Question: For the next three problems, assume that the continuously compounded interest rate is 6% and the storage cost of widgets is $0.03 quarterly (payable at

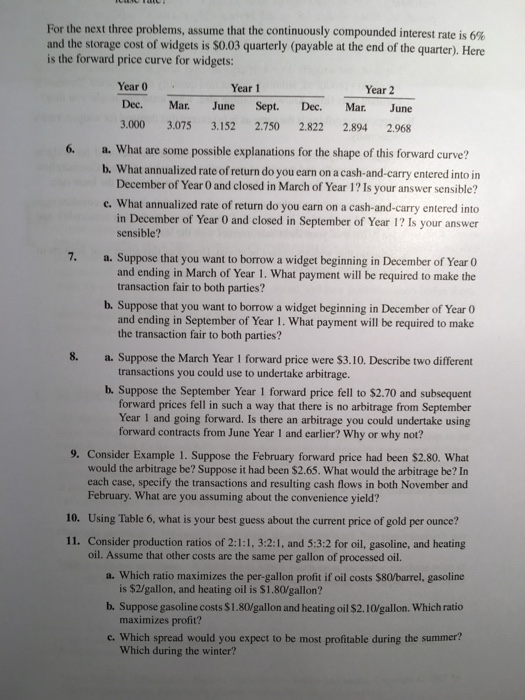

For the next three problems, assume that the continuously compounded interest rate is 6% and the storage cost of widgets is $0.03 quarterly (payable at the end of the quarter). Here is the forward price curve for widgets Year 0 Year 1 Year 2 Dec. Mar. June Sept. Dec. Mar. June 3.000 3.075 3.152 2.750 2.822 2894 2.968 6. a. What are some possible explanations for the shape of this forward curve? b. What annualized rate of return do you earn on a cash-and-carry entered into in December of Year 0 and closed in March of Year 1? Is your answer sensible? c. What annualized rate of return do you earn on a cash-and-carry entered into in December of Year 0 and closed in September of Year 1? Is your answer sensible? a. Suppose that you want to borrow a widget beginning in December of Year 0 and ending in March of Year 1. What payment will be required to make the 7. transaction fair to both parties? b. Suppose that you want to borrow a widget beginning in December of Year 0 and ending in September of Year 1. What payment will be required to make the transaction fair to both parties? 8. a. Suppose the March Year 1 forward price were $3.10. Describe two different transactions you could use to undertake arbitrage. b. Suppose the September Year 1 forward price fell to $2.70 and subsequent forward prices fell in such a way that there is no arbitrage from September Year 1 and going forward. Is there an arbitrage you could undertake using forward contracts from June Year 1 and earlier? Why or why not? 9. Consider Example 1. Suppose the February forward price had been $2.80. What would the arbitrage be? Suppose it had been $2.65. What would the arbitrage be? In each case, specify the transactions and resulting cash flows in both November and February. What are you assuming about the convenience yield? 10. Using Table 6, what is your best guess about the current price of gold per ounce? 11. Consider production ratios of 2:1:1, 3:2:1, and 5:3:2 for oil, gasoline, and heating a. Which ratio maximizes the per-gallon profit if oil costs $80/barrel, gasoline b. Suppose gasoline costs $1.80/gallon and heating oil $2.10/gallon. Which ratio e. Which spread would you expect to be most profitable during the summer? oil. Assume that other costs are the same per gallon of processed oil. is $2/gallon, and heating oil is $1.80/gallon? maximizes profit? Which during the winter

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts