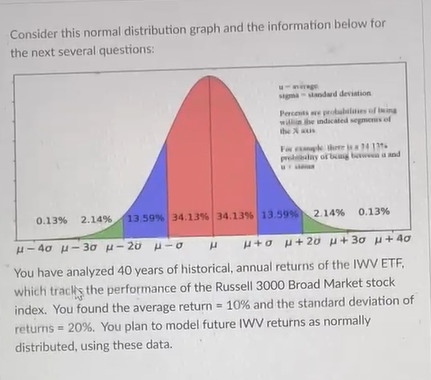

Question: Consider this normal distribution graph and the information below for the next several questions: eg mandard deviation Persepolis of ling will be indicated me Fest

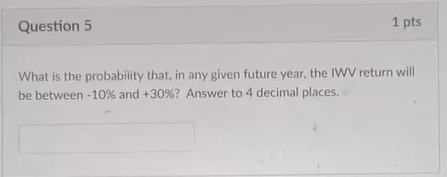

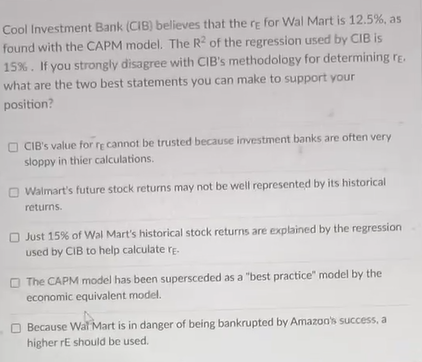

Consider this normal distribution graph and the information below for the next several questions: eg mandard deviation Persepolis of ling will be indicated me Fest 1411 0.13% 2.14% 13.59% 34.13% 34.13% 13.59% 2.14% 0.13% - 4 - 30 - 2 - W+ou + 20 u +30 + 40 You have analyzed 40 years of historical, annual returns of the IWV ETF, which tracks the performance of the Russell 3000 Broad Market stock index. You found the average return - 10% and the standard deviation of returns = 20%. You plan to model future IWV returns as normally distributed, using these data. Question 5 1 pts What is the probability that, in any given future year, the IWV return will be between -10% and +30%? Answer to 4 decimal places, Cool Investment Bank (CIB) believes that there for Wal Mart is 12.5%, as found with the CAPM model. The R of the regression used by CIB is 15%. If you strongly disagree with CIB's methodology for determining re, what are the two best statements you can make to support your position CIB's value for re cannot be trusted because investment banks are often very sloppy in thier calculations. Walmart's future stock returns may not be well represented by its historical returns. Just 15% of Wal Mart's historical stock returns are explained by the regression used by CIB to help calculate re The CAPM model has been supersceded as a "best practice" model by the economic equivalent model. Because Wal Mart is in danger of being bankrupted by Amazon's success, a higher rE should be used. Consider this normal distribution graph and the information below for the next several questions: eg mandard deviation Persepolis of ling will be indicated me Fest 1411 0.13% 2.14% 13.59% 34.13% 34.13% 13.59% 2.14% 0.13% - 4 - 30 - 2 - W+ou + 20 u +30 + 40 You have analyzed 40 years of historical, annual returns of the IWV ETF, which tracks the performance of the Russell 3000 Broad Market stock index. You found the average return - 10% and the standard deviation of returns = 20%. You plan to model future IWV returns as normally distributed, using these data. Question 5 1 pts What is the probability that, in any given future year, the IWV return will be between -10% and +30%? Answer to 4 decimal places, Cool Investment Bank (CIB) believes that there for Wal Mart is 12.5%, as found with the CAPM model. The R of the regression used by CIB is 15%. If you strongly disagree with CIB's methodology for determining re, what are the two best statements you can make to support your position CIB's value for re cannot be trusted because investment banks are often very sloppy in thier calculations. Walmart's future stock returns may not be well represented by its historical returns. Just 15% of Wal Mart's historical stock returns are explained by the regression used by CIB to help calculate re The CAPM model has been supersceded as a "best practice" model by the economic equivalent model. Because Wal Mart is in danger of being bankrupted by Amazon's success, a higher rE should be used

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts