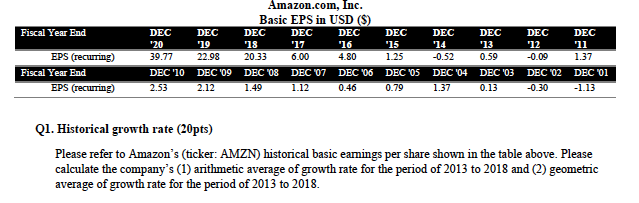

Question: For the first table please calculate the arithmetic average of growth rate and the geometric one for the period of 2013 to 2018 For the

For the first table please calculate the arithmetic average of growth rate and the geometric one for the period of 2013 to 2018

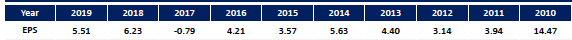

For the second table please calculate the arithmetic average of growth rate and the geometric one for the period of 2015 to 2019

Fiscal Year End DEC "12 EPS (recurring) Fiscal Year End EPS (recurring) DEC "20 39.77 DEC '10 DEC '19 22.98 DEC '09 Amazon.com, Inc. Basic EPS in USD ($) DEC DEC DEC '18 '17 '16 20.33 6.00 4.80 DEC '08 DEC '07 DEC 06 1.49 1.12 0.46 DEC '15 1.25 DEC 05 0.79 DEC DEC '14 '13 -0.52 0.59 DEC 04 DEC 03 1.37 0.13 -0.09 DEC 02 -0.30 DEC 11 1.37 DEC 01 -1.13 2.53 2.12 Q1. Historical growth rate (20pts) Please refer to Amazon's (ticker: AMZN) historical basic eamings per share shown in the table above. Please calculate the company's (1) arithmetic average of growth rate for the period of 2013 to 2018 and (2) geometric average of growth rate for the period of 2013 to 2018. Year 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 EPS 5.51 6.23 -0.79 4.21 3.57 5.63 4.40 3.14 3.94 14.47 Fiscal Year End DEC "12 EPS (recurring) Fiscal Year End EPS (recurring) DEC "20 39.77 DEC '10 DEC '19 22.98 DEC '09 Amazon.com, Inc. Basic EPS in USD ($) DEC DEC DEC '18 '17 '16 20.33 6.00 4.80 DEC '08 DEC '07 DEC 06 1.49 1.12 0.46 DEC '15 1.25 DEC 05 0.79 DEC DEC '14 '13 -0.52 0.59 DEC 04 DEC 03 1.37 0.13 -0.09 DEC 02 -0.30 DEC 11 1.37 DEC 01 -1.13 2.53 2.12 Q1. Historical growth rate (20pts) Please refer to Amazon's (ticker: AMZN) historical basic eamings per share shown in the table above. Please calculate the company's (1) arithmetic average of growth rate for the period of 2013 to 2018 and (2) geometric average of growth rate for the period of 2013 to 2018. Year 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 EPS 5.51 6.23 -0.79 4.21 3.57 5.63 4.40 3.14 3.94 14.47

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts