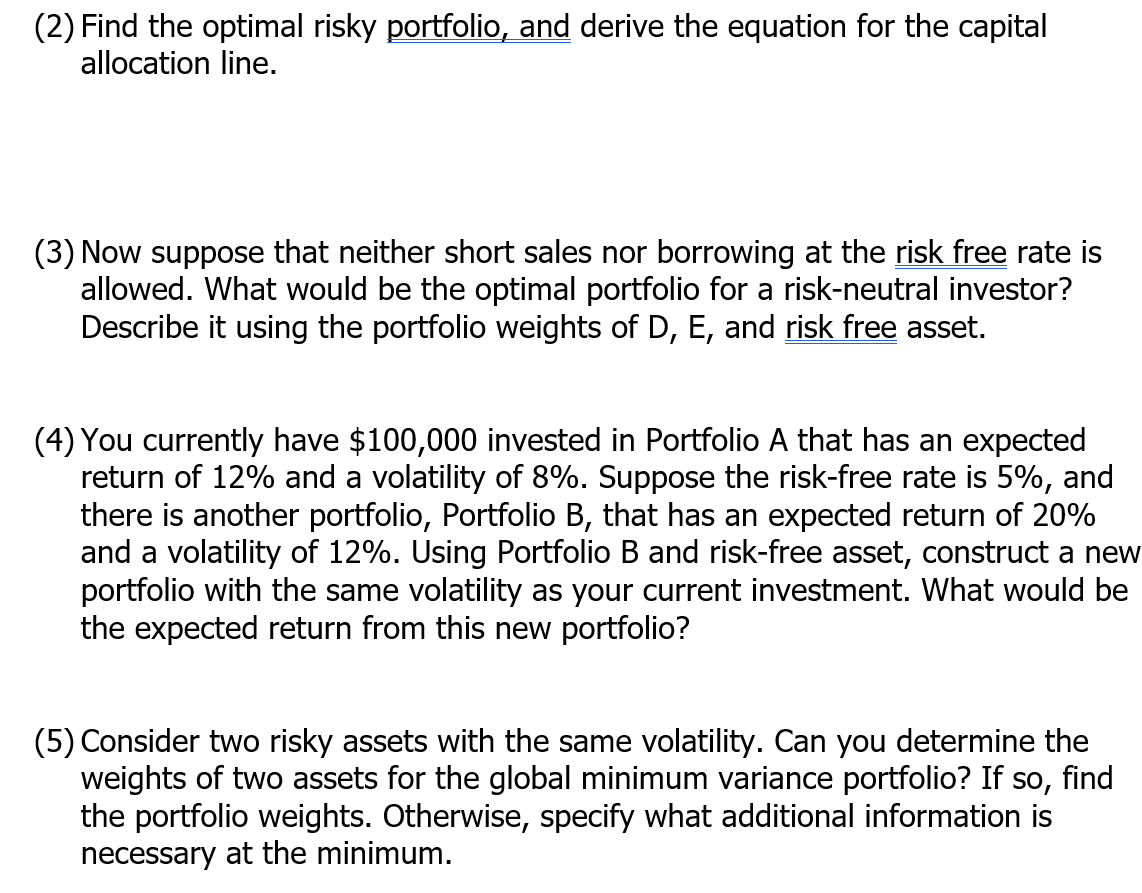

Question: [For Questions (2) - (3)] The data shown below apply to two efficient portfolios. Assume that short sales and borrowing at the risk free rate

![[For Questions (2) - (3)] The data shown below apply to](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66fe41bbc6d50_00366fe41bb63410.jpg)

[For Questions (2) - (3)] The data shown below apply to two efficient portfolios. Assume that short sales and borrowing at the risk free rate are allowed and that the risk free rate is 5 percent. D E 8% 13% 12% 20% Expected return, E() Standard deviation, o Covariance, Cov(rore) Correlation coefficient, PDE 0.0072 0.30 (2) Find the optimal risky portfolio, and derive the equation for the capital allocation line. (3) Now suppose that neither short sales nor borrowing at the risk free rate is allowed. What would be the optimal portfolio for a risk-neutral investor? Describe it using the portfolio weights of D, E, and risk free asset. (4) You currently have $100,000 invested in Portfolio A that has an expected return of 12% and a volatility of 8%. Suppose the risk-free rate is 5%, and there is another portfolio, Portfolio B, that has an expected return of 20% and a volatility of 12%. Using Portfolio B and risk-free asset, construct a new portfolio with the same volatility as your current investment. What would be the expected return from this new portfolio? (5) Consider two risky assets with the same volatility. Can you determine the weights of two assets for the global minimum variance portfolio? If so, find the portfolio weights. Otherwise, specify what additional information is necessary at the minimum

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts