Question: Foreign Reporting - T 1 1 3 5 ( 5 minutes - 3 marks ) The following assets are owned by independent Canadian taxpayers who

Foreign Reporting T minutes marks

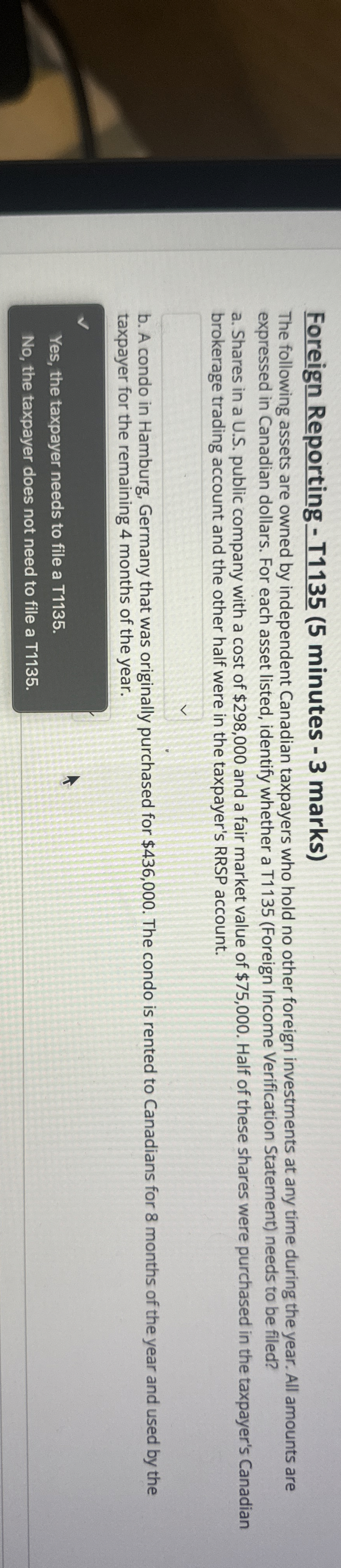

The following assets are owned by independent Canadian taxpayers who hold no other foreign investments at any time during the year. All amounts are expressed in Canadian dollars. For each asset listed, identify whether a TForeign Income Verification Statement needs to be filed?

a Shares in a US public company with a cost of $ and a fair market value of $ Half of these shares were purchased in the taxpayer's Canadian brokerage trading account and the other half were in the taxpayer's RRSP account.

b A condo in Hamburg, Germany that was originally purchased for $ The condo is rented to Canadians for months of the year and used by the taxpayer for the remaining months of the year.

Yes, the taxpayer needs to file a T

No the taxpayer does not need to file a T

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock