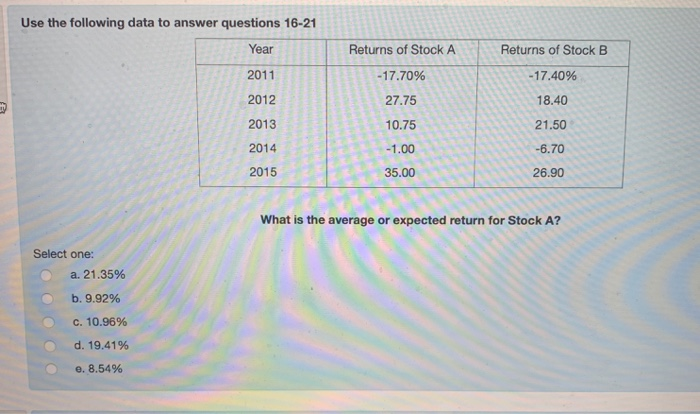

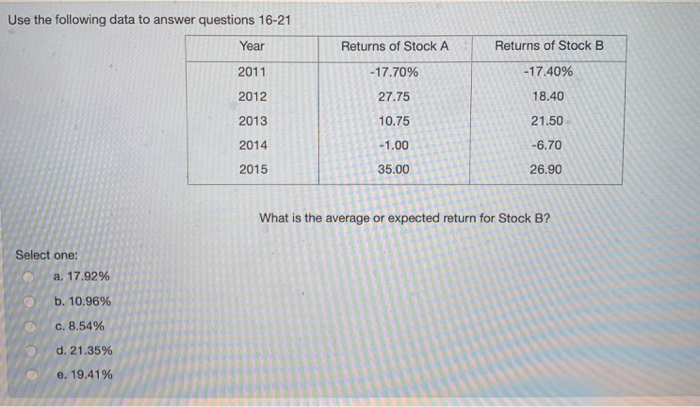

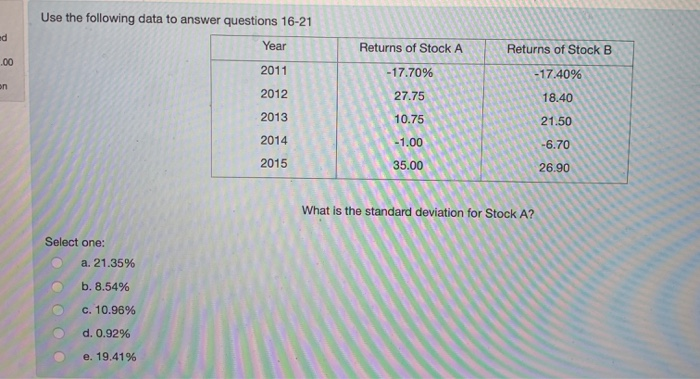

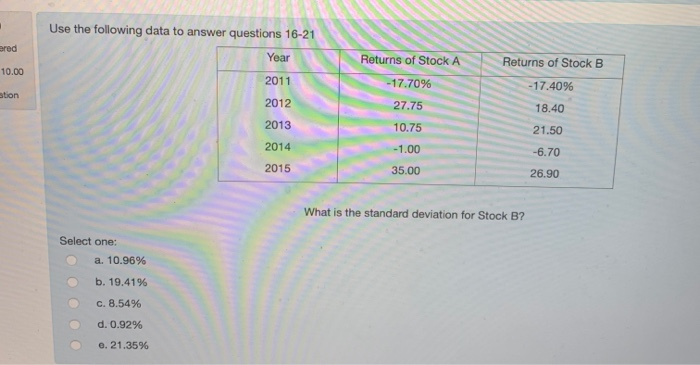

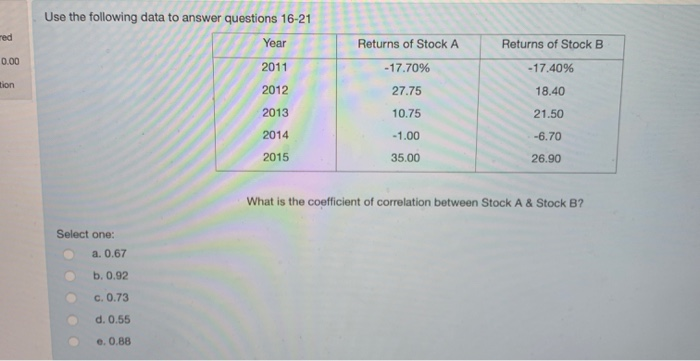

Question: Use the following data to answer questions 16-21 Year Returns of Stock A -17.70% 27.75 Returns of Stock B -17.40% 18.40 21.50 -6.70 26.90 10.75

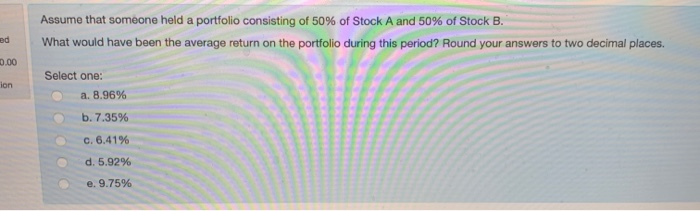

Use the following data to answer questions 16-21 Year Returns of Stock A -17.70% 27.75 Returns of Stock B -17.40% 18.40 21.50 -6.70 26.90 10.75 What is the average or expected return for Stock A? Select one: a. 21.35% b. 9.92% C. 10.96% d. 19.41% e. 8.54% Use the following data to answer questions 16-21 Year Returns of Stock -17.70% 27.75 2011 2012 2013 2014 2015 Returns of Stock B -17.40% 18.40 21.50 -6.70 26.90 10.75 -1.00 35.00 What is the average or expected return for Stock B? Select one: a. 17,92% b. 10.96% c. 8.54% d. 21.35% e. 19.41% Use the following data to answer questions 16-2 33 Returns of Stock -17.70% Returns of Stock B -17.40% 18.40 21.50 V 2013 2014 35.00 26.90 nard deviation for Stock What is the standard deviation for Select one: a. 21.35% b. 8.54% c. 10.96% d. 0.92% e. 19.41% ered Returns of Stock A 10.00 tion Use the following data to answer questions 16-21 Year 2011 2012 2013 2014 2015 -17.70% 27.75 Returns of Stock B -17.40% 18.40 21.50 -6.70 26.90 10.75 -1.00 35.00 What is the standard deviation for Stock B? Select one: a. 10.96% b. 19.41% c. 8.54% d. 0.92% e. 21.35% Returns of Stock B 0.00 -17.40% Use the following data to answer questions 16-21 Year 2011 2012 2013 2014 2015 Returns of Stock A -17.70% 27.75 10.75 -1.00 35.00 18.40 21.50 -6.70 26.90 What is the coefficient of correlation between Stock A & Stock B? Select one: a. 0.67 b. 0.92 c. 0.73 d. 0.55 0.0.88 Assume that someone held a portfolio consisting of 50% of Stock A and 50% of Stock B. What would have been the average return on the portfolio during this period? Round your answers to two decimal places. ed 0.00 ion Select one: a. 8.96% b. 7.35% c. 6.41% d. 5.92% e. 9.75%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts