Question: For this question, use the initial bond yields and prices for the 5-year and 10-year T-notes futures in Exhibit 1 and 2 (below). Continue to

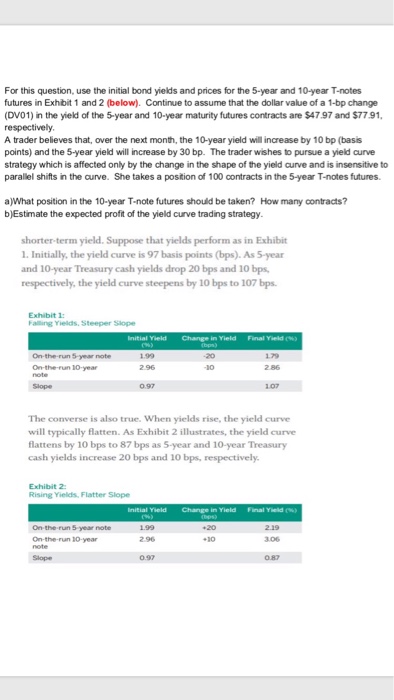

For this question, use the initial bond yields and prices for the 5-year and 10-year T-notes futures in Exhibit 1 and 2 (below). Continue to assume that the dollar value of a 1-bp change (DV01) in the yield of the 5-year and 10-year maturity futures contracts are $47.97 and $7791, A trader believes that, over the next month, the 10-year yield will increase by 10 bp (basis points) and the 5-year yield will increase by 30 bp. The trader wishes to pursue a yield curve strategy which is affected only by the change in the shape of the yield curve and is insensitive to parallel shifts in the aurve. She takes a position of 100 contracts in the 5-year T-notes futures. a)What position in the 10-year T-note futures should be taken? How many contracts? b)Estimate the expected profit of the yield curve trading strategy shorter-term yield. Suppose that yields perform as in Exhibit 1. Initially, the yield curve is 97 basis points (bps). As 5-year and 10-year Treasury cash yields drop 20 bps and 10 bps respectively, the yield curve steepens by 10 bps to 107 bps. Exhibit 1: 2.96 2.86 1.07 The converse is also true. When yields rise, the yield curve will typically flatten. As Exhibit 2 illustrates, the yield curve flattens by 10 bps to 87 bps as 5-year and 10-year Treasury cash yields increase 20 bps and 10 bps, respectively. Exhibit 2 Rising Yields, Flatter Slope 2.96 30 3.06 Slope 0.87

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts