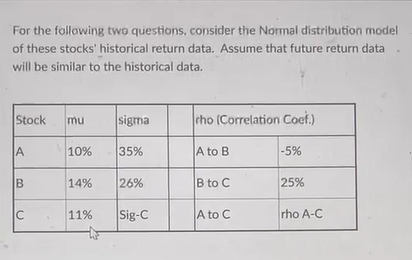

Question: For the following two questions, consider the Normal distribution model of these stocks' historical return data. Assume that future return data will be similar to

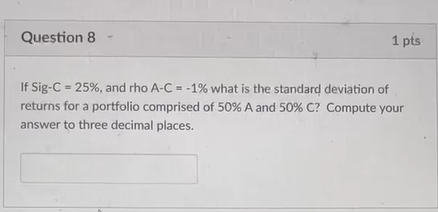

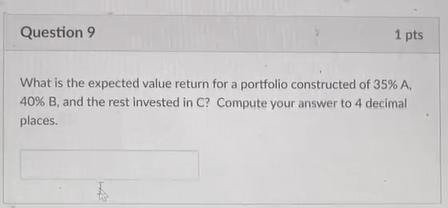

For the following two questions, consider the Normal distribution model of these stocks' historical return data. Assume that future return data will be similar to the historical data. Stock mu sigma rho (Correlation Coet.) A 10% 35% A to B -5% B 14% 26% B to C 25% IC C 11% Sig-C A to C rho A-C Question 8 1 pts If Sig-C - 25%, and rho A-C = -1% what is the standard deviation of returns for a portfolio comprised of 50% A and 50% C? Compute your answer to three decimal places. Question 9 1 pts What is the expected value return for a portfolio constructed of 35% A, 40% B, and the rest invested in C? Compute your answer to 4 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts