Question: FOR THE FIRST QUESTION I ONLY NEED THE QUESTION B You run a construction firm. You have just won a contract to build a government

FOR THE FIRST QUESTION I ONLY NEED THE QUESTION B

FOR THE FIRST QUESTION I ONLY NEED THE QUESTION B

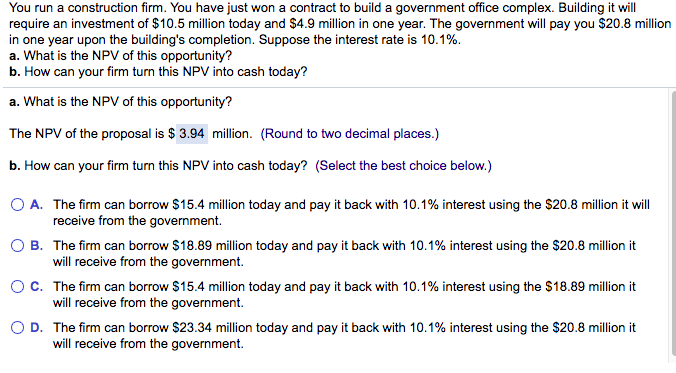

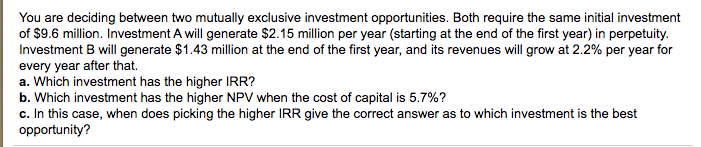

You run a construction firm. You have just won a contract to build a government office complex. Building it will require an investment of $10.5 million today and $4.9 million in one year. The government will pay you $20.8 million in one year upon the building's completion. Suppose the interest rate is 10.1%. a. What is the NPV of this opportunity? b. How can your firm turn this NPV into cash today? a. What is the NPV of this opportunity? The NPV of the proposal is $ 3.94 million. (Round to two decimal places.) b. How can your firm turn this NPV into cash today? (Select the best choice below.) O A. The firm can borrow $15.4 million today and pay it back with 10.1% interest using the $20.8 million it will receive from the government. O B. The firm can borrow $18.89 million today and pay it back with 10.1% interest using the $20.8 million it will receive from the government. OC. The firm can borrow $15.4 million today and pay it back with 10.1% interest using the $18.89 million it will receive from the government OD. The firm can borrow $23.34 million today and pay it back with 10.1% interest using the $20.8 million it will receive from the government. You are deciding between two mutually exclusive investment opportunities. Both require the same initial investment of $9.6 million. Investment A will generate $2.15 million per year (starting at the end of the first year) in perpetuity. Investment B will generate $1.43 million at the end of the first year, and its revenues will grow at 2.2% per year for every year after that. a. Which investment has the higher IRR? b. Which investment has the higher NPV when the cost of capital is 5.7%? c. In this case, when does picking the higher IRR give the correct answer as to which investment is the best opportunity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts