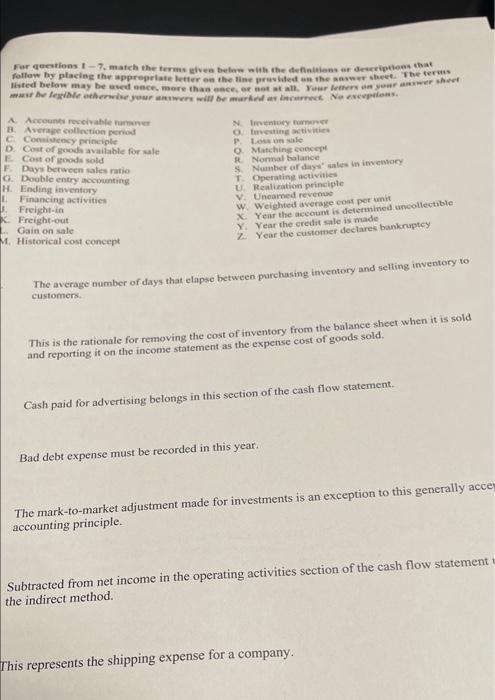

Question: For questions 1-7, match the terms given below with the definitions or descriptions tha follow by placing the appropriate letter on the line provided on

A. Accountr roceivakle humaver A. Averape collinetion perriod C. Conaishency primeind D. Cont of evocili avaliable for sale F. Days between sales ratio C. Double entry acconuting If. Endinge firvicntory 2. Financing activities 1. Freight-in K. Freightrout Cain on sale M. Historical cost concept N. Imexntusy curnerese Q. Imvesties activities p. I roe in wale O. Mutehing soocept \&. Nommal balanee S. Nomal balance T. Operatine activities i. Pealination principle V. Unearned revenuc W. Weighed averaje cons por unit W. Year the accoun is determined uncollectible Y. Year the credit sale is made Z. Year the customer declares bankruptey The average number of days that elapse between purchasing inventory and selling inventory to customers. This is the rationale for removing the cost of inventory from the balance sheet when it is sold This is the rationale for removing the cost of inventory from the balance shect Cash paid for advertising belongs in this section of the cash flow statement. Bad debt expense must be recorded in this year. The mark-to-market adjustment made for investments is an exception to this generally acce accounting principle. Subtracted from net income in the operating activities section of the cash flow statement the indirect method. This represents the shipping expense for a company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts