Question: for the bottom question, Im trying to calcukate the value using this price of bond formula : P= Face Value / (1+YTM n )^n YTM=Yield

for the bottom question, Im trying to calcukate the value using this price of bond formula :

P= Face Value / (1+YTM n )^n

YTM=Yield to Maturity

I dont know what the n should be.

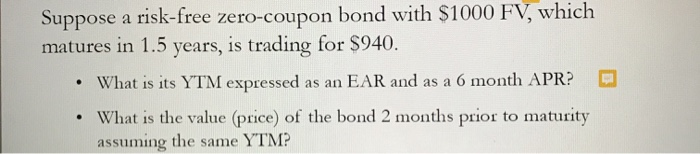

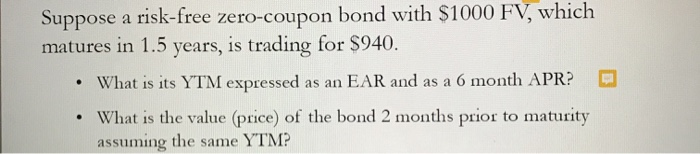

Suppose a risk-free zero-coupon bond with $1000 FV, which matures in 1.5 years, is trading for $940. What is its YTM expressed as an EAR and as a 6 month APR? What is the value (price) of the bond 2 months prior to maturity assuming the same YTM

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock