Question: Format Arrange View Share Window Help PMA - BACHELOR AEU - FINANCIAL MANAGEMENT 150% T View Zoom Add Page Insert Table Chart Text Shape Media

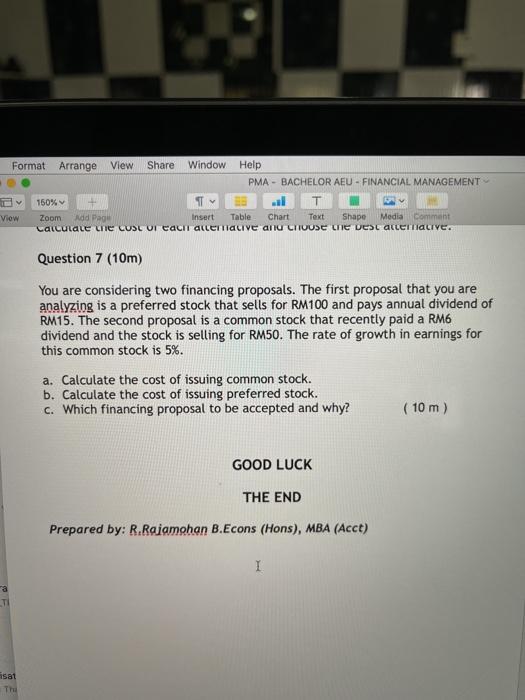

Format Arrange View Share Window Help PMA - BACHELOR AEU - FINANCIAL MANAGEMENT 150% T View Zoom Add Page Insert Table Chart Text Shape Media Comment calculate the CUSC VI Cach atcerative and CHOUSE Le Dest accerTalive. Question 7 (10m) You are considering two financing proposals. The first proposal that you are analyzing is a preferred stock that sells for RM100 and pays annual dividend of RM15. The second proposal is a common stock that recently paid a RM6 dividend and the stock is selling for RM50. The rate of growth in earnings for this common stock is 5%. a. Calculate the cost of issuing common stock. b. Calculate the cost of issuing preferred stock. c. Which financing proposal to be accepted and why? (10 m) GOOD LUCK THE END Prepared by: R.Rajamohan B.Econs (Hons), MBA (Acct) I TI isat The

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts