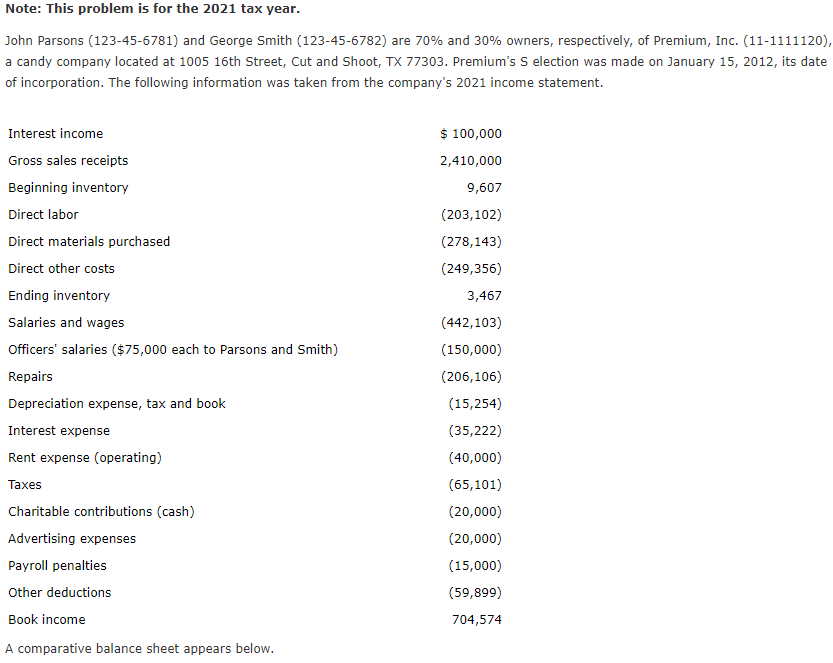

Question: Note: This problem is for the 2021 tax year. John Parsons (123-45-6781) and George Smith (123-45-6782) are 70% and 30% owners, respectively, of Premium, Inc.

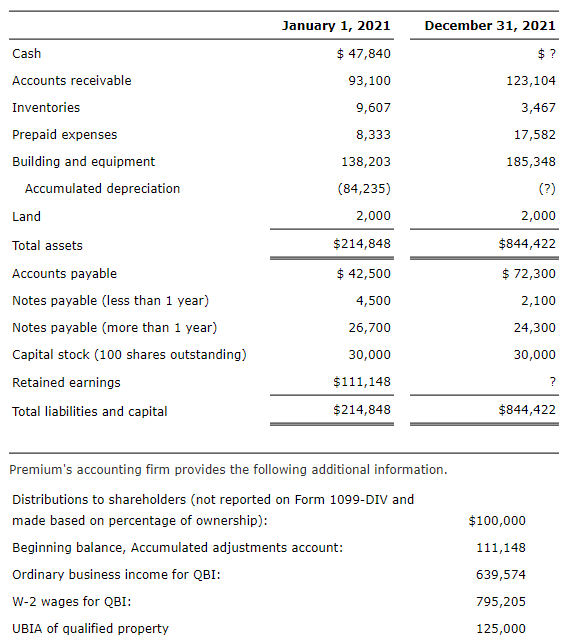

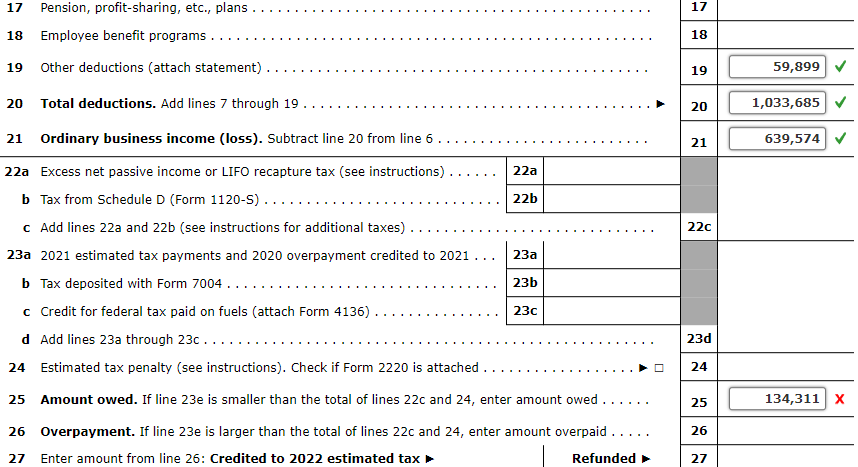

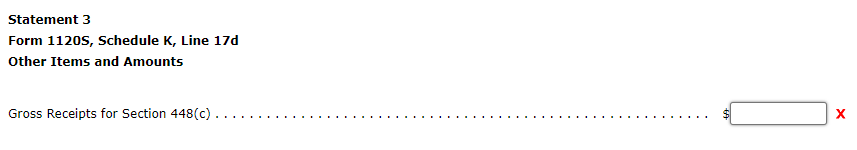

Note: This problem is for the 2021 tax year. John Parsons (123-45-6781) and George Smith (123-45-6782) are 70\% and 30\% owners, respectively, of Premium, Inc. (11-1111120), a candy company located at 1005 16th Street, Cut and Shoot, TX 77303. Premium's S election was made on January 15, 2012, its date Premium's accounting firm provides the following additional information. Distributions to shareholders (not reported on Form 1099-DIV and madebasedonpercentageofownership):$100,000 Beginning balance, Accumulated adjustments account: 111,148 Ordinary business income for QBI: 639,574 W-2 wages for QBI : 795,205 UBIA of qualified property 125,000 17 Pension, profit-sharing, etc., plans. 18 Employee benefit programs . 19 Other deductions (attach statement) 20 Total deductions. Add lines 7 through 19 21 Ordinary business income (loss). Subtract line 20 from line 6. 22a Excess net passive income or LIFO recapture tax (see instructions). b Tax from Schedule D (Form 1120-S) c Add lines 22a and 22b (see instructions for additional taxes) 23a 2021 estimated tax payments and 2020 overpayment credited to 2021 . . . 23 a b Tax deposited with Form 7004 c Credit for federal tax paid on fuels (attach Form 4136) d Add lines 23a through 23c 24 Estimated tax penalty (see instructions). Check if Form 2220 is attached 25 Amount owed. If line 23e is smaller than the total of lines 22c and 24 , enter amount owed ..... 26 Overpayment. If line 23e is larger than the total of lines 22c and 24 , enter amount overpaid . ... 27 Enter amount from line 26: Credited to 2022 estimated tax \begin{tabular}{|c|r} \hline 17 & \\ \hline 18 & \\ \hline 19 & 59,899 \\ \hline 20 & 1,033,685 \\ \hline 21 & 639,574 \\ \hline 22c & \\ \hline & \\ \hline 23d & \\ \hline 24 & \\ \hline 25 & \\ \hline 26 & \\ \hline 27 & \\ \hline \end{tabular} Statement 3 Form 1120s, Schedule K, Line 17d Other Items and Amounts x

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts