Question: For the current year 1. Compute the return on total assets. 2. Compute the return on common stockholder's equity. 3. Compute current ratio 4.

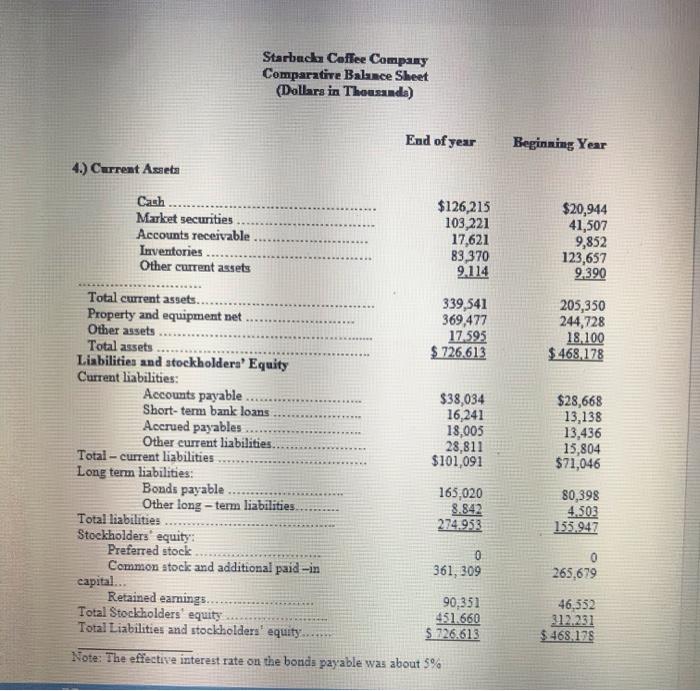

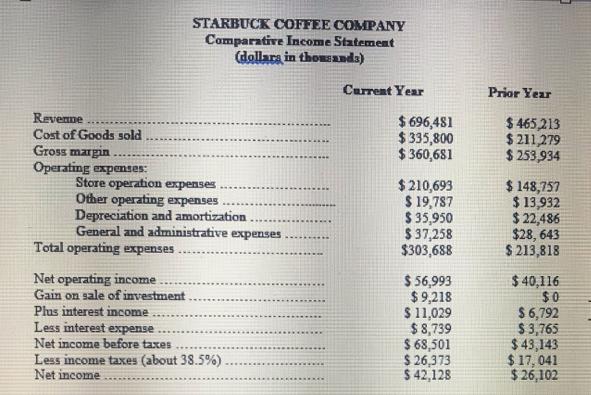

For the current year 1. Compute the return on total assets. 2. Compute the return on common stockholder's equity. 3. Compute current ratio 4. Compute acid-test (quick) ratio 5. Compute the inventory turnover 6.Compute the average sale - period 7. Compute the debt-to-equity ratio 4.) Current Assets Cash. Market securities. Accounts receivable Inventories..... Other current assets Total current assets.. Property and equipment net. Other assets Starbucks Coffee Company Comparative Balance Sheet (Dollars in Thousands) Total assets Liabilities and stockholders' Equity Current liabilities: Accounts payable. Short-term bank loans Accrued payables Other current liabilities.. Total-current liabilities. Long term liabilities: Bonds payable. Other long-term liabilities. Total liabilities Stockholders' equity: Preferred stock. Common stock and additional paid -in End of year $126,215 103,221 17,621 83,370 9,114 339,541 369,477 17.595 $726,613 $38,034 16,241 18,005 28,811 $101,091 165,020 8.842 274.953 361, 309 capital... Retained earnings.. Total Stockholders' equity Total Liabilities and stockholders' equity. $ Note: The effective interest rate on the bonds payable was about 5% 90,351 451.660 726.613 Beginning Year $20,944 41,507 9,852 123,657 9,390 205,350 244,728 18,100 $468,178 $28,668 13,138 13,436 15,804 $71,046 80,398 4.503 155,947 0 265,679 46,552 312.231 $468.178 Revenne Cost of Goods sold Gross margin Operating expenses: Store operation expenses Other operating expenses Depreciation and amortization General and administrative expenses Total operating expenses STARBUCK COFFEE COMPANY Comparative Income Statement (dollara in thousands) Net operating income Gain on sale of investment Plus interest income Less interest expense Net income before taxes Less income taxes (about 38.5%) Net income Current Year $696,481 $ 335,800 $360,681 $ 210,693 $19,787 $ 35,950 $37,258 $303,688 $ 56,993 $9,218 $ 11,029 $8,739 $ 68,501 $ 26,373 $ 42,128 Prior Year $465,213 $ 211,279 $253,934 $ 148,757 $ 13,932 $22,486 $28,643 $213,818 $40,116 $0 $ 6,792 $3,765 $43,143 $17, 041 $26,102

Step by Step Solution

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step 1 Meaning of Ratio It is the relationship between the two related or more interdependent items ... View full answer

Get step-by-step solutions from verified subject matter experts