Question: For this problem set, assume the following: - Your trading account has $300,000 of cash on Jan 15,2014 , before you begin trading on the

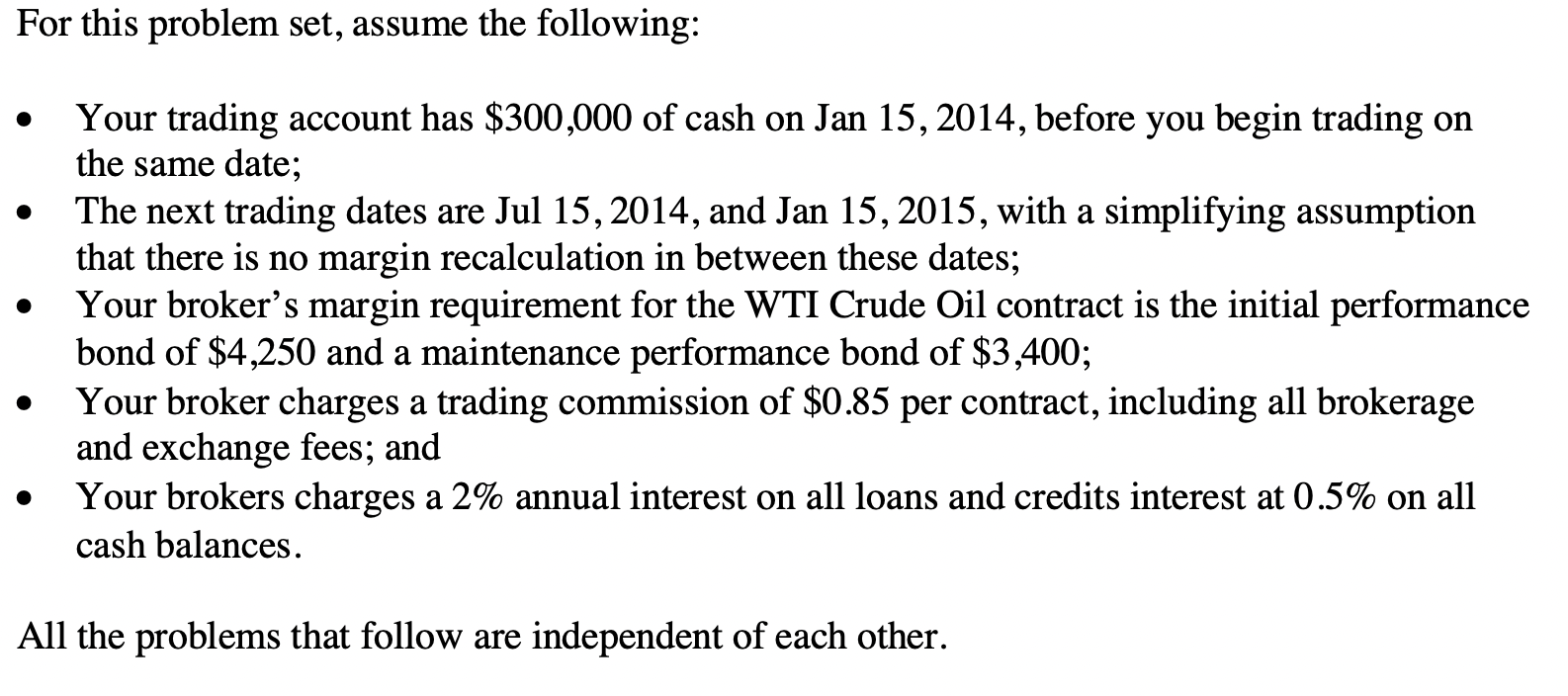

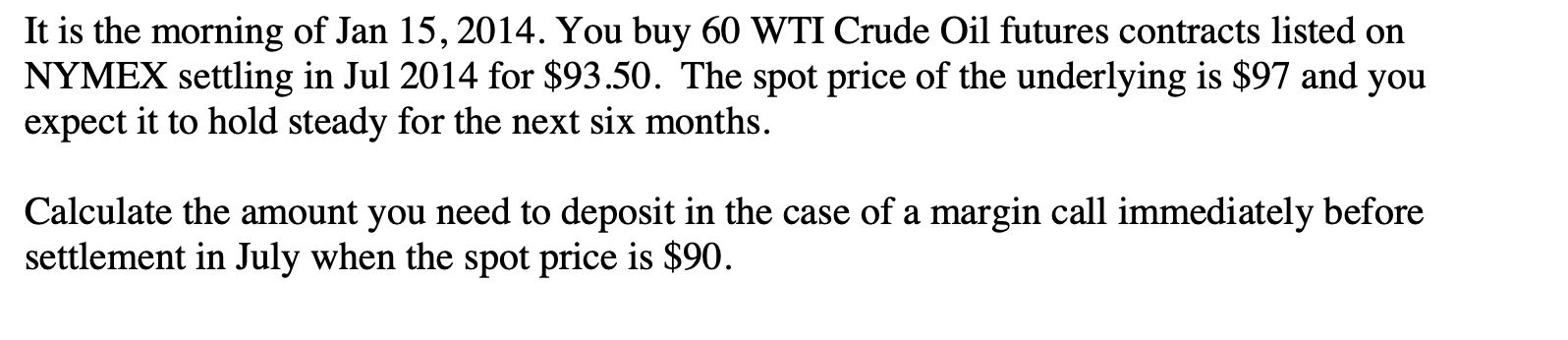

For this problem set, assume the following: - Your trading account has $300,000 of cash on Jan 15,2014 , before you begin trading on the same date; - The next trading dates are Jul 15, 2014, and Jan 15, 2015, with a simplifying assumption that there is no margin recalculation in between these dates; - Your broker's margin requirement for the WTI Crude Oil contract is the initial performance bond of $4,250 and a maintenance performance bond of $3,400; - Your broker charges a trading commission of $0.85 per contract, including all brokerage and exchange fees; and - Your brokers charges a 2% annual interest on all loans and credits interest at 0.5% on all cash balances. All the problems that follow are independent of each other. It is the morning of Jan 15,2014 . You buy 60 WTI Crude Oil futures contracts listed on NYMEX settling in Jul 2014 for $93.50. The spot price of the underlying is $97 and you expect it to hold steady for the next six months. Calculate the amount you need to deposit in the case of a margin call immediately before settlement in July when the spot price is $90

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts