Question: For this assignment, you will complete a Trial Balance for Dec 31, 2020 by starting with the Trial Balance for Oct 1, 2020 and posting

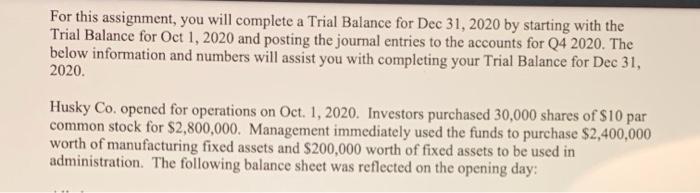

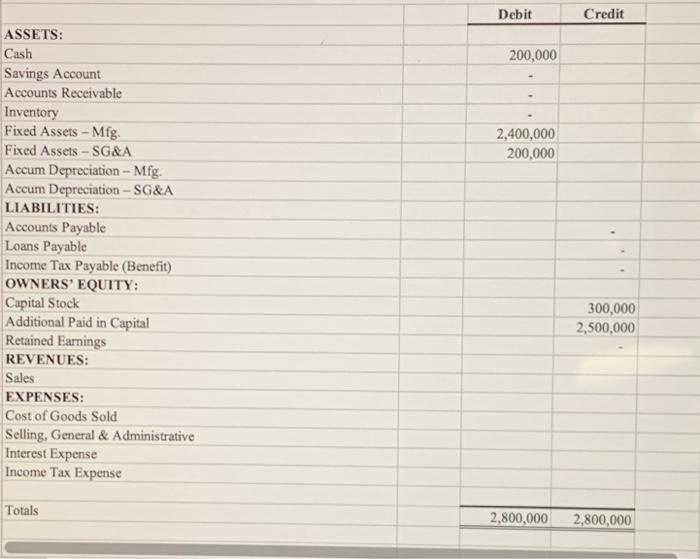

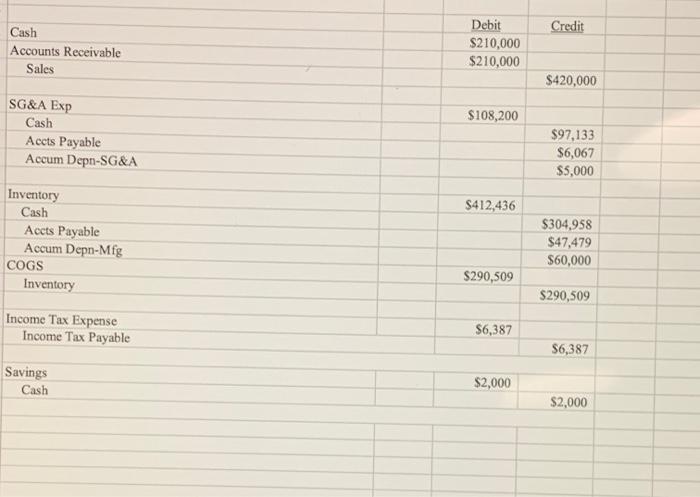

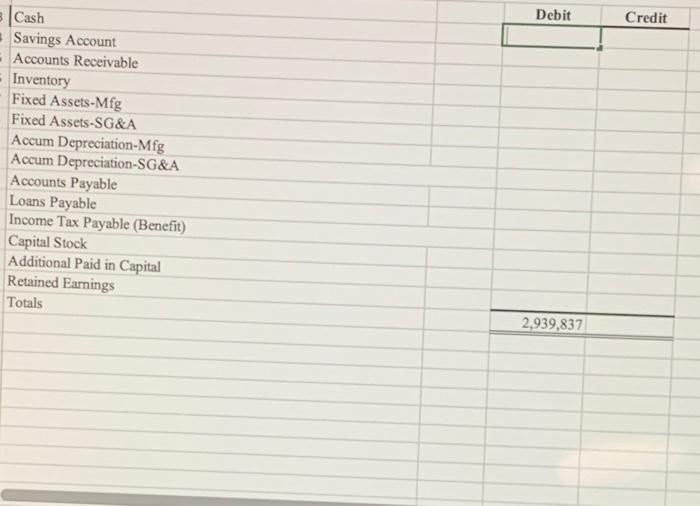

For this assignment, you will complete a Trial Balance for Dec 31, 2020 by starting with the Trial Balance for Oct 1, 2020 and posting the journal entries to the accounts for Q4 2020. The below information and numbers will assist you with completing your Trial Balance for Dec 31, 2020. Husky Co. opened for operations on Oct. 1, 2020. Investors purchased 30,000 shares of $10 par common stock for $2,800,000. Management immediately used the funds to purchase $2,400,000 worth of manufacturing fixed assets and $200,000 worth of fixed assets to be used in administration. The following balance sheet was reflected on the opening day: Debit Credit 200,000 2,400,000 200,000 ASSETS: Cash Savings Account Accounts Receivable Inventory Fixed Assets - Mfg. Fixed Assets - SG&A Accum Depreciation - Mfg. Accum Depreciation - SG&A LIABILITIES: Accounts Payable Loans Payable Income Tax Payable (Benefit) OWNERS' EQUITY: Capital Stock Additional Paid in Capital Retained Earnings REVENUES: Sales EXPENSES: Cost of Goods Sold Selling. General & Administrative Interest Expense Income Tax Expense 300,000 2,500,000 Totals 2,800,000 2,800,000 Credit Cash Accounts Receivable Sales Debit S210,000 $210,000 $420,000 $108,200 SG&A Exp Cash Acets Payable Aceum Depn-SG&A $97,133 $6,067 $5,000 $412,436 Inventory Cash Acets Payable Accum Depn-Mfg COGS Inventory $304,958 $47,479 $60,000 $290,509 $290,509 Income Tax Expense Income Tax Payable $6,387 56,387 Savings Cash $2,000 $2,000 Debit Credit Cash Savings Account - Accounts Receivable - Inventory Fixed Assets-Mfg Fixed Assets-SG&A Accum Depreciation-Mfg Accum Depreciation-SG&A Accounts Payable Loans Payable Income Tax Payable (Benefit) Capital Stock Additional Paid in Capital Retained Earnings Totals 2,939,837

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts