Question: For the vertical analysis portion I know the answer should be 73.3, 15.4, 11.3 and so on. I just want to know how you get

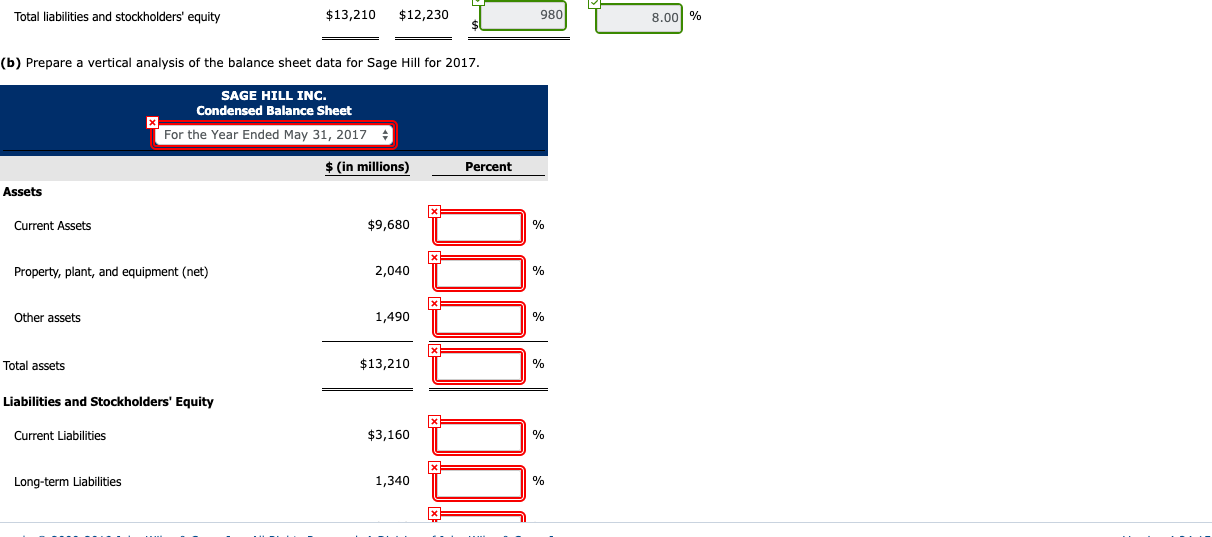

For the vertical analysis portion I know the answer should be 73.3, 15.4, 11.3 and so on. I just want to know how you get to those solutions. Such as the formula and the exact numbers that need to be plugged in to get to that point.

For the vertical analysis portion I know the answer should be 73.3, 15.4, 11.3 and so on. I just want to know how you get to those solutions. Such as the formula and the exact numbers that need to be plugged in to get to that point.

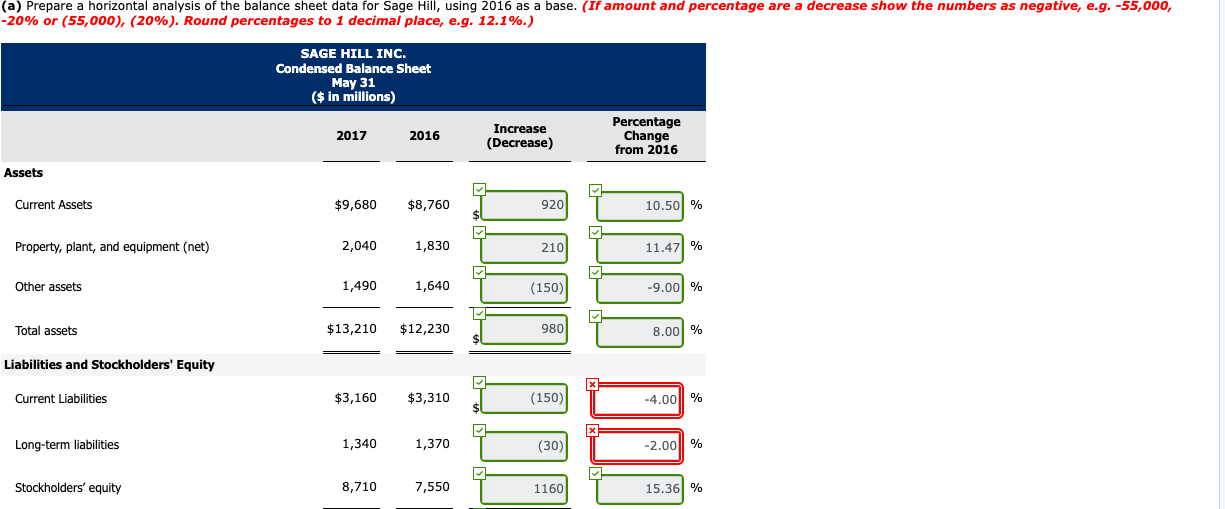

(a) Prepare a horizontal analysis of the balance sheet data for Sage Hill, using 2016 as a base. (If amount and percentage are a decrease show the numbers as negative, e.g. -55,000, -20% or (55,000), (20%). Round percentages to 1 decimal place, e.g. 12.1%.) SAGE HILL INC. Condensed Balance Sheet May 31 ($ in millions) 2017 2016 Increase (Decrease) Percentage Change from 2016 Assets Current Assets $9,680 $8,760 10.50 Property, plant, and equipment (net) 2,040 1,830 2101 T 11.471 Other assets 1,490 1,640 T (150) T -9.00 Total assets $13,210 $12,230 980 8.00% Liabilities and Stockholders' Equity Current Liabilities $3,160 $3,310 4.00% $3,160 1,340 $3,310 1,370 (150) (30) Long-term liabilities -2.00 Stockholders' equity 8,710 7,550 1160 15.36 Total liabilities and stockholders' equity $13,210 $12,230 8.00 % (b) Prepare a vertical analysis of the balance sheet data for Sage Hill for 2017. SAGE HILL INC. Condensed Balance Sheet For the Year Ended May 31, 2017 $ (in millions) Percent Assets Current Assets $9,680 Property, plant, and equipment (net) 2,040 Other assets 1,490 Total assets $13,210 MN I Liabilities and Stockholders' Equity Current Liabilities $3,160 Long-term Liabilities 1,340

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts