Question: Form 4684, Section B, and Schedule A (Form Form 4684, Section B, and Schedule D (Form Form 4684, Section A, and Schedule A (Form Form

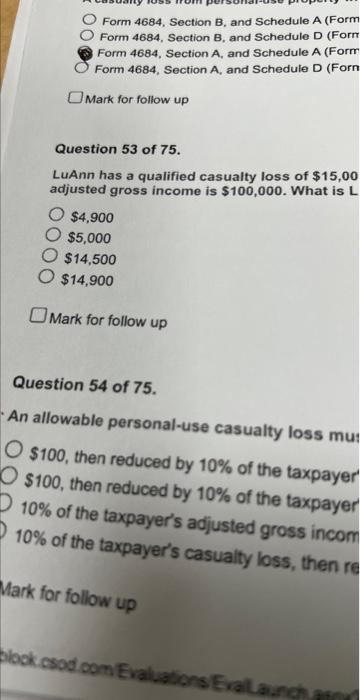

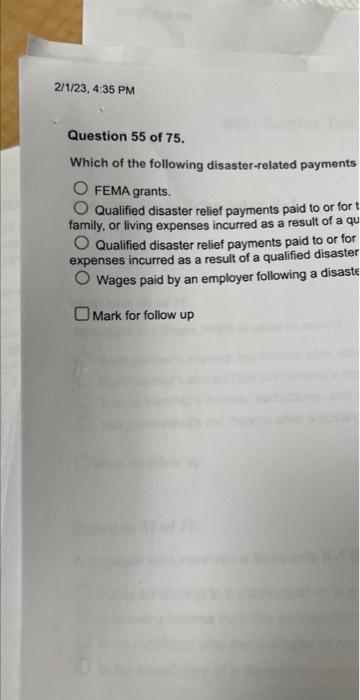

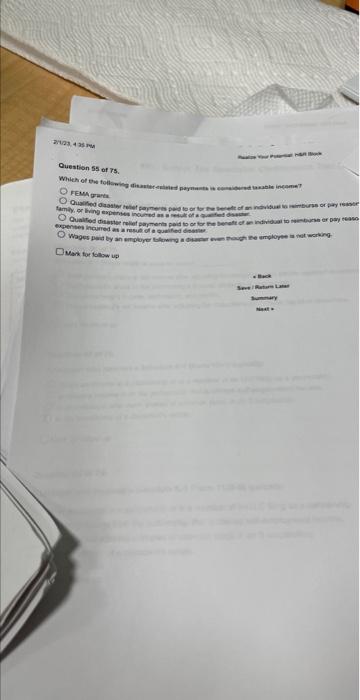

Form 4684, Section B, and Schedule A (Form Form 4684, Section B, and Schedule D (Form Form 4684, Section A, and Schedule A (Form Form 4684, Section A, and Schedule D (Forn Mark for follow up Question 53 of 75 . LuAnn has a qualified casualty loss of $15,00 adjusted gross income is $100,000. What is L $4,900$5,000$14,500$14,900 Mark for follow up Question 54 of 75. An allowable personal-use casualty loss mu: $100, then reduced by 10% of the taxpayer $100, then reduced by 10% of the taxpayer 10% of the taxpayer's adjusted gross incom 10% of the taxpayer's casualty loss, then re Mark for follow up Question 55 of 75. Which of the following disaster-related payments FEMA grants. Qualified disaster relief payments paid to or for t family, or living expenses incurred as a result of a qu Qualified disaster relief payments paid to or for expenses incurred as a result of a qualified disaster Wages paid by an employer following a disaste Mark for follow up Question 55 of 75 . FeMu grarta Mank for follow up Form 4684, Section B, and Schedule A (Form Form 4684, Section B, and Schedule D (Form Form 4684, Section A, and Schedule A (Form Form 4684, Section A, and Schedule D (Forn Mark for follow up Question 53 of 75 . LuAnn has a qualified casualty loss of $15,00 adjusted gross income is $100,000. What is L $4,900$5,000$14,500$14,900 Mark for follow up Question 54 of 75. An allowable personal-use casualty loss mu: $100, then reduced by 10% of the taxpayer $100, then reduced by 10% of the taxpayer 10% of the taxpayer's adjusted gross incom 10% of the taxpayer's casualty loss, then re Mark for follow up Question 55 of 75. Which of the following disaster-related payments FEMA grants. Qualified disaster relief payments paid to or for t family, or living expenses incurred as a result of a qu Qualified disaster relief payments paid to or for expenses incurred as a result of a qualified disaster Wages paid by an employer following a disaste Mark for follow up Question 55 of 75 . FeMu grarta Mank for follow up

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts