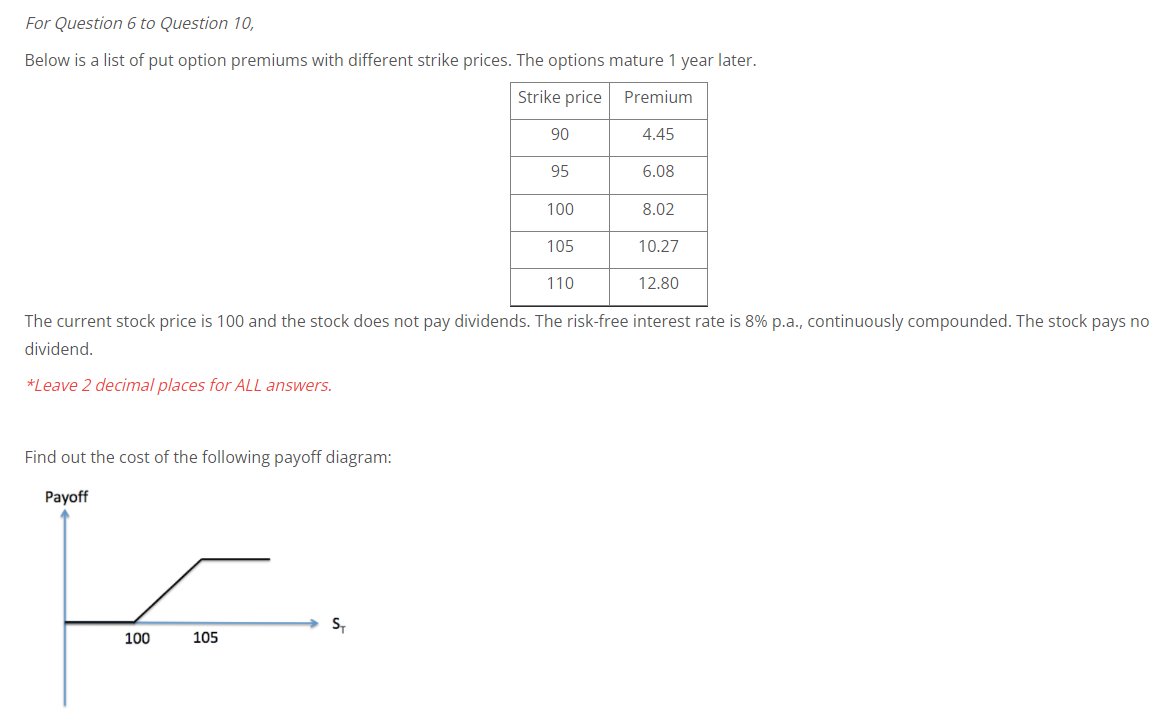

Question: For Question 6 to Question 10, Below is a list of put option premiums with different strike prices. The options mature 1 year later. Strike

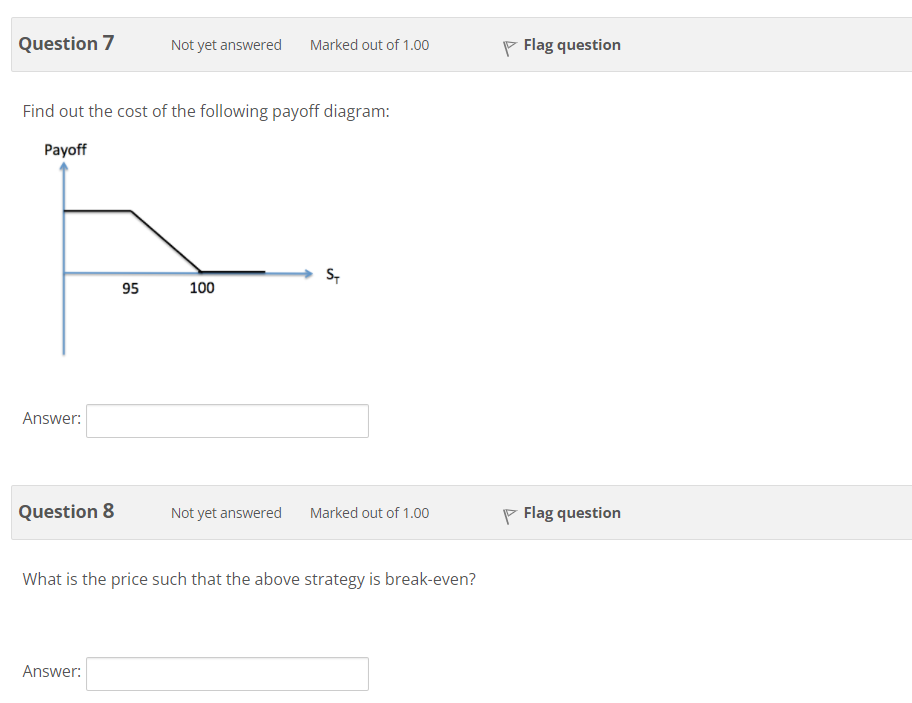

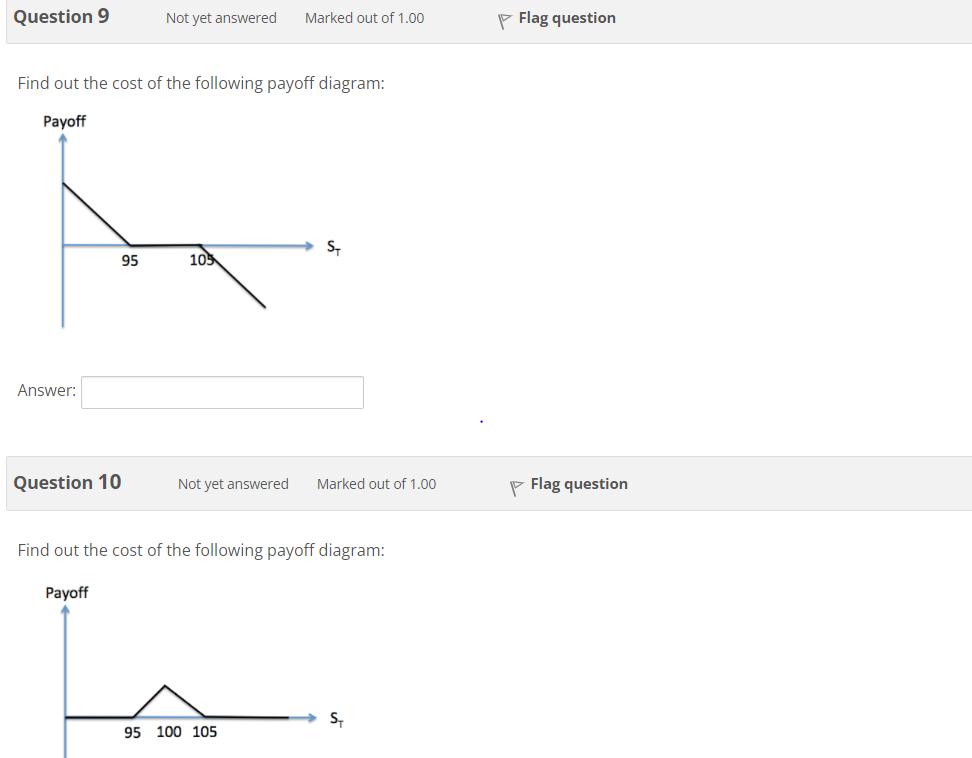

For Question 6 to Question 10, Below is a list of put option premiums with different strike prices. The options mature 1 year later. Strike price Premium 90 4.45 95 6.08 100 8.02 105 10.27 110 12.80 The current stock price is 100 and the stock does not pay dividends. The risk-free interest rate is 8% p.a., continuously compounded. The stock pays no dividend. *Leave 2 decimal places for ALL answers. Find out the cost of the following payoff diagram: Payoff S. 100 105 Question 7 Not yet answered Marked out of 1.00 P Flag question Find out the cost of the following payoff diagram: Payoff S, 95 100 Answer: Question 8 Not yet answered Marked out of 1.00 p Flag question What is the price such that the above strategy is break-even? Answer: Question 9 Not yet answered Marked out of 1.00 Flag question Find out the cost of the following payoff diagram: Payoff 95 105 Answer: Question 10 Not yet answered Marked out of 1.00 p Flag question Find out the cost of the following payoff diagram: Payoff S 95 100 105 For Question 6 to Question 10, Below is a list of put option premiums with different strike prices. The options mature 1 year later. Strike price Premium 90 4.45 95 6.08 100 8.02 105 10.27 110 12.80 The current stock price is 100 and the stock does not pay dividends. The risk-free interest rate is 8% p.a., continuously compounded. The stock pays no dividend. *Leave 2 decimal places for ALL answers. Find out the cost of the following payoff diagram: Payoff S. 100 105 Question 7 Not yet answered Marked out of 1.00 P Flag question Find out the cost of the following payoff diagram: Payoff S, 95 100 Answer: Question 8 Not yet answered Marked out of 1.00 p Flag question What is the price such that the above strategy is break-even? Answer: Question 9 Not yet answered Marked out of 1.00 Flag question Find out the cost of the following payoff diagram: Payoff 95 105 Answer: Question 10 Not yet answered Marked out of 1.00 p Flag question Find out the cost of the following payoff diagram: Payoff S 95 100 105

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts