Question: For this question, use the initial bond yields and prices for the 5-year and 10-year T-notes futures in Exhibit 1 and 2 (below). Continue to

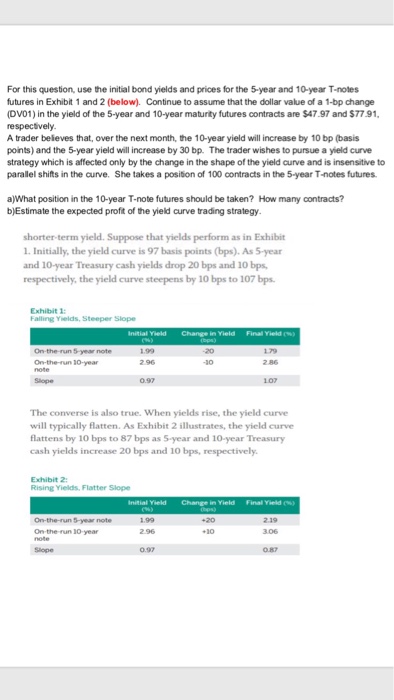

For this question, use the initial bond yields and prices for the 5-year and 10-year T-notes futures in Exhibit 1 and 2 (below). Continue to assume that the dollar value of a 1-bp change (DV01) in the yield of the 5-year and 10-year maturity futures contracts are $47.97 and $77.91, A trader beleves that, over the next month, the 10-year yield will increase by 10 bp (basis points) and the 5-year yield will increase by 30 bp. The trader wishes to pursue a yield curve strategy which is affected only by the change in the shape of the yield curve and is insensitive to parallel shifts in the curve. She takes a position of 100 contracts in the 5-year T-notes futures a)What position in the 10-year T-note futures should be taken? How many contracts? b)Estimate the expected profit of the yield curve trading strategy shorter-term yield. Suppose that yields perform as in Exhibit 1. Initially, the yield curve is 97 basis points (bps). As 5-year and 10-year Treasury cash yields drop 20 bps and 10 bps, respectively, the yield curve steepens by 10 bps to 107 bps Exhibit Hids, steeper initial Yield Change in Yield Final Yield (%) 2.96 2.86 1.07 The converse is also true. When yields rise, the yield curve will typically flatten. As Exhibit 2 illustrates, the yield curve flattens by 10 bps to 87 bps as S year and 10-year Treasury cash yields increase 20 bps and 10 bps, respectively Exhibit 2 Rising Vields, Flatter Slope 2.96 3.06 Slope 0.87

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts