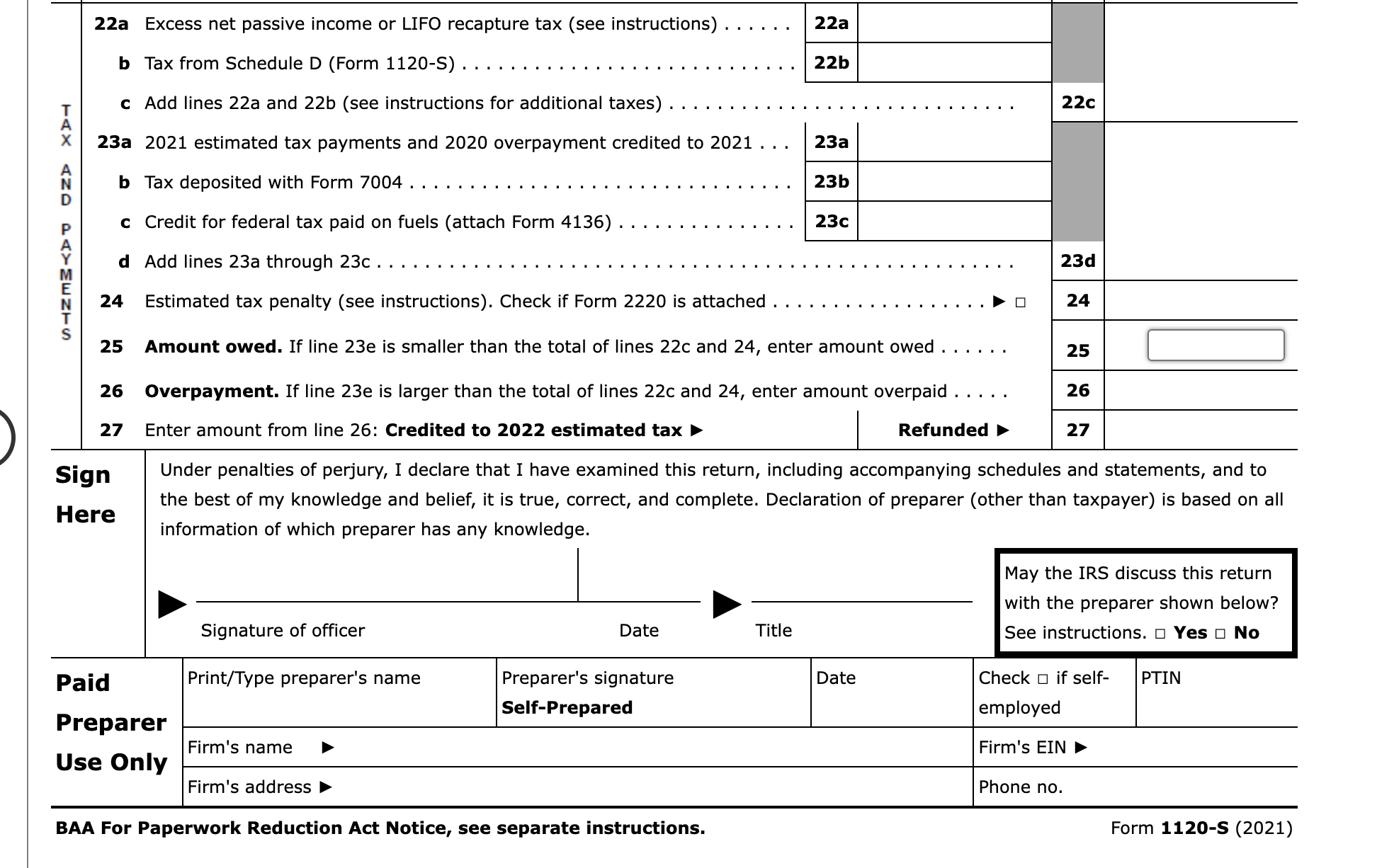

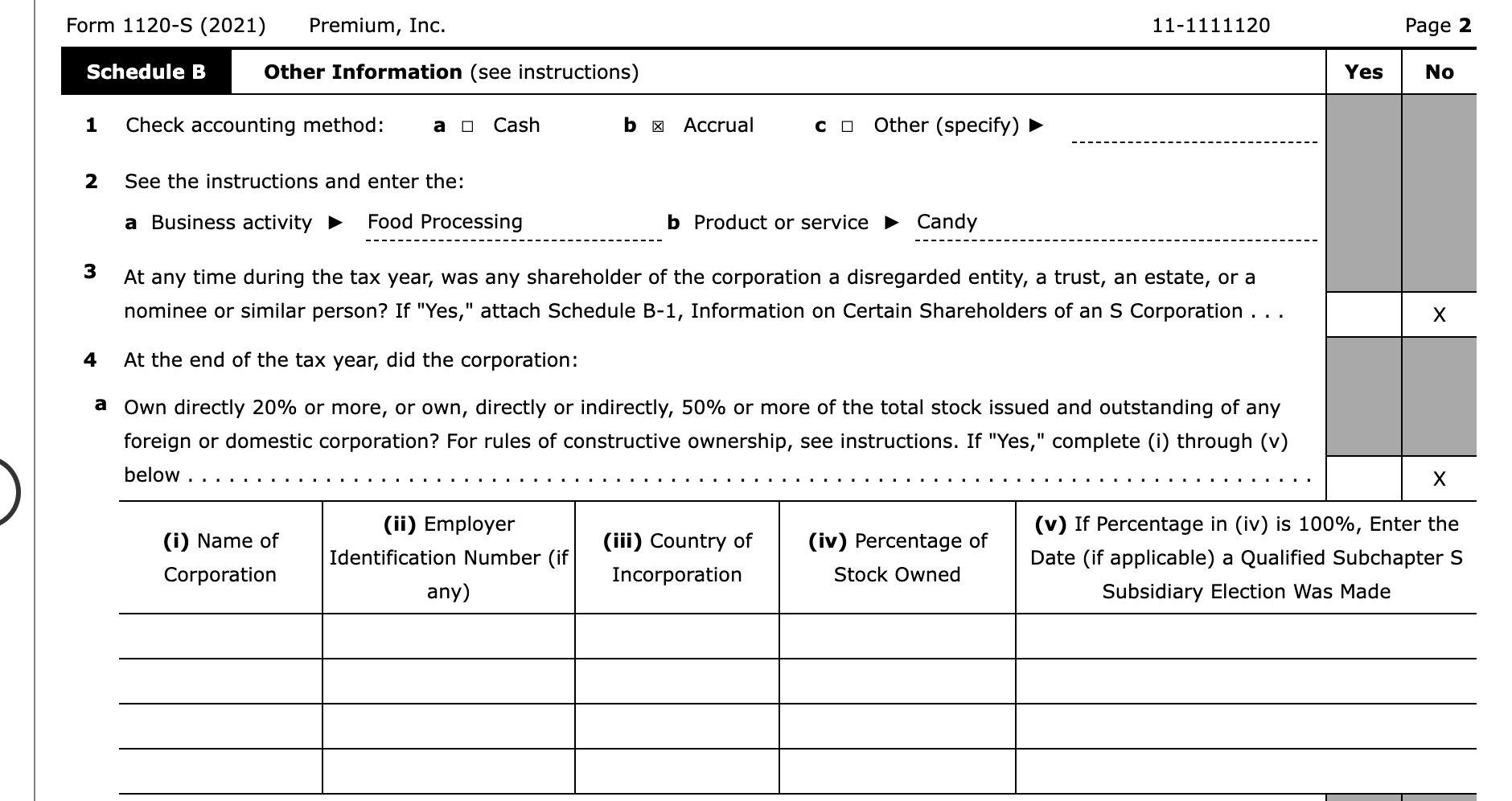

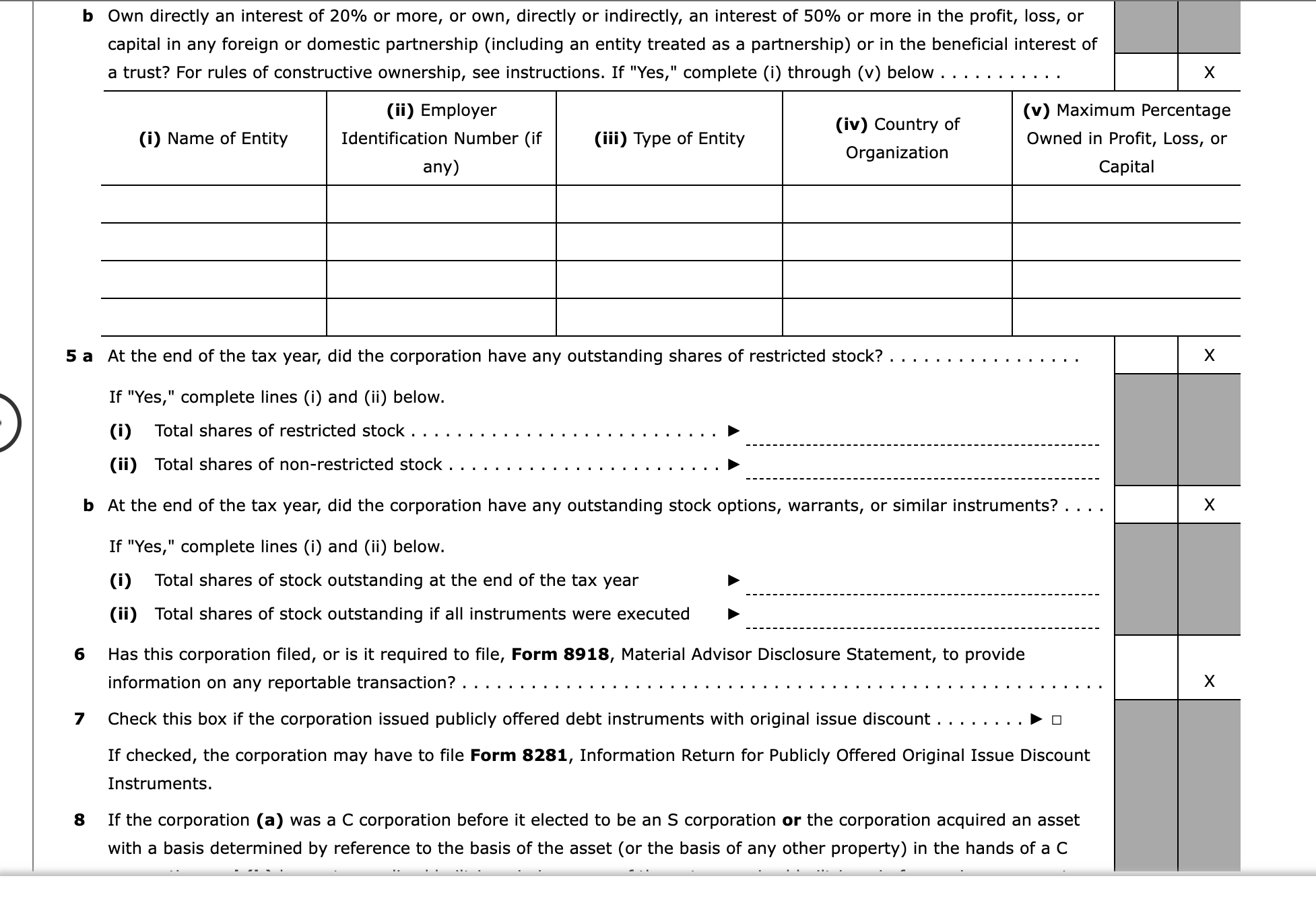

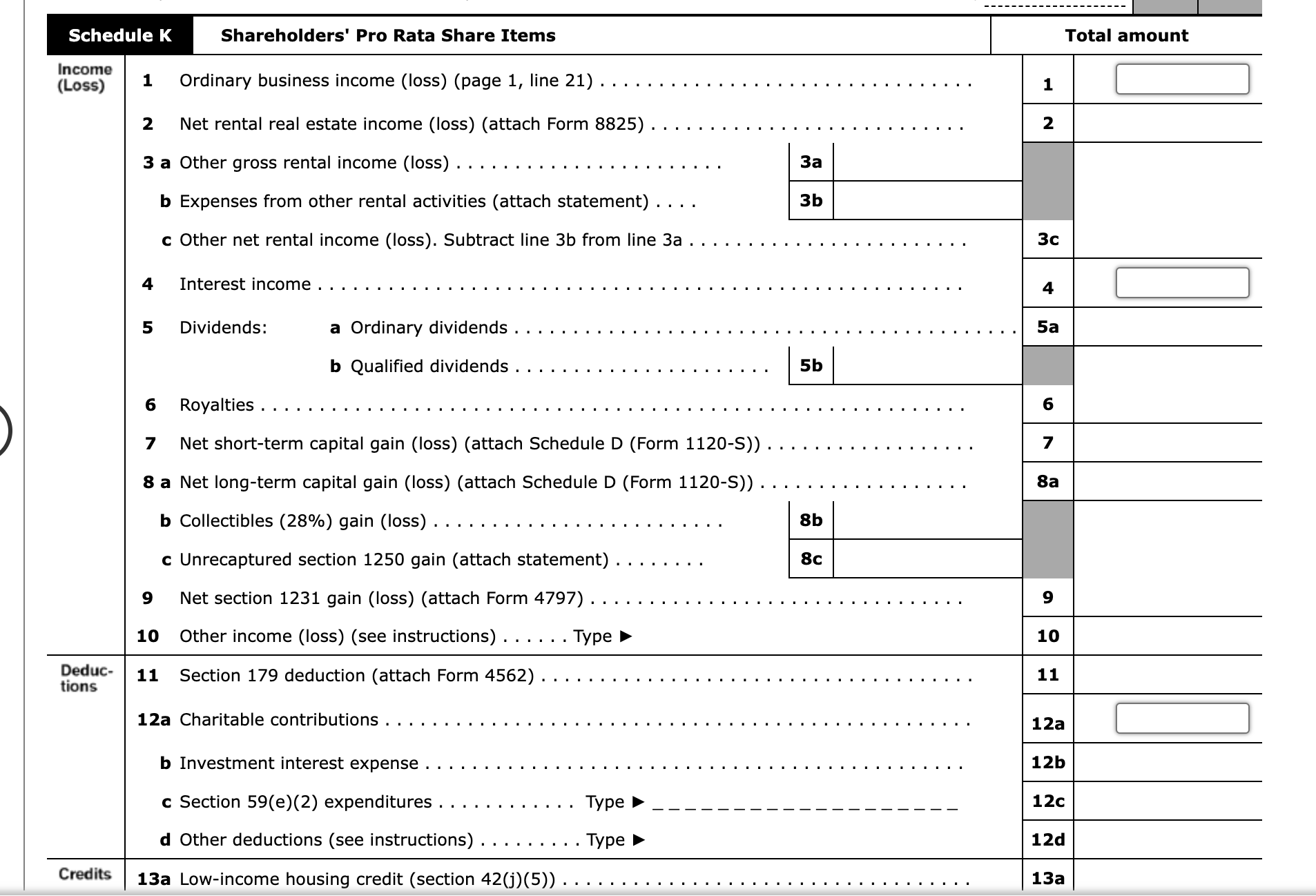

Question: Form 1120-S Tax Return Simulation Note: This problem is for the 2021 tax year. John Parsons (123-45-6781) and George Smith (123-45-6782) are 70% and 30%

Form 1120-S Tax Return Simulation

Form 1120-S Tax Return Simulation

Note: This problem is for the 2021 tax year.

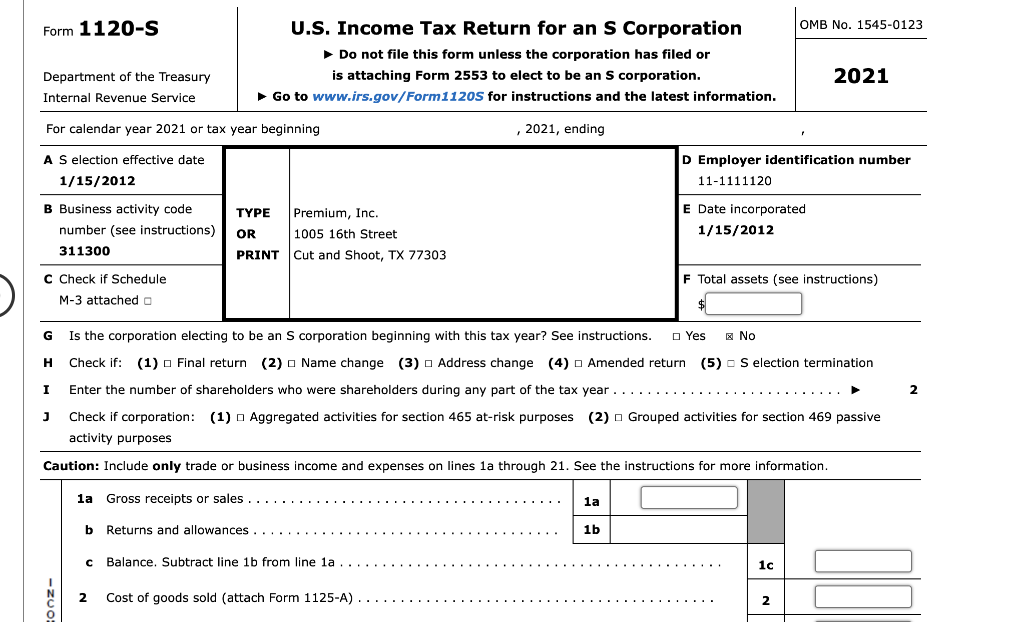

John Parsons (123-45-6781) and George Smith (123-45-6782) are 70% and 30% owners, respectively, of Premium, Inc. (11-1111120), a candy company located at 1005 16th Street, Cut and Shoot, TX 77303. Premium's S election was made on January 15, 2012, its date of incorporation. The following information was taken from the company's 2021 income statement.

| Interest income | $ 100,000 |

| Gross sales receipts | 2,410,000 |

| Beginning inventory | 9,607 |

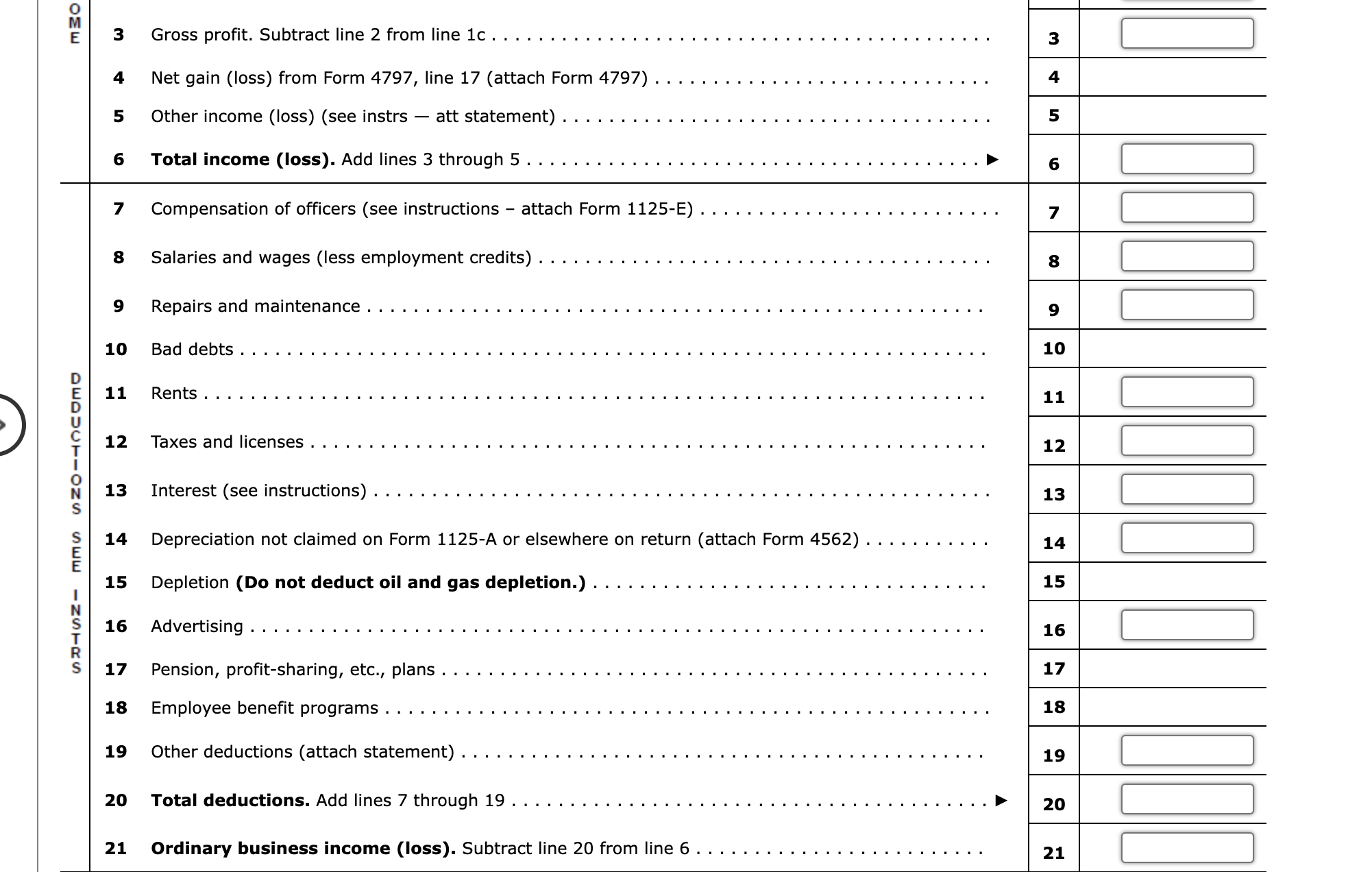

| Direct labor | (203,102) |

| Direct materials purchased | (278,143) |

| Direct other costs | (249,356) |

| Ending inventory | 3,467 |

| Salaries and wages | (442,103) |

| Officers' salaries ($75,000 each to Parsons and Smith) | (150,000) |

| Repairs | (206,106) |

| Depreciation expense, tax and book | (15,254) |

| Interest expense | (35,222) |

| Rent expense (operating) | (40,000) |

| Taxes | (65,101) |

| Charitable contributions (cash) | (20,000) |

| Advertising expenses | (20,000) |

| Payroll penalties | (15,000) |

| Other deductions | (59,899) |

| Book income | 704,574 |

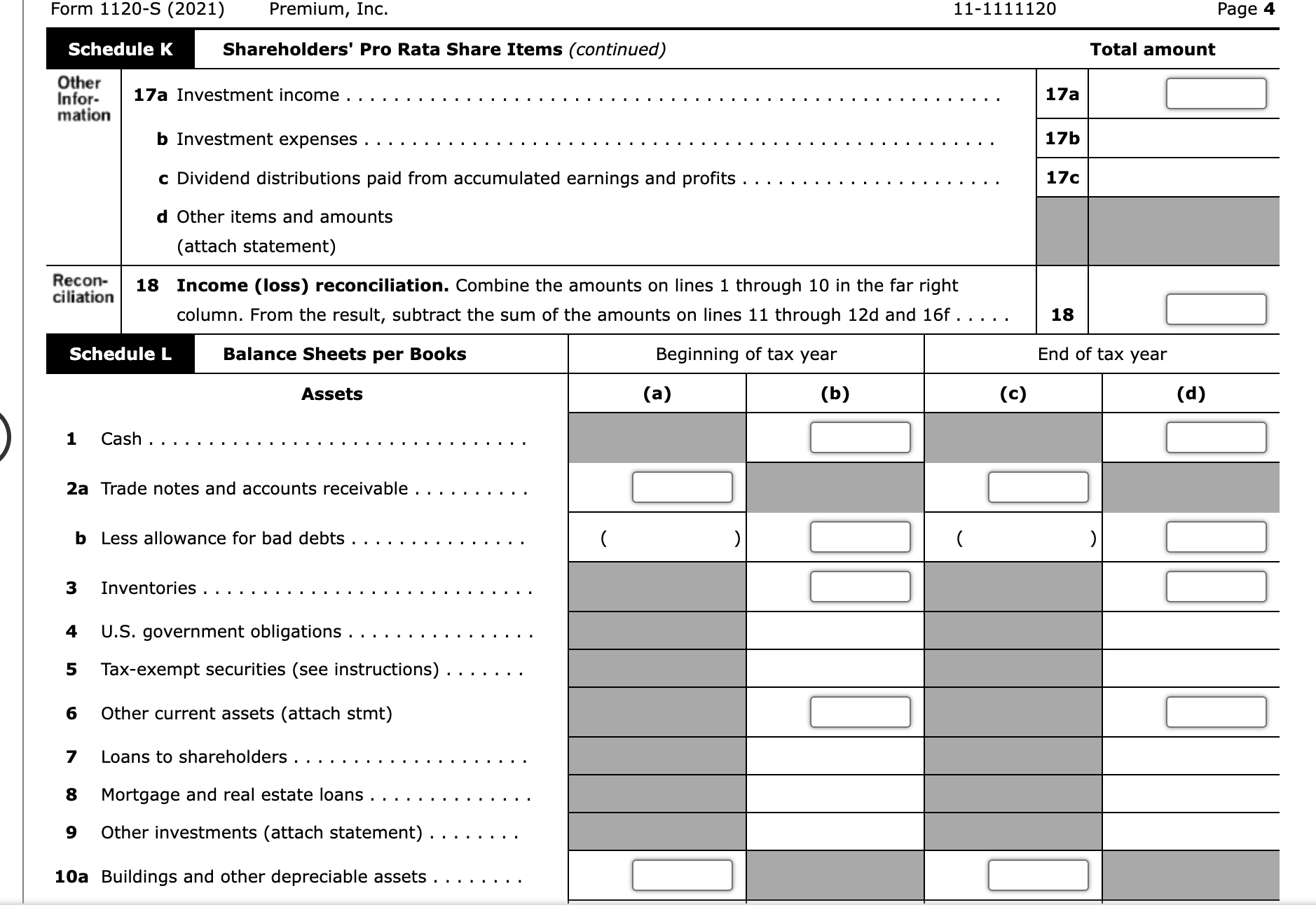

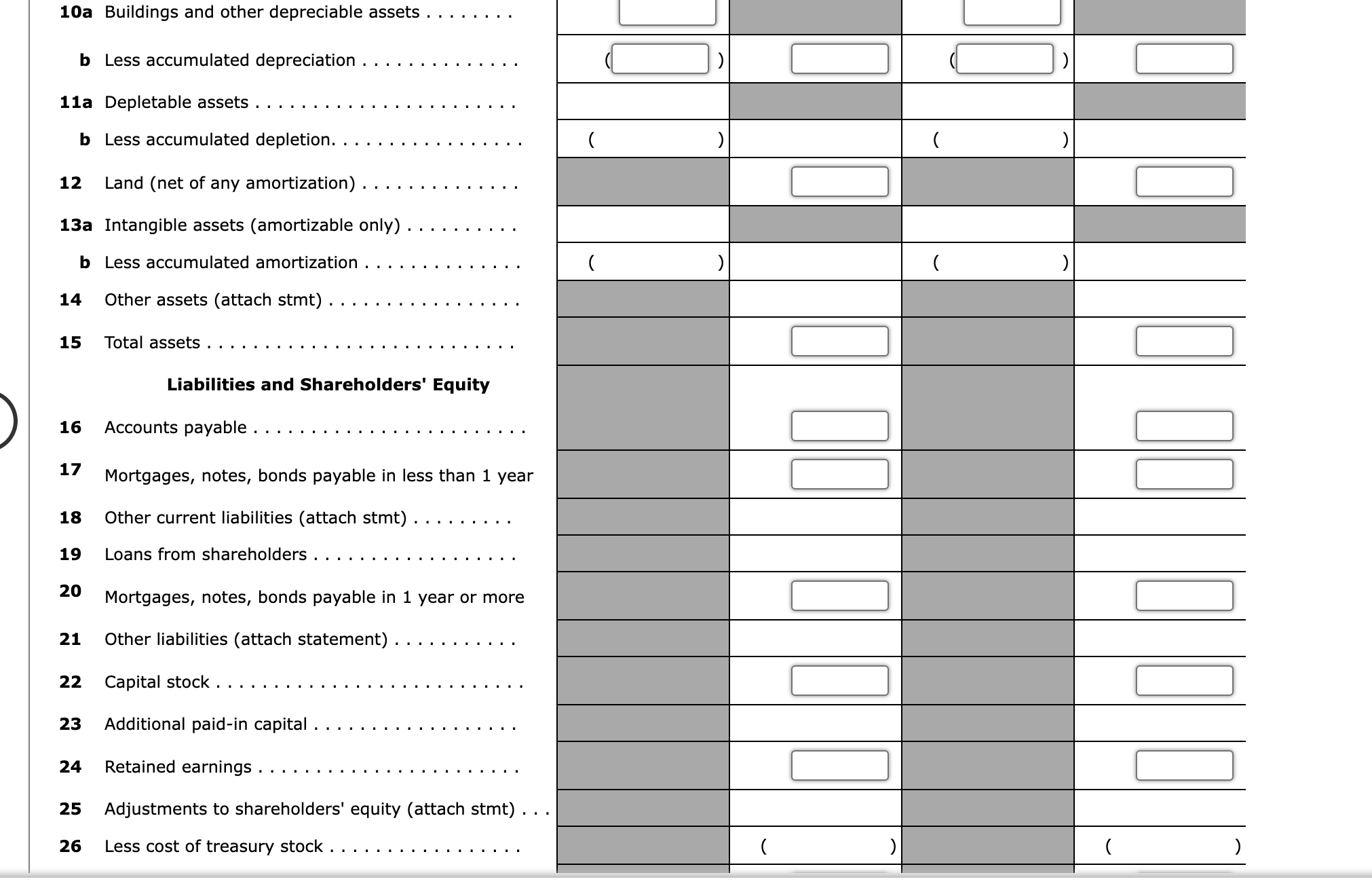

A comparative balance sheet appears below.

| January 1, 2021 | December 31, 2021 | ||

| Cash | $ 47,840 | $ ? | |

| Accounts receivable | 93,100 | 123,104 | |

| Inventories | 9,607 | 3,467 | |

| Prepaid expenses | 8,333 | 17,582 | |

| Building and equipment | 138,203 | 185,348 | |

| Accumulated depreciation | (84,235) | (?) | |

| Land | 2,000 | 2,000 | |

| Total assets | $214,848 | $844,422 | |

| Accounts payable | $ 42,500 | $ 72,300 | |

| Notes payable (less than 1 year) | 4,500 | 2,100 | |

| Notes payable (more than 1 year) | 26,700 | 24,300 | |

| Capital stock (100 shares outstanding) | 30,000 | 30,000 | |

| Retained earnings | $111,148 | ? | |

| Total liabilities and capital | $214,848 | $844,422 | |

Premium's accounting firm provides the following additional information.

| Distributions to shareholders (not reported on Form 1099-DIV and made based on percentage of ownership): | $100,000 |

| Beginning balance, Accumulated adjustments account: | 111,148 |

| Ordinary business income for QBI: | 639,574 |

| W-2 wages for QBI: | 795,205 |

| UBIA of qualified property | 125,000 |

Required:

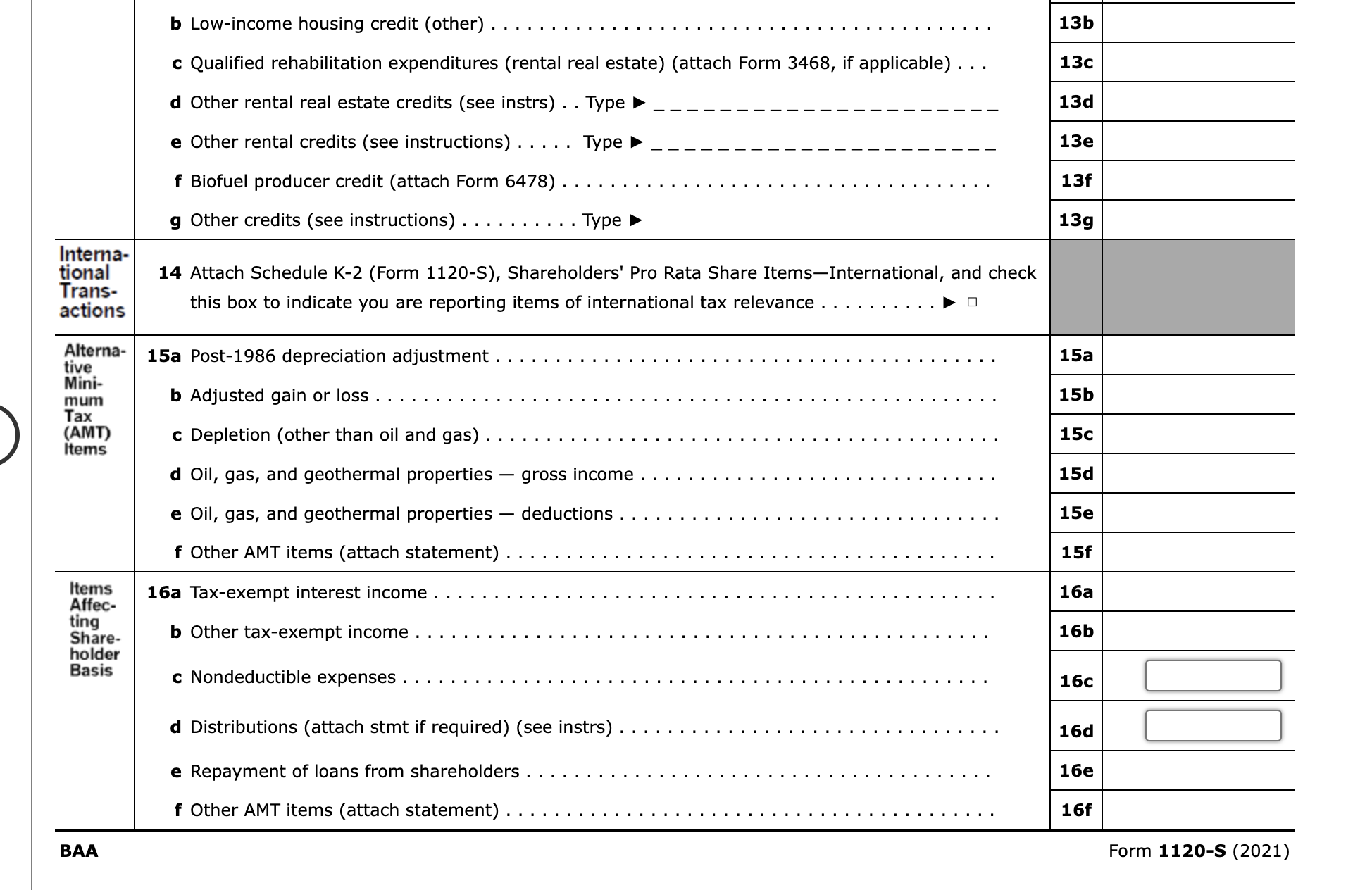

Prepare Premium's Form 1120S, Additional Information - Continuation Statement, and Schedule K-1s for John Parsons and George Smith, 5607 20th Street, Cut and Shoot, TX 77303.

If an amount box does not require an entry or the answer is zero, enter "0".

Enter all amounts as positive numbers, unless otherwise instructed.

If required, round amounts to the nearest dollar.

Make realistic assumptions about any missing data.

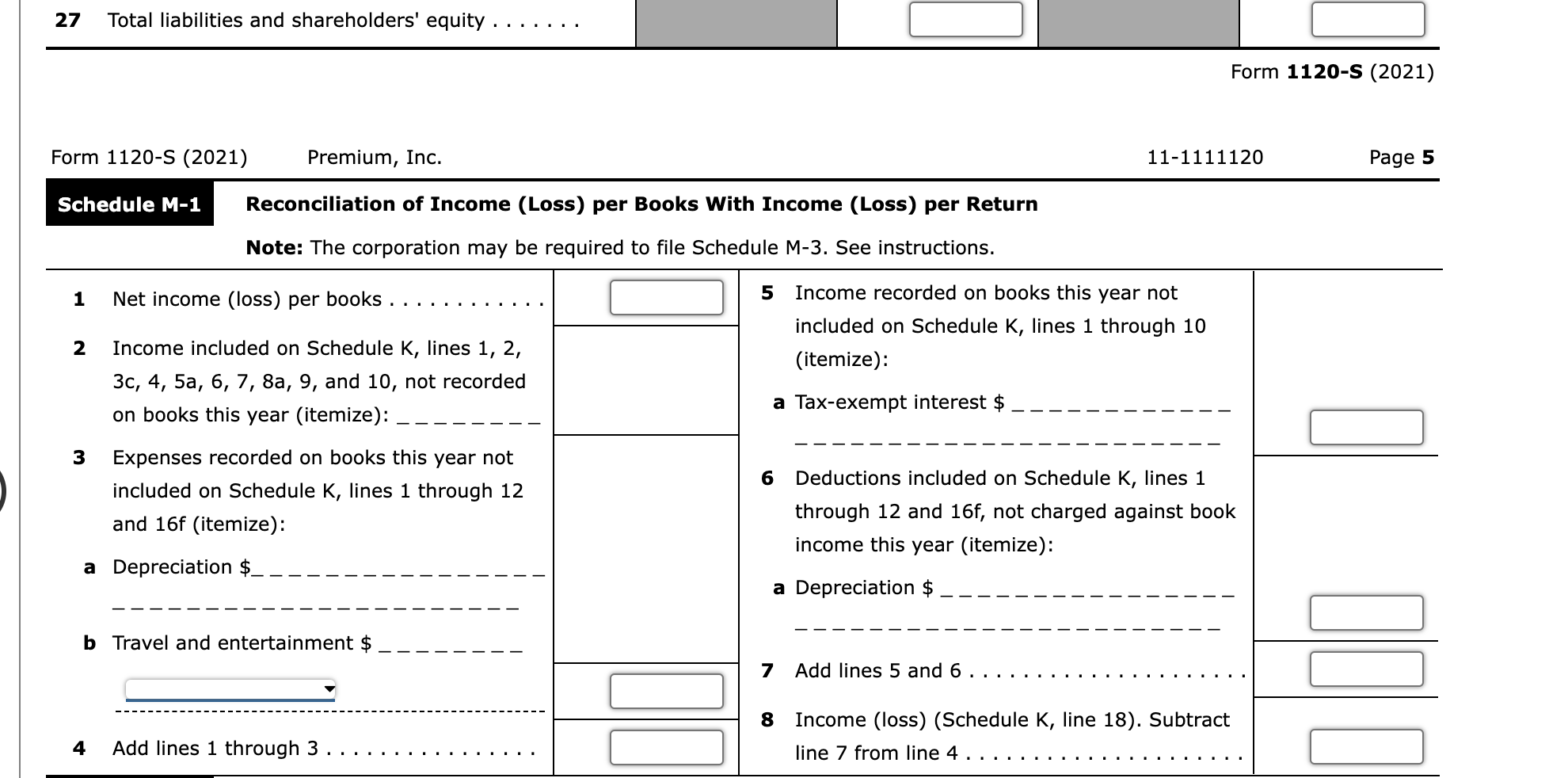

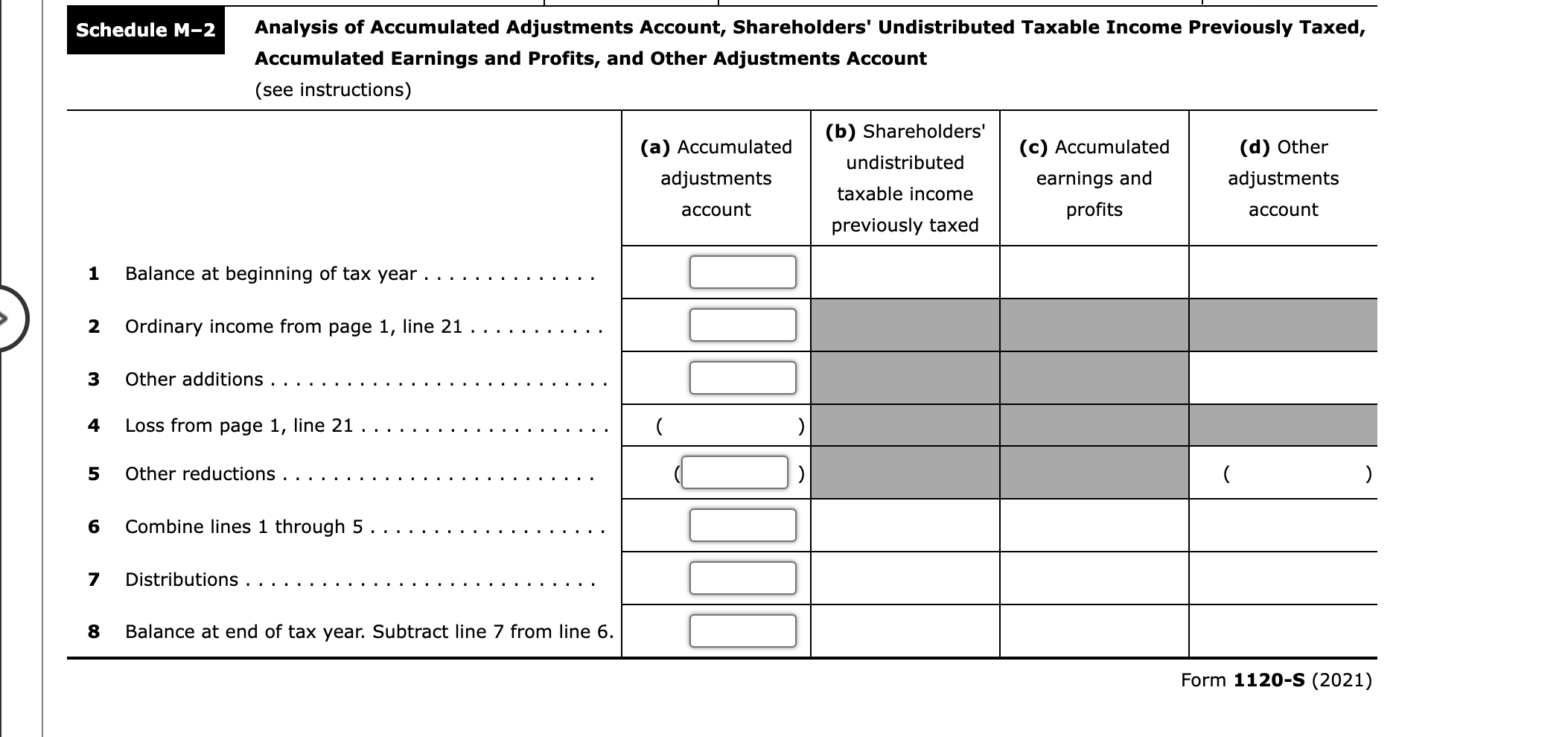

27 Total liabilities and shareholders' equity ... . . . Form 1120-S (2021) Form 1120-S (2021) Premium, Inc. 111111120 Page 5 Schedule M-1 Reconciliation of Income (Loss) per Books With Income (Loss) per Return Note: The corporation may be required to file Schedule M-3. See instructions. Analysis of Accumulated Adjustments Account, Shareholders' Undistributed Taxable Income Previously Taxed, Accumulated Earnings and Profits, and Other Adjustments Account (see instructions) For calendar year 2021 or tax year beginning , 2021 , ending G Is the corporation electing to be an S corporation beginning with this tax year? See instructions. Yes No H Check if: (1) Final return (2) Name change (3) Address change (4) Amended return (5) S election termination I Enter the number of shareholders who were shareholders during any part of the tax year ..................... 2 J Check if corporation: (1) Aggregated activities for section 465 at-risk purposes (2) Grouped activities for section 469 passive activity purposes Caution: Include only trade or business income and expenses on lines 1 a through 21 . See the instructions for more information. BAA For Paperwork Reduction Act Notice, see separate instructions. Form 1120-S (2021) Form 1120-S (2021) Premium, Inc. 111111120 Page 2 \begin{tabular}{l|c|c|c|c} \hline (i)NameofCorporation & (ii)EmployerIdentificationNumber(ifany) & (iii)CountryofIncorporation & (iv)PercentageofStockOwned & (v)IfPercentagein(iv)is100%,EntertheDate(ifapplicable)aQualifiedSubchapterSSubsidiaryElectionWasMade \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular} b Own directly an interest of 20% or more, or own, directly or indirectly, an interest of 50% or more in the profit, loss, or capital in any foreign or domestic partnership (including an entity treated as a partnership) or in the beneficial interest of a trust? For rules of constructive ownership, see instructions. If "Yes," complete (i) through (v) below ......... 5 a At the end of the tax year, did the corporation have any outstanding shares of restricted stock? If "Yes," complete lines (i) and (ii) below. (i) Total shares of restricted stock . (ii) Total shares of non-restricted stock b At the end of the tax year, did the corporation have any outstanding stock options, warrants, or similar instruments? .... If "Yes," complete lines (i) and (ii) below. (i) Total shares of stock outstanding at the end of the tax year (ii) Total shares of stock outstanding if all instruments were executed 6 Has this corporation filed, or is it required to file, Form 8918, Material Advisor Disclosure Statement, to provide information on any reportable transaction? 7 Check this box if the corporation issued publicly offered debt instruments with original issue discount If checked, the corporation may have to file Form 8281, Information Return for Publicly Offered Original Issue Discount Instruments. 8 If the corporation (a) was a C corporation before it elected to be an S corporation or the corporation acquired an asset with a basis determined by reference to the basis of the asset (or the basis of any other property) in the hands of a C Form 1120-S (2021) Premium, Inc. 11-1111120 Page 4 10a Buildings and other depreciable assets b Less accumulated depreciation . . . . . ....... 11a Depletable assets . . . . . . . . . . . . .... b Less accumulated depletion. 12 Land (net of any amortization) . . . ........ 13a Intangible assets (amortizable only) . . . . . .. b Less accumulated amortization . . . . . . . ..... 14 Other assets (attach stmt) 15 Total assets Liabilities and Shareholders' Equity 16 Accounts payable . . ................. 17 Mortgages, notes, bonds payable in less than 1 year 18 Other current liabilities (attach stmt) ........ 19 Loans from shareholders . . . . . . . . . . . . . . . 20 Mortgages, notes, bonds payable in 1 year or more 21 Other liabilities (attach statement) . . . . . . ... 22 Capital stock . .................... 23 Additional paid-in capital 24 Retained earnings 25 Adjustments to shareholders' equity (attach stmt) ... 26 Less cost of treasury stock 27 Total liabilities and shareholders' equity ... . . . Form 1120-S (2021) Form 1120-S (2021) Premium, Inc. 111111120 Page 5 Schedule M-1 Reconciliation of Income (Loss) per Books With Income (Loss) per Return Note: The corporation may be required to file Schedule M-3. See instructions. Analysis of Accumulated Adjustments Account, Shareholders' Undistributed Taxable Income Previously Taxed, Accumulated Earnings and Profits, and Other Adjustments Account (see instructions) For calendar year 2021 or tax year beginning , 2021 , ending G Is the corporation electing to be an S corporation beginning with this tax year? See instructions. Yes No H Check if: (1) Final return (2) Name change (3) Address change (4) Amended return (5) S election termination I Enter the number of shareholders who were shareholders during any part of the tax year ..................... 2 J Check if corporation: (1) Aggregated activities for section 465 at-risk purposes (2) Grouped activities for section 469 passive activity purposes Caution: Include only trade or business income and expenses on lines 1 a through 21 . See the instructions for more information. BAA For Paperwork Reduction Act Notice, see separate instructions. Form 1120-S (2021) Form 1120-S (2021) Premium, Inc. 111111120 Page 2 \begin{tabular}{l|c|c|c|c} \hline (i)NameofCorporation & (ii)EmployerIdentificationNumber(ifany) & (iii)CountryofIncorporation & (iv)PercentageofStockOwned & (v)IfPercentagein(iv)is100%,EntertheDate(ifapplicable)aQualifiedSubchapterSSubsidiaryElectionWasMade \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular} b Own directly an interest of 20% or more, or own, directly or indirectly, an interest of 50% or more in the profit, loss, or capital in any foreign or domestic partnership (including an entity treated as a partnership) or in the beneficial interest of a trust? For rules of constructive ownership, see instructions. If "Yes," complete (i) through (v) below ......... 5 a At the end of the tax year, did the corporation have any outstanding shares of restricted stock? If "Yes," complete lines (i) and (ii) below. (i) Total shares of restricted stock . (ii) Total shares of non-restricted stock b At the end of the tax year, did the corporation have any outstanding stock options, warrants, or similar instruments? .... If "Yes," complete lines (i) and (ii) below. (i) Total shares of stock outstanding at the end of the tax year (ii) Total shares of stock outstanding if all instruments were executed 6 Has this corporation filed, or is it required to file, Form 8918, Material Advisor Disclosure Statement, to provide information on any reportable transaction? 7 Check this box if the corporation issued publicly offered debt instruments with original issue discount If checked, the corporation may have to file Form 8281, Information Return for Publicly Offered Original Issue Discount Instruments. 8 If the corporation (a) was a C corporation before it elected to be an S corporation or the corporation acquired an asset with a basis determined by reference to the basis of the asset (or the basis of any other property) in the hands of a C Form 1120-S (2021) Premium, Inc. 11-1111120 Page 4 10a Buildings and other depreciable assets b Less accumulated depreciation . . . . . ....... 11a Depletable assets . . . . . . . . . . . . .... b Less accumulated depletion. 12 Land (net of any amortization) . . . ........ 13a Intangible assets (amortizable only) . . . . . .. b Less accumulated amortization . . . . . . . ..... 14 Other assets (attach stmt) 15 Total assets Liabilities and Shareholders' Equity 16 Accounts payable . . ................. 17 Mortgages, notes, bonds payable in less than 1 year 18 Other current liabilities (attach stmt) ........ 19 Loans from shareholders . . . . . . . . . . . . . . . 20 Mortgages, notes, bonds payable in 1 year or more 21 Other liabilities (attach statement) . . . . . . ... 22 Capital stock . .................... 23 Additional paid-in capital 24 Retained earnings 25 Adjustments to shareholders' equity (attach stmt) ... 26 Less cost of treasury stock

Step by Step Solution

There are 3 Steps involved in it

Form 1120S Preparation Step 1 Calculate Gross Profit Gross ReceiptsSales 2410000 Cost of Goods Sold ... View full answer

Get step-by-step solutions from verified subject matter experts