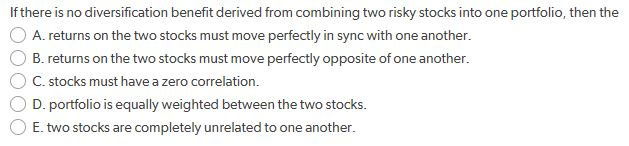

Question: If there is no diversification benefit derived from combining two risky stocks into one portfolio, then the O A. returns on the two stocks must

If there is no diversification benefit derived from combining two risky stocks into one portfolio, then the O A. returns on the two stocks must move perfectly in sync with one another. O B. returns on the two stocks must move perfectly opposite of one another. OC. stocks must have a zero correlation. O D. portfolio is equally weighted between the two stocks. O E. two stocks are completely unrelated to one another

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts