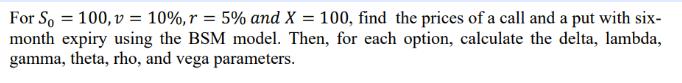

Question: For So 100, v = 10%, r = 5% and X = 100, find the prices of a call and a put with six-

For So 100, v = 10%, r = 5% and X = 100, find the prices of a call and a put with six- month expiry using the BSM model. Then, for each option, calculate the delta, lambda, gamma, theta, rho, and vega parameters.

Step by Step Solution

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Given S0 100 v 10 01 r 5 005 X 100 Time to expiry T 6 months 0... View full answer

Get step-by-step solutions from verified subject matter experts