Question: For this example problem, how would you file a return with this scenario? Amanda Shires lives at 818 Fiddle Lane, Mussel Shoals, Alabama. She and

For this example problem, how would you file a return with this scenario?

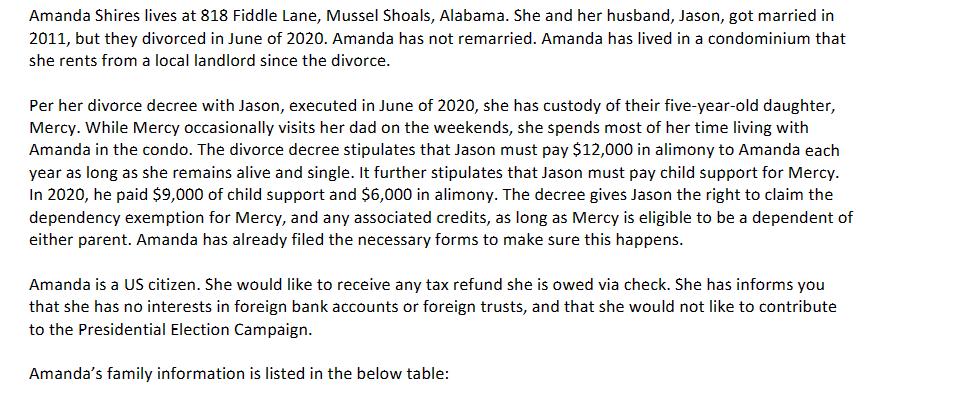

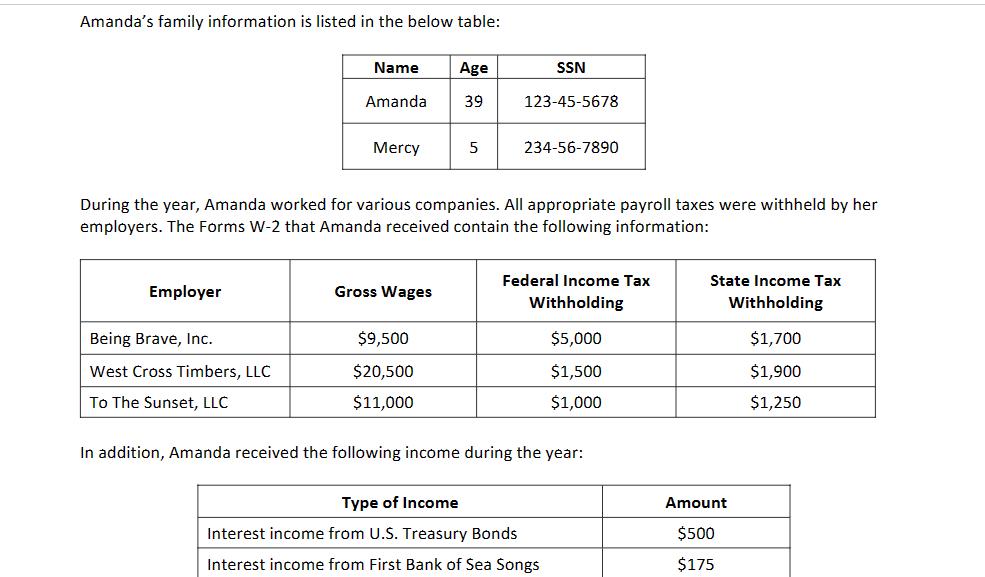

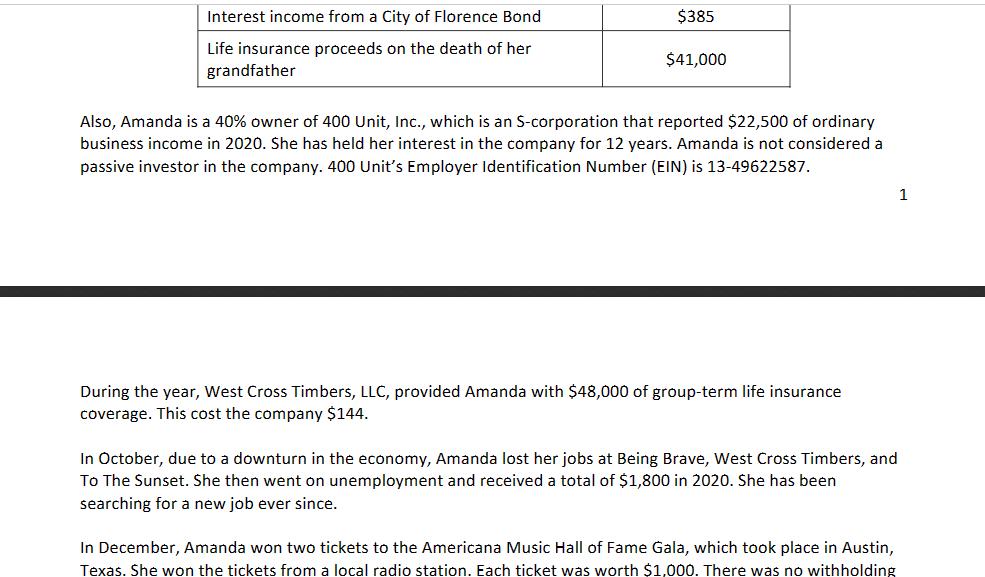

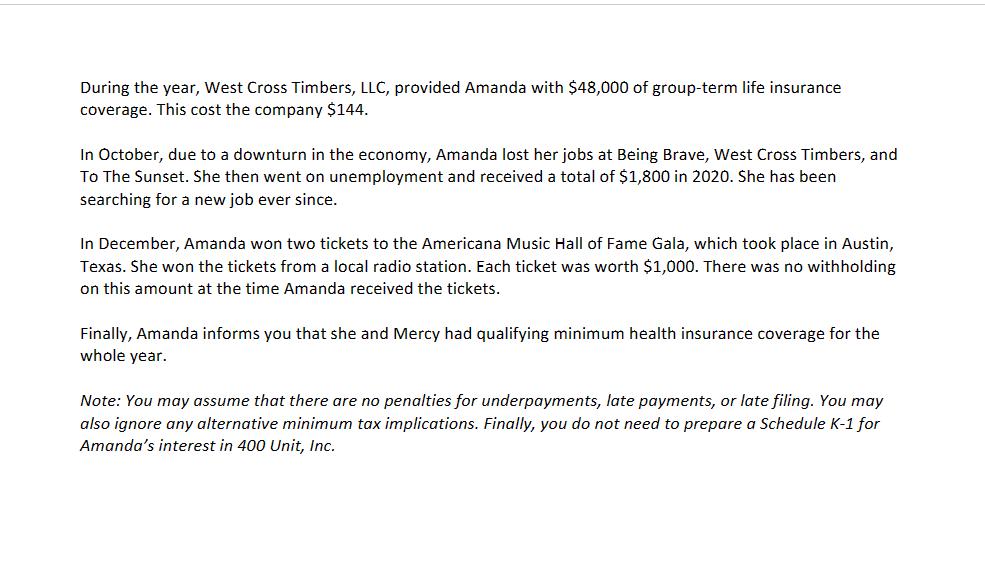

Amanda Shires lives at 818 Fiddle Lane, Mussel Shoals, Alabama. She and her husband, Jason, got married in 2011, but they divorced in June of 2020. Amanda has not remarried. Amanda has lived in a condominium that she rents from a local landlord since the divorce. Per her divorce decree with Jason, executed in June of 2020, she has custody of their five-year-old daughter, Mercy. While Mercy occasionally visits her dad on the weekends, she spends most of her time living with Amanda in the condo. The divorce decree stipulates that Jason must pay $12,000 in alimony to Amanda each year as long as she remains alive and single. It further stipulates that Jason must pay child support for Mercy. In 2020, he paid $9,000 of child support and $6,000 in alimony. The decree gives Jason the right to claim the dependency exemption for Mercy, and any associated credits, as long as Mercy is eligible to be a dependent of either parent. Amanda has already filed the necessary forms to make sure this happens. Amanda is a US citizen. She would like to receive any tax refund she is owed via check. She has informs you that she has no interests in foreign bank accounts or foreign trusts, and that she would not like to contribute to the Presidential Election Campaign. Amanda's family information is listed in the below table:

Step by Step Solution

3.42 Rating (152 Votes )

There are 3 Steps involved in it

In order to file a return with this scenario you would need to gather the required documentation first This would include her Forms W2 from her employ... View full answer

Get step-by-step solutions from verified subject matter experts