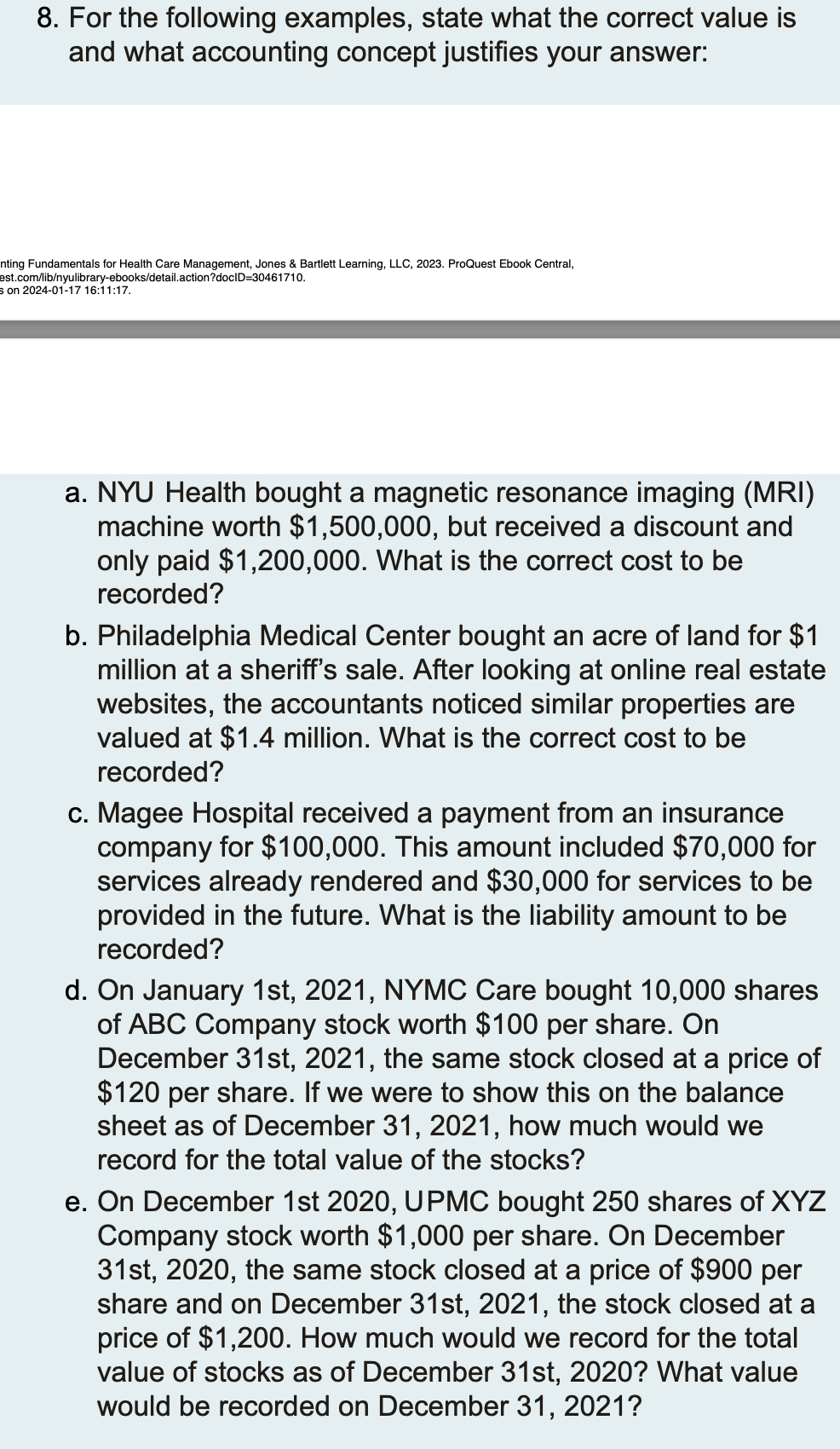

Question: For the following examples, state what the correct value is and what accounting concept justifies your answer: a . NYU Health bought a magnetic resonance

For the following examples, state what the correct value is

and what accounting concept justifies your answer:

a NYU Health bought a magnetic resonance imaging MRI

machine worth $ but received a discount and

only paid $ What is the correct cost to be

recorded?

b Philadelphia Medical Center bought an acre of land for $

million at a sheriff's sale. After looking at online real estate

websites, the accountants noticed similar properties are

valued at $ million. What is the correct cost to be

recorded?

c Magee Hospital received a payment from an insurance

company for $ This amount included $ for

services already rendered and $ for services to be

provided in the future. What is the liability amount to be

recorded?

d On January st NYMC Care bought shares

of ABC Company stock worth $ per share. On

December st the same stock closed at a price of

$ per share. If we were to show this on the balance

sheet as of December how much would we

record for the total value of the stocks?

e On December st UPMC bought shares of XYZ

Company stock worth $ per share. On December

st the same stock closed at a price of $ per

share and on December st the stock closed at a

price of $ How much would we record for the total

value of stocks as of December st What value

would be recorded on December

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock