Question: For ref 7,8 and 9, how to get those numbers by showing the workings and explain why On 1 July 2014, Pepper Ltd acquired all

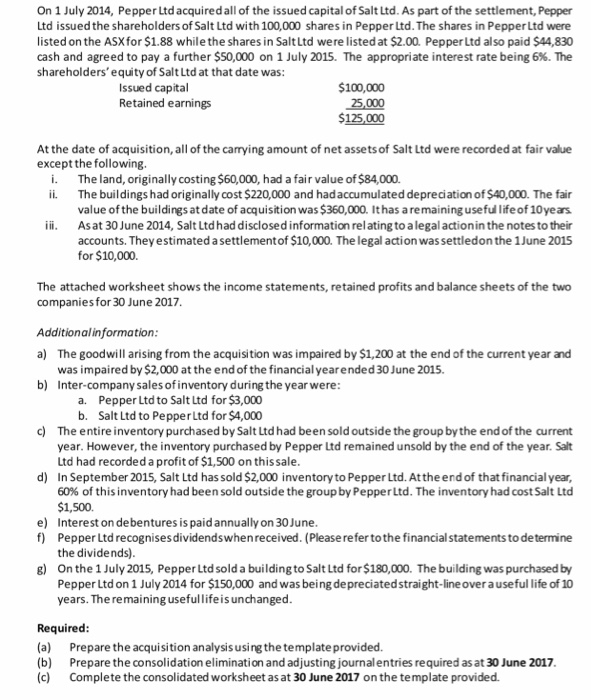

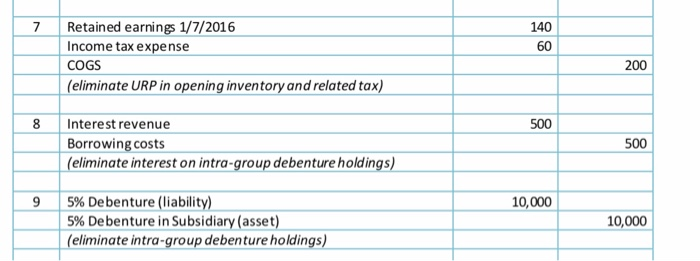

On 1 July 2014, Pepper Ltd acquired all of the issued capital of Salt Ltd. As part of the settlement, Pepper Ltd issued the shareholders of Salt Ltd with 100,000 shares in PepperLtd.The shares in PepperLtd were listed on the ASXfor $1.88 while the shares in Salt Ltd were listed at $2.00. PepperLtd also paid $44,830 cash and agreed to pay a further $50,000 on 1 July 2015, The appropriate interest rate being 6%. The shareholders' equity of Salt Ltd at that date was: Issued capital Retained earnings $100,000 25,000 125,000 At the date of acquisition, all of the carrying amount of net assets of Salt Ltd were recorded at fair value except the following i. ii. The land, originally costing $60,000, had a fair value of $84,000. The buildings had originally cost $220,000 and hadaccumulated depreciation of $40,000. The fair value of the buildings at date of acquisition was $360,000. It has a remaining useful life of 10yeas i Asat 30 June 2014, Salt Ltd had disclosed information rel ating to alegalactionin the notes to their accounts. They estimated a settlementof $10,000. The legal action wassettledon the 1June 2015 for $10,000. The attached worksheet shows the income statements, retained profits and balance sheets of the two companies for 30 June 2017 Additionalinformation a) The goodwill arising from the acquisition was impaired by $1,200 at the end of the current year and was impaired by $2,000 at the end of the financial yearended 30 June 2015 Inter-company sales of inventory during the year were b) a. b. Pepper Ltd to Salt Ltd for $3,000 Salt Ltd to PepperLtd for $4,000 c) The entire inventory purchased by Salt Ltd had been sold outside the group by the end of the current year. However, the inventory purchased by Pepper Ltd remained unsold by the end of the year. Salt Ltd had recorded a profit of $1,500 on thissale In September 2015, Salt Ltd has sold $2,000 inventory to Pepper Ltd. Attheend of that financial year 60% of this inventory had been sold outside the group by Pepper Ltd. The inventory had cost Salt Ltd $1,500. Interest on debentures is paidannually on 30 June Pepper Ltd recognisesdividendswhenreceived. (Please refer tothe financial statements to determine the dividends) On the 1 July 2015, Pepper Ltd sold a building to Salt Ltd for $180,000. The building was purchased by Pepper Ltd on 1 July 2014 for $150,000 and was being depreciatedstraight-line over auseful life of 10 years. The remaining usefullifeis unchanged d) e) f) g) Required (a) Prepare the acquisition analysisusing the template provided. (b) Prepare the consolidation elimination and adjusting journalentries required as at 30 June 2017 (c) Complete the consolidated worksheet as at 30 June 2017 on the template provided. 140 60 7 Retained earnings 1/7/2016 Income tax expense COGS (eliminateURP in opening inventory and related tax) 200 8 Interest revenue 500 Borrowing costs (eliminate interest on intra-group debenture holdings) 500 10,000 5% Debenture in Subsidiary (asset) (eliminate intra-groupdebenture holdings) 10,000 On 1 July 2014, Pepper Ltd acquired all of the issued capital of Salt Ltd. As part of the settlement, Pepper Ltd issued the shareholders of Salt Ltd with 100,000 shares in PepperLtd.The shares in PepperLtd were listed on the ASXfor $1.88 while the shares in Salt Ltd were listed at $2.00. PepperLtd also paid $44,830 cash and agreed to pay a further $50,000 on 1 July 2015, The appropriate interest rate being 6%. The shareholders' equity of Salt Ltd at that date was: Issued capital Retained earnings $100,000 25,000 125,000 At the date of acquisition, all of the carrying amount of net assets of Salt Ltd were recorded at fair value except the following i. ii. The land, originally costing $60,000, had a fair value of $84,000. The buildings had originally cost $220,000 and hadaccumulated depreciation of $40,000. The fair value of the buildings at date of acquisition was $360,000. It has a remaining useful life of 10yeas i Asat 30 June 2014, Salt Ltd had disclosed information rel ating to alegalactionin the notes to their accounts. They estimated a settlementof $10,000. The legal action wassettledon the 1June 2015 for $10,000. The attached worksheet shows the income statements, retained profits and balance sheets of the two companies for 30 June 2017 Additionalinformation a) The goodwill arising from the acquisition was impaired by $1,200 at the end of the current year and was impaired by $2,000 at the end of the financial yearended 30 June 2015 Inter-company sales of inventory during the year were b) a. b. Pepper Ltd to Salt Ltd for $3,000 Salt Ltd to PepperLtd for $4,000 c) The entire inventory purchased by Salt Ltd had been sold outside the group by the end of the current year. However, the inventory purchased by Pepper Ltd remained unsold by the end of the year. Salt Ltd had recorded a profit of $1,500 on thissale In September 2015, Salt Ltd has sold $2,000 inventory to Pepper Ltd. Attheend of that financial year 60% of this inventory had been sold outside the group by Pepper Ltd. The inventory had cost Salt Ltd $1,500. Interest on debentures is paidannually on 30 June Pepper Ltd recognisesdividendswhenreceived. (Please refer tothe financial statements to determine the dividends) On the 1 July 2015, Pepper Ltd sold a building to Salt Ltd for $180,000. The building was purchased by Pepper Ltd on 1 July 2014 for $150,000 and was being depreciatedstraight-line over auseful life of 10 years. The remaining usefullifeis unchanged d) e) f) g) Required (a) Prepare the acquisition analysisusing the template provided. (b) Prepare the consolidation elimination and adjusting journalentries required as at 30 June 2017 (c) Complete the consolidated worksheet as at 30 June 2017 on the template provided. 140 60 7 Retained earnings 1/7/2016 Income tax expense COGS (eliminateURP in opening inventory and related tax) 200 8 Interest revenue 500 Borrowing costs (eliminate interest on intra-group debenture holdings) 500 10,000 5% Debenture in Subsidiary (asset) (eliminate intra-groupdebenture holdings) 10,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts