Question: Problem 2) (25 points) UNR inc. has completed the analysis of new machine and estimated the following cash flows. At the end of year 5,

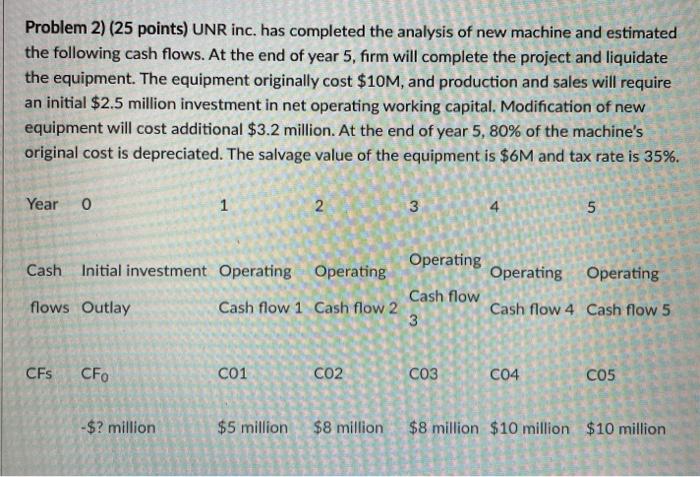

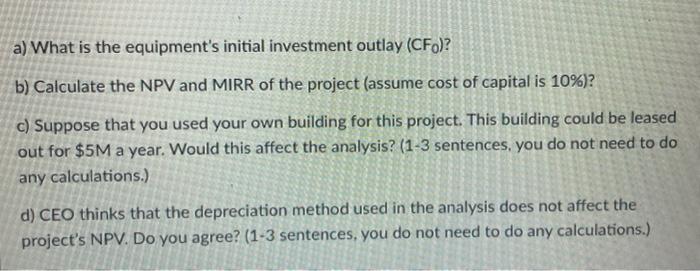

Problem 2) (25 points) UNR inc. has completed the analysis of new machine and estimated the following cash flows. At the end of year 5, firm will complete the project and liquidate the equipment. The equipment originally cost $10M, and production and sales will require an initial $2.5 million investment in net operating working capital. Modification of new equipment will cost additional $3.2 million. At the end of year 5, 80% of the machine's original cost is depreciated. The salvage value of the equipment is $6M and tax rate is 35%. Year 0 1 2 3 4 5 Cash Initial investment Operating Operating Operating Operating Operating Cash flow Cash flow 4 Cash flow 5 3 flows Outlay Cash flow 1 Cash flow 2 CFs CF C01 CO2 CO3 C04 CO5 -$? million $5 million $8 million $8 million $10 million $10 million a) What is the equipment's initial investment outlay (CF)? b) Calculate the NPV and MIRR of the project (assume cost of capital is 10%)? c) Suppose that you used your own building for this project. This building could be leased out for $5M a year. Would this affect the analysis? (1-3 sentences, you do not need to do any calculations.) d) CEO thinks that the depreciation method used in the analysis does not affect the project's NPV. Do you agree? (1-3 sentences, you do not need to do any calculations.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts