Question: (For this problem, I recommend you work with Excel and copy your clean answer table here) You are considering two investment options, which are expected

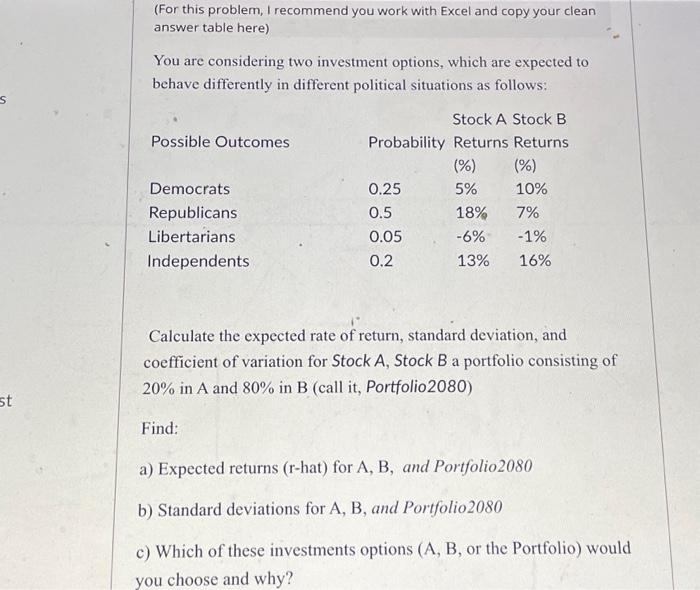

(For this problem, I recommend you work with Excel and copy your clean answer table here) You are considering two investment options, which are expected to behave differently in different political situations as follows: Calculate the expected rate of return, standard deviation, and coefficient of variation for Stock A, Stock B a portfolio consisting of 20% in A and 80% in B (call it, Portfolio 2080) Find: a) Expected returns (r-hat) for A, B, and Portfolio2080 b) Standard deviations for A, B, and Portfolio2080 c) Which of these investments options (A, B, or the Portfolio) would you choose and why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts