Question: For this, I need to solve a problem. Can you explain this problem to me? After finding it, I will need to put that value

For this, I need to solve a problem. Can you explain this problem to me? After finding it, I will need to put that value into my Multi-income statement.

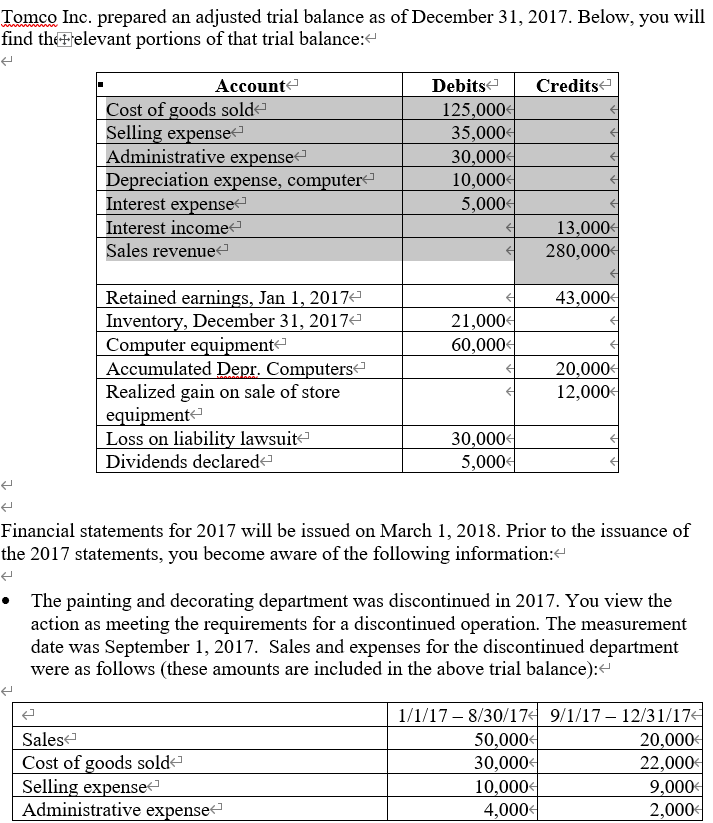

The problem is : A decision was made to change depreciation methods for the computer equipment. The change will be effective for 2017. The firm will switch from the Straight-line method to the Double declining balance method depreciation with a 5-year remaining life (as of 1/1/17). The computers were purchased in January of 2016 for $60,000. They were being depreciated over 6 years with no salvage value. Salvage value is now estimated to be $5,000. Note that 2017 depreciation has already been recorded using the straight-line method.

Tomco Inc. prepared an adjusted trial balance as of December 31, 2017. Below, you will find the #elevant portions of that trial balance: Credits Account Cost of goods solde Selling expense Administrative expense- Depreciation expense, computer Interest expense Interest income Sales revenue Debits 125,000 35,000 30,0004 10,000 5,000 13,000 280,000 43,000 21,000+ 60,000 Retained earnings, Jan 1, 2017 Inventory, December 31, 20174 Computer equipment Accumulated Depr. Computers Realized gain on sale of store equipment Loss on liability lawsuit Dividends declared 20,000 12,000 30,000 5,000 Financial statements for 2017 will be issued on March 1, 2018. Prior to the issuance of the 2017 statements, you become aware of the following information: & The painting and decorating department was discontinued in 2017. You view the action as meeting the requirements for a discontinued operation. The measurement date was September 1, 2017. Sales and expenses for the discontinued department were as follows (these amounts are included in the above trial balance): Sales Cost of goods sold Selling expense Administrative expense 1/1/17-8/30/174 9/1/17 - 12/31/174 50,000 20,000 30,000 22,0004 10,000 9,000 4,000 2,0004

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts