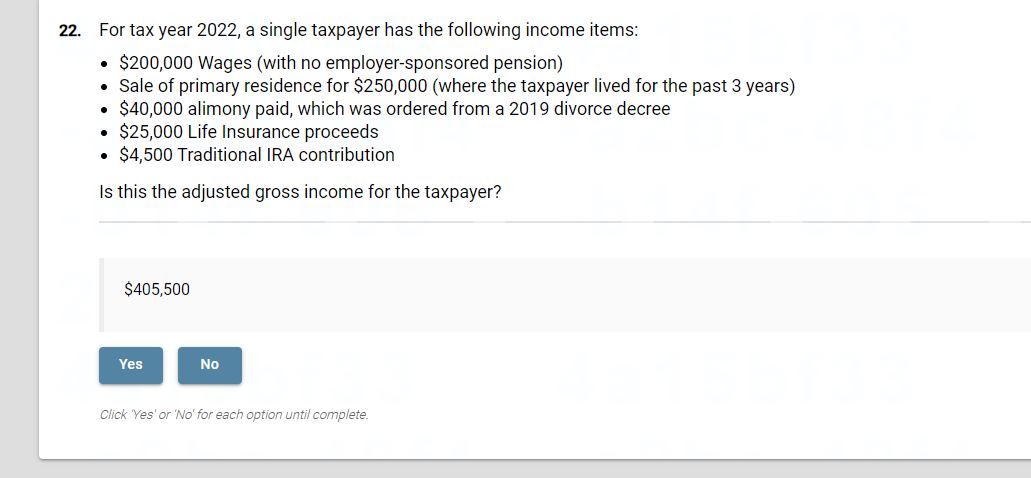

Question: For tax year 2 0 2 2 , a single taxpayer has the following income items: $ 2 0 0 , 0 0 0 Wages

For tax year a single taxpayer has the following income items:

$ Wages with no employersponsored pension

Sale of primary residence for $where the taxpayer lived for the past years

$ alimony paid, which was ordered from a divorce decree

$ Life Insurance proceeds

$ Traditional IRA contribution

Is this the adjusted gross income for the taxpayer?

$

Click 'Yes' or No for each option until complete.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock