Question: please answer the following questions about WACC delete. dont need it answered posted the wrong question dont need it answered Calculate the Components of WACC

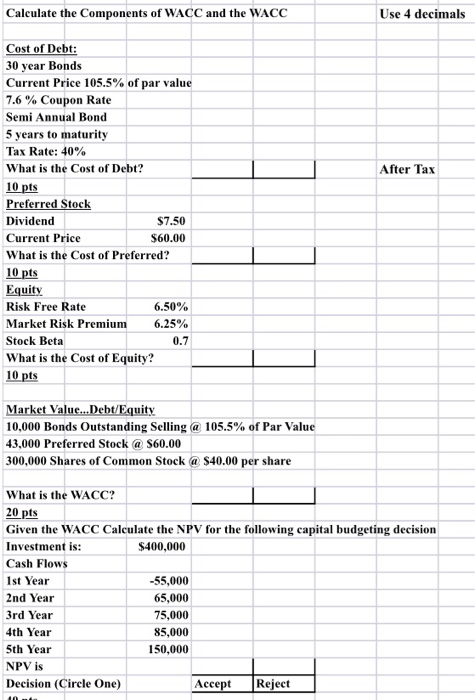

Calculate the Components of WACC and the WACC Use 4 decimals After Tax Cost of Debt: 30 year Bonds Current Price 105.5% of par value 7.6 % Coupon Rate Semi Annual Bond 5 years to maturity Tax Rate: 40% What is the Cost of Debt? 10 pts Preferred Stock Dividend $7.50 Current Price $60.00 What is the Cost of Preferred? 10 pts Equity Risk Free Rate 6.50% Market Risk Premium 6.25% Stock Beta 0.7 What is the Cost of Equity? 10 pts Market Value...Debt/Equity 10,000 Bonds Outstanding Selling @ 105.5% of Par Value 43,000 Preferred Stock @ $60.00 300,000 Shares of Common Stock a $40.00 per share What is the WACC? 20 pts Given the WACC Calculate the NPV for the following capital budgeting decision Investment is: $400,000 Cash Flows 1st Year -55,000 2nd Year 65,000 3rd Year 75,000 4th Year 85,000 5th Year 150,000 NPV is Decision (Circle One) Accept Reject

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts