Question: Ford Motor Company-Aligned Business Framework: (Read Case Study 2-3 from page 41 to 43 of Johnson textbook 15th Ed): worth 55 pts Support your answers

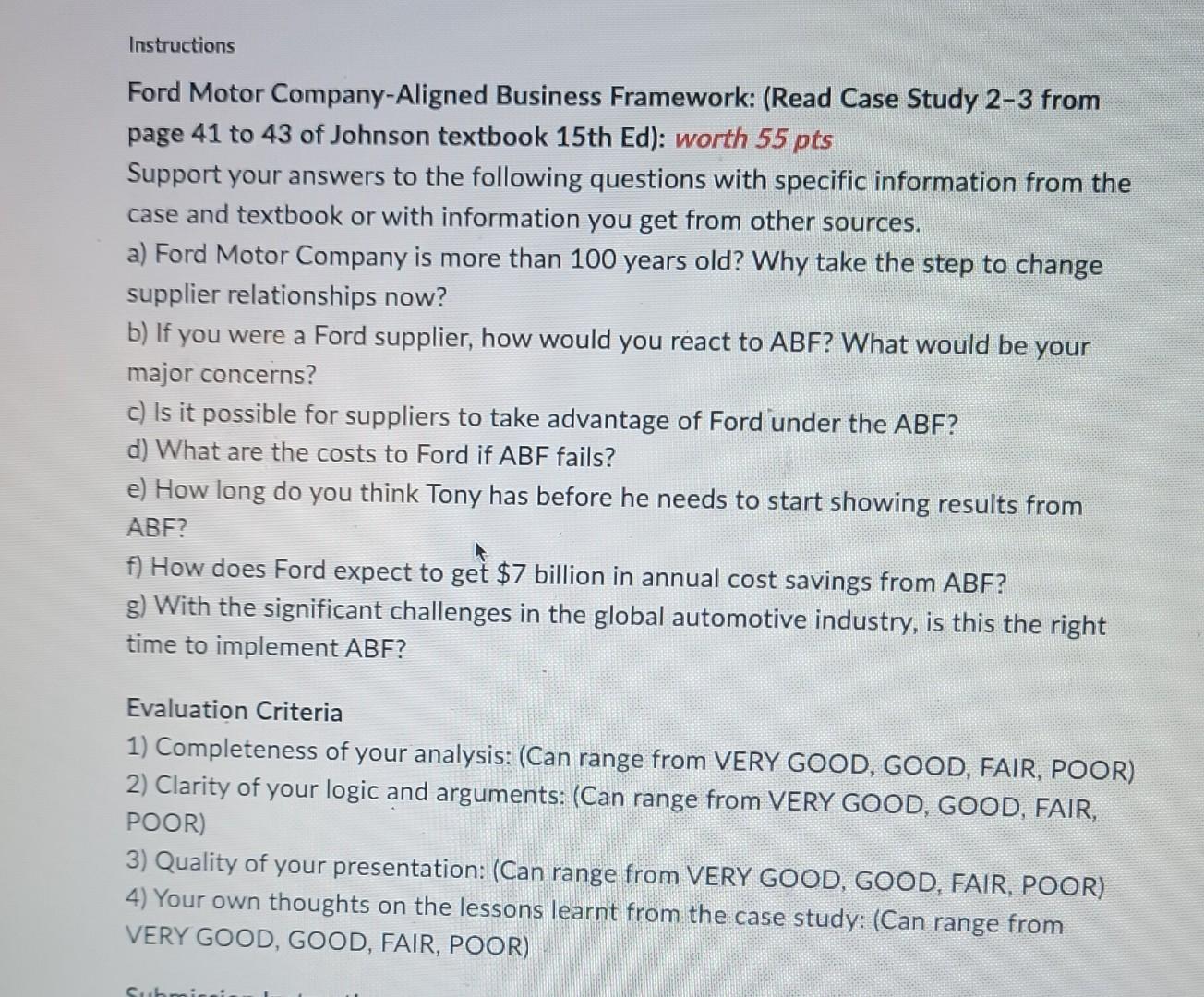

Ford Motor Company-Aligned Business Framework: (Read Case Study 2-3 from page 41 to 43 of Johnson textbook 15th Ed): worth 55 pts Support your answers to the following questions with specific information from the case and textbook or with information you get from other sources. a) Ford Motor Company is more than 100 years old? Why take the step to change supplier relationships now? b) If you were a Ford supplier, how would you react to ABF ? What would be your major concerns? c) Is it possible for suppliers to take advantage of Ford under the ABF? d) What are the costs to Ford if ABF fails? e) How long do you think Tony has before he needs to start showing results from ABF? f) How does Ford expect to get $7 billion in annual cost savings from ABF ? g) With the significant challenges in the global automotive industry, is this the right time to implement ABF? Evaluation Criteria 1) Completeness of your analysis: (Can range from VERY GOOD, GOOD, FAIR, POOR) 2) Clarity of your logic and arguments: (Can range from VERY GOOD, GOOD, FAIR, POOR) 3) Quality of your presentation: (Can range from VERY GOOD, GOOD, FAIR, POOR) 4) Your own thoughts on the lessons learnt from the case study: (Can range from VERY GOOD, GOOD, FAIR, POOR) Ford Motor Company-Aligned Business Framework: (Read Case Study 2-3 from page 41 to 43 of Johnson textbook 15th Ed): worth 55 pts Support your answers to the following questions with specific information from the case and textbook or with information you get from other sources. a) Ford Motor Company is more than 100 years old? Why take the step to change supplier relationships now? b) If you were a Ford supplier, how would you react to ABF ? What would be your major concerns? c) Is it possible for suppliers to take advantage of Ford under the ABF? d) What are the costs to Ford if ABF fails? e) How long do you think Tony has before he needs to start showing results from ABF? f) How does Ford expect to get $7 billion in annual cost savings from ABF ? g) With the significant challenges in the global automotive industry, is this the right time to implement ABF? Evaluation Criteria 1) Completeness of your analysis: (Can range from VERY GOOD, GOOD, FAIR, POOR) 2) Clarity of your logic and arguments: (Can range from VERY GOOD, GOOD, FAIR, POOR) 3) Quality of your presentation: (Can range from VERY GOOD, GOOD, FAIR, POOR) 4) Your own thoughts on the lessons learnt from the case study: (Can range from VERY GOOD, GOOD, FAIR, POOR)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock