Question: For this assignment, you will answer the questions below and submit a document of your solutions. You must show your work or no credit will

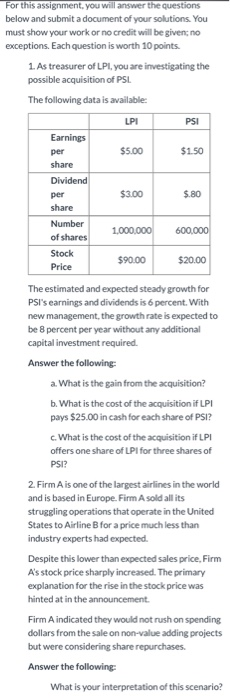

For this assignment, you will answer the questions below and submit a document of your solutions. You must show your work or no credit will be given, no exceptions. Each question is worth 10 points 1. As treasurer of LPI, you are investigating the possible acquisition of PSL The following data is available: LPI PSI Earnings $5.00 $1.50 share Dividend per $3.00 $.80 share Number 1,000,000 600,000 of shares Stock $90.00 $20.00 per Price The estimated and expected steady growth for PSI's earnings and dividends is 6 percent. With new management, the growth rate is expected to be 8 percent per year without any additional capital investment required Answer the following: a. What is the gain from the acquisition? b. What is the cost of the acquisition if LPI pays $25.00 in cash for each share of PSI? c. What is the cost of the acquisition if LPI offers one share of LPI for three shares of PSI? 2. Firm A is one of the largest airlines in the world and is based in Europe. Firm A sold all its struggling operations that operate in the United States to Airline B for a price much less than industry experts had expected Despite this lower than expected sales price, Firm A's stock price sharply increased. The primary explanation for the rise in the stock price was hinted at in the announcement. Firm A indicated they would not rush on spending dollars from the sale on non-value adding projects but were considering share repurchases. Answer the following: What is your interpretation of this scenario

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts