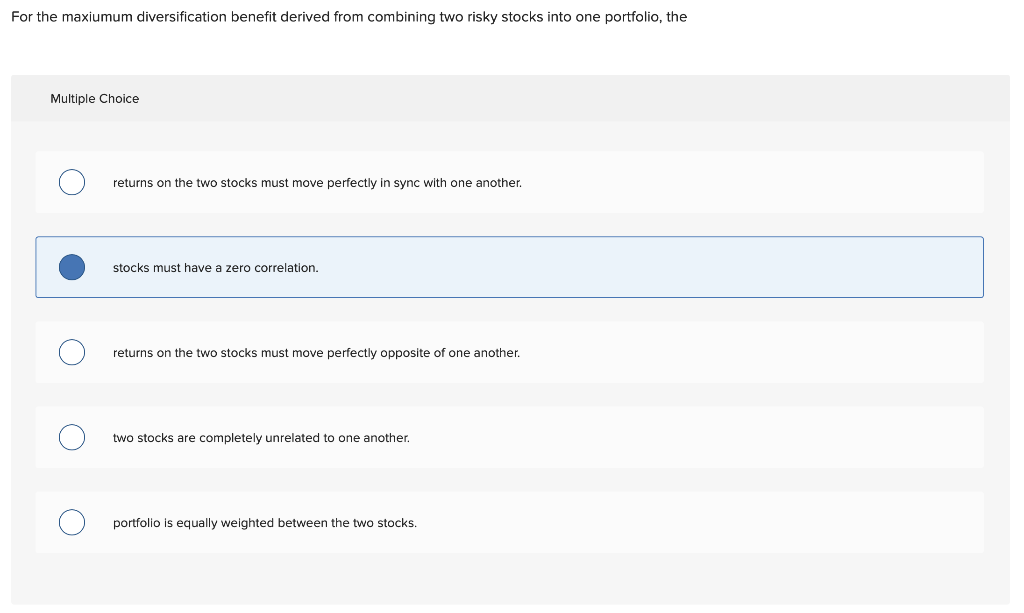

Question: For the maxiumum diversification benefit derived from combining two risky stocks into one portfolio, the Multiple Choice returns on the two stocks must move perfectly

For the maxiumum diversification benefit derived from combining two risky stocks into one portfolio, the Multiple Choice returns on the two stocks must move perfectly in sync with one another. stocks must have a zero correlation. returns on the two stocks must move perfectly opposite of one another. two stocks are completely unrelated to one another. O O portfolio is equally weighted between the two stocks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts