Question: Forecasting with the Parsimonious Method and Estimating Share Value Using the ROPI Model Following are income statements and balance sheets for Cisco Systems. Note: Complete

Forecasting with the Parsimonious Method and Estimating Share Value Using the ROPI Model

Following are income statements and balance sheets for Cisco Systems.

Note: Complete the entire question in Excel and format each answer to two decimal places. Then enter the answers into the provided spaces below with two decimal places.

| Cisco Systems | ||

|---|---|---|

| Consolidated Statements of Income | ||

| Years Ended December ($ millions) | July 27, 2019 | July 28, 2018 |

| Revenue | ||

| Product | $39,005 | $36,709 |

| Service | 12,899 | 12,621 |

| Total revenue | 51,904 | 49,330 |

| Cost of sales | ||

| Product | 14,863 | 14,427 |

| Service | 4,375 | 4,297 |

| Total cost of sales | 19,238 | 18,724 |

| Gross margin | 32,666 | 30,606 |

| Operating expenses | ||

| Research and development | 6,577 | 6,332 |

| Sales and marketing | 9,571 | 9,242 |

| General and administrative | 1,827 | 2,144 |

| Amortization of purchased intangible assets | 150 | 221 |

| Restructuring and other charges | 322 | 358 |

| Total operating expenses | 18,447 | 18,297 |

| Operating income | 14,219 | 12,309 |

| Interest income | 1,308 | 1,508 |

| Interest expense | (859) | (943) |

| Other income (loss), net | (97) | 165 |

| Interest and other income (loss), net | 352 | 730 |

| Income before provision for income taxes | 14,571 | 13,039 |

| Provision for income taxes | 2,950 | 12,929 |

| Net income | $11,621 | $110 |

| Cisco Systems Inc. | ||

|---|---|---|

| Consolidated Balance Sheets | ||

| In millions, except par value | July 27, 2019 | July 28, 2018 |

| Assets | ||

| Current assets | ||

| Cash and cash equivalents | $11,750 | $8,934 |

| Investments | 21,663 | 37,614 |

| Accounts receivable, net of allowance for doubtful accounts | 5,491 | 5,554 |

| Inventories | 1,383 | 1,846 |

| Financing receivables, net | 5,095 | 4,949 |

| Other current assets | 2,373 | 2,940 |

| Total current assets | 47,755 | 61,837 |

| Property and equipment, net | 2,789 | 3,006 |

| Financing receivables, net | 4,958 | 4,882 |

| Goodwill | 33,529 | 31,706 |

| Purchased intangible assets, net | 2,201 | 2,552 |

| Deferred tax assets | 4,065 | 3,219 |

| Other assets | 2,496 | 1,582 |

| Total assets | $97,793 | $108,784 |

| Liabilities and equity | ||

| Current liabilities | ||

| Short-term debt | $10,191 | $5,238 |

| Accounts payable | 2,059 | 1,904 |

| Income taxes payable | 1,149 | 1,004 |

| Accrued compensation | 3,221 | 2,986 |

| Deferred revenue | 10,668 | 11,490 |

| Other current liabilities | 4,424 | 4,413 |

| Total current liabilities | 31,712 | 27,035 |

| Long-term debt | 14,475 | 20,331 |

| Income taxes payable | 8,927 | 8,585 |

| Deferred revenue | 7,799 | 8,195 |

| Other long-term liabilities | 1,309 | 1,434 |

| Total liabilities | 64,222 | 65,580 |

| Equity: | ||

| Cisco shareholders' equity | ||

| Preferred stock, no par value: 5 shares authorized; none issued and outstanding | 0 | 0 |

| Common stock and additional paid-in capital, $0.001 par value: 20,000 shares authorized; | ||

| 4,250 and 4,614 shares issued and outstanding at July 27, 2019, and July 28, 2018, respectively | 40,266 | 42,820 |

| (Accumulated deficit) Retained earnings | (5,903) | 1,233 |

| Accumulated other comprehensive income (loss) | (792) | (849) |

| Total Cisco shareholders' equity | 33,571 | 43,204 |

| Total equity | 33,571 | 43,204 |

| Total liabilities and equity | $97,793 | $108,784 |

| Federal and state statutory tax rate | 22% |

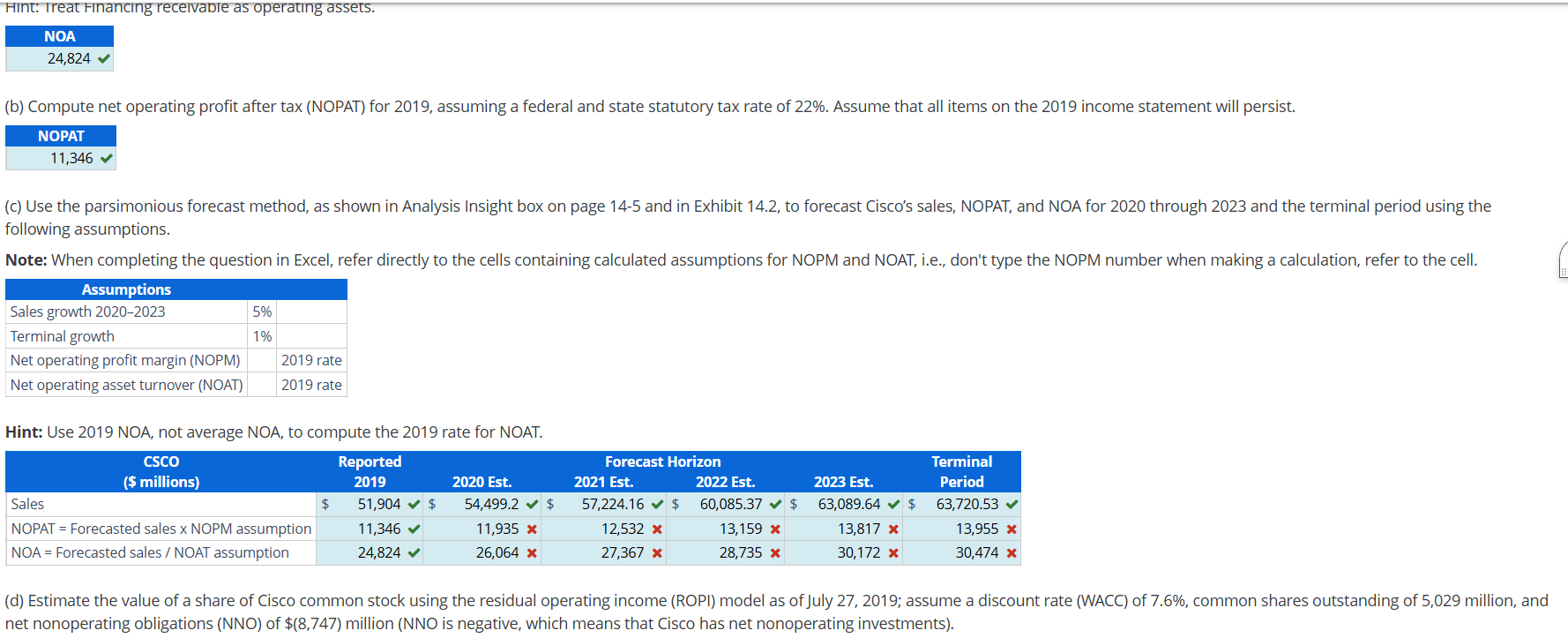

(a) Compute net operating assets (NOA) for 2019.

Hint: Treat Financing receivable as operating assets.

| NOA | |

|---|---|

Answer 1

|

(b) Compute net operating profit after tax (NOPAT) for 2019, assuming a federal and state statutory tax rate of 22%. Assume that all items on the 2019 income statement will persist.

| NOPAT | |

|---|---|

Answer 2

|

(c) Use the parsimonious forecast method, as shown in Analysis Insight box on page 14-5 and in Exhibit 14.2, to forecast Cisco's sales, NOPAT, and NOA for 2020 through 2023 and the terminal period using the following assumptions.

Note: When completing the question in Excel, refer directly to the cells containing calculated assumptions for NOPM and NOAT, i.e., don't type the NOPM number when making a calculation, refer to the cell.

| Assumptions | ||

|---|---|---|

| Sales growth 2020-2023 | 5% | |

| Terminal growth | 1% | |

| Net operating profit margin (NOPM) | 2019 rate | |

| Net operating asset turnover (NOAT) | 2019 rate |

Hint: Use 2019 NOA, not average NOA, to compute the 2019 rate for NOAT.

| CSCO | Reported | Forecast Horizon | Terminal | ||||

|---|---|---|---|---|---|---|---|

| ($ millions) | 2019 | 2020 Est. | 2021 Est. | 2022 Est. | 2023 Est. | Period | |

| Sales | Answer 3

| Answer 4

| Answer 5

| Answer 6

| Answer 7

| Answer 8

| |

| NOPAT = Forecasted sales x NOPM assumption | Answer 9

| Answer 10

| Answer 11

| Answer 12

| Answer 13

| Answer 14

| |

| NOA = Forecasted sales / NOAT assumption | Answer 15

| Answer 16

| Answer 17

| Answer 18

| Answer 19

| Answer 20

|

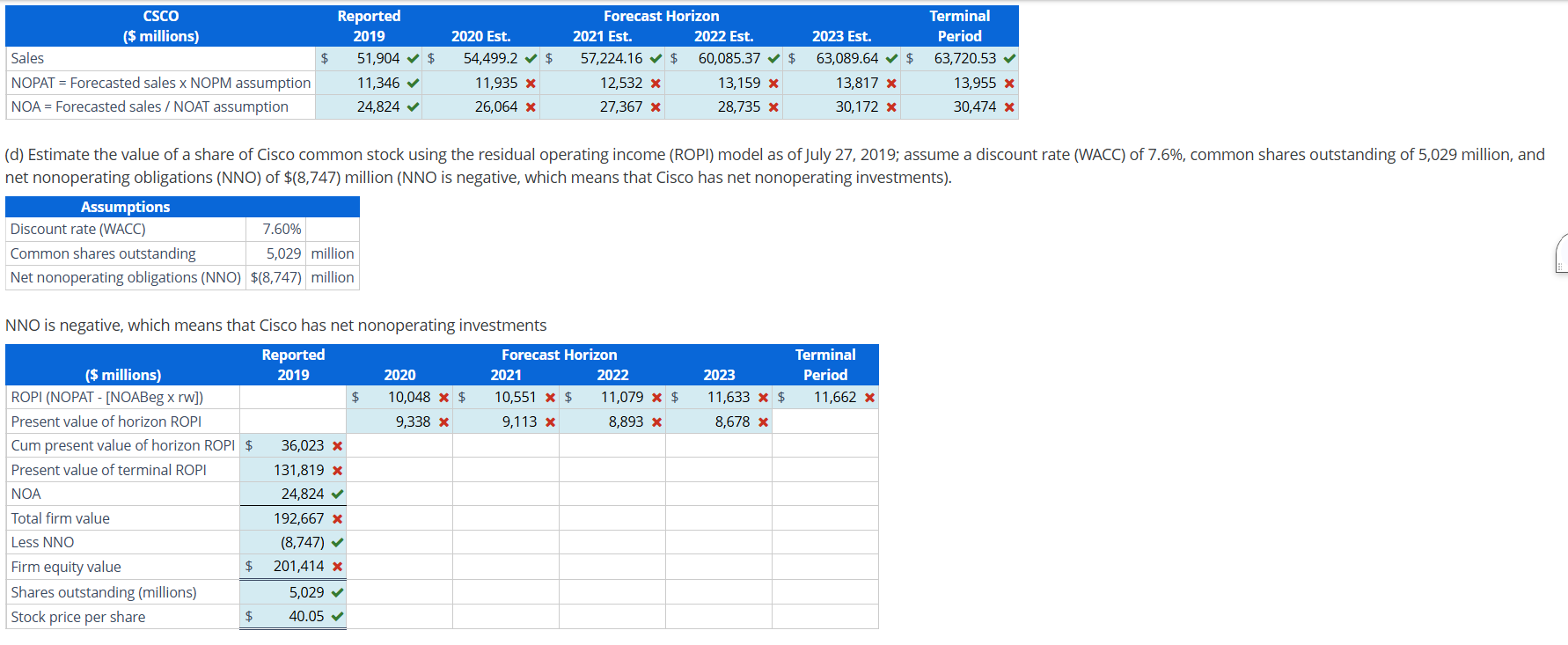

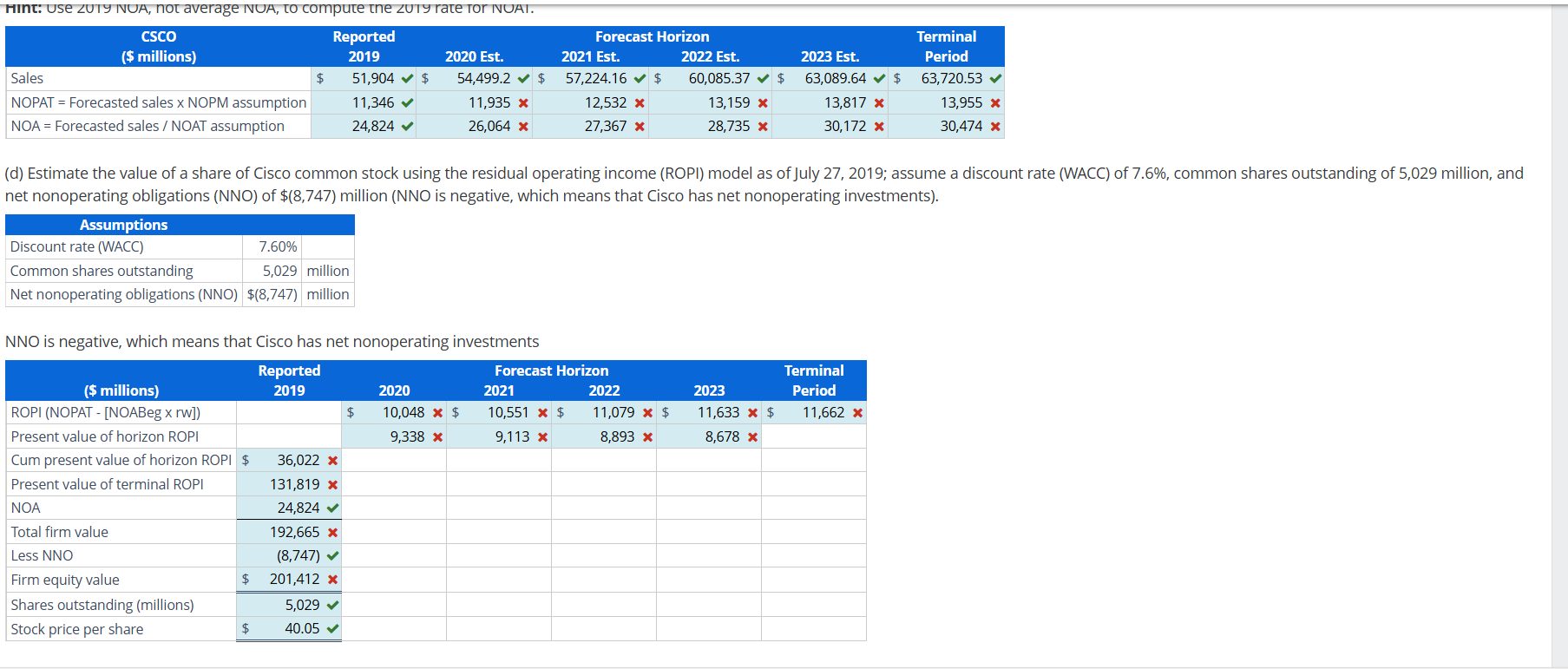

(d) Estimate the value of a share of Cisco common stock using the residual operating income (ROPI) model as of July 27, 2019; assume a discount rate (WACC) of 7.6%, common shares outstanding of 5,029 million, and net nonoperating obligations (NNO) of $(8,747) million (NNO is negative, which means that Cisco has net nonoperating investments).

| Assumptions | ||

|---|---|---|

| Discount rate (WACC) | 7.60% | |

| Common shares outstanding | 5,029 | million |

| Net nonoperating obligations (NNO) | $(8,747) | million |

NNO is negative, which means that Cisco has net nonoperating investments

| Reported | Forecast Horizon | Terminal | |||||

|---|---|---|---|---|---|---|---|

| ($ millions) | 2019 | 2020 | 2021 | 2022 | 2023 | Period | |

| ROPI (NOPAT - [NOABeg x rw]) | Answer 21

| Answer 22

| Answer 23

| Answer 24

| Answer 25

| ||

| Present value of horizon ROPI | Answer 26

| Answer 27

| Answer 28

| Answer 29

| |||

| Cum present value of horizon ROPI | Answer 30

| ||||||

| Present value of terminal ROPI | Answer 31

| ||||||

| NOA | Answer 32

| ||||||

| Total firm value | Answer 33

| ||||||

| Less NNO | Answer 34

| ||||||

| Firm equity value | Answer 35

| ||||||

| Shares outstanding (millions) | Answer 36

| ||||||

| Stock price per share | Answer 37

|

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts