Question: Format Font Tools Table WindowHelp @ 0 ay 96% Rsa, | Pepsico.docx nts Tables Charts SmartArt Review Paragraph Normal No SpacingHeading 1Heading 2 0 1.

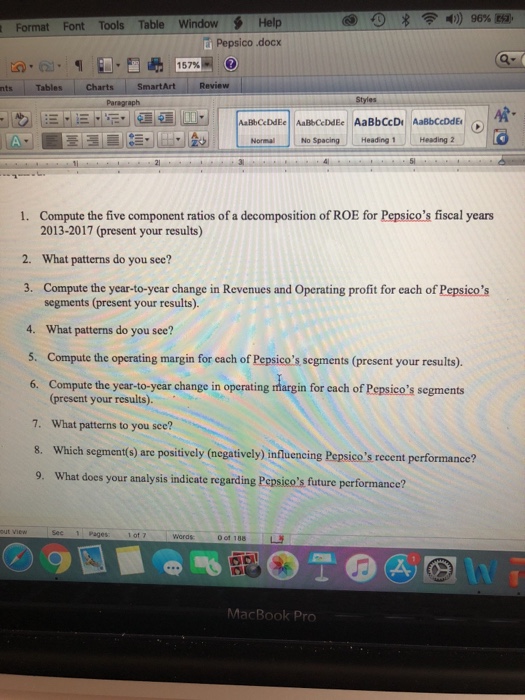

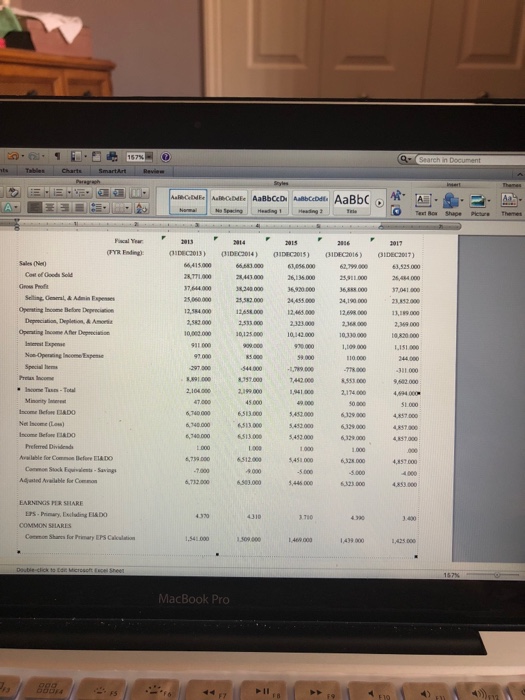

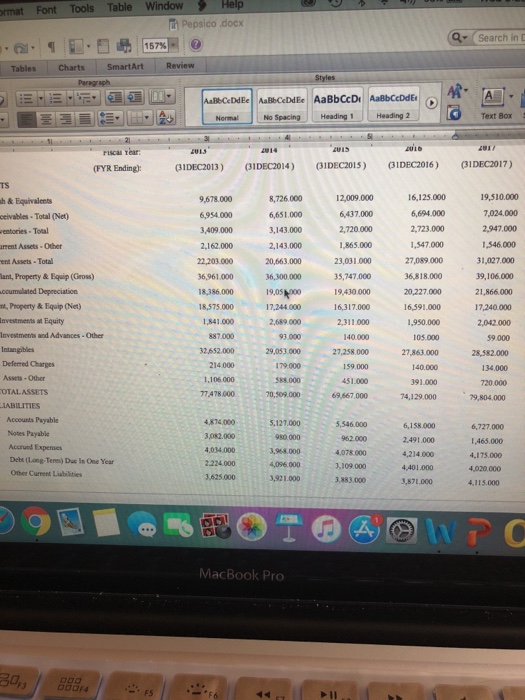

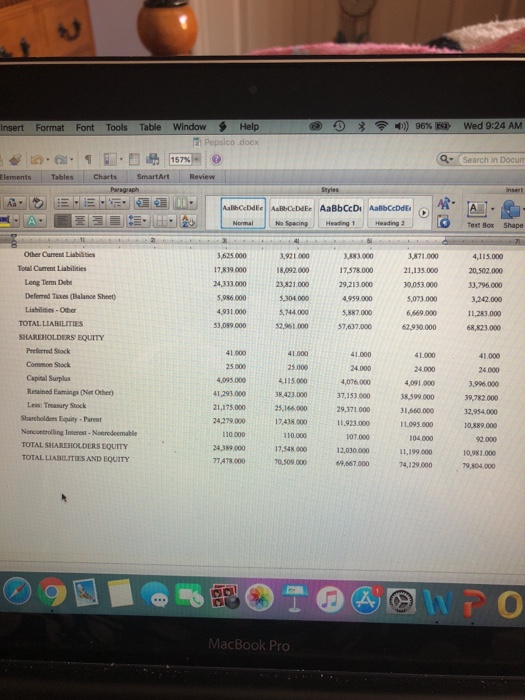

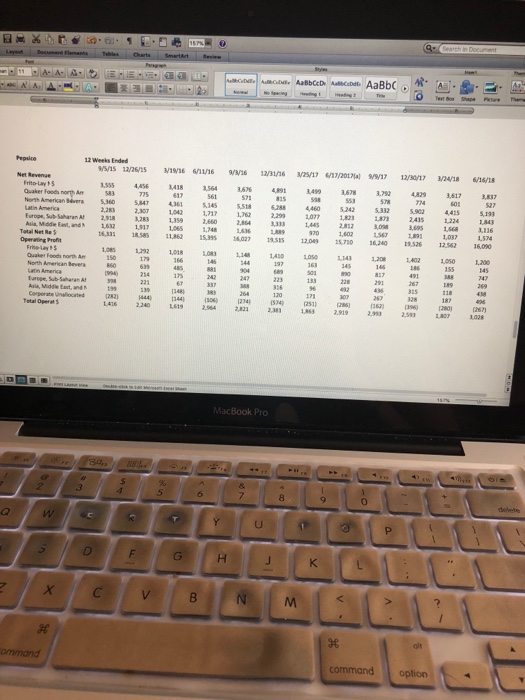

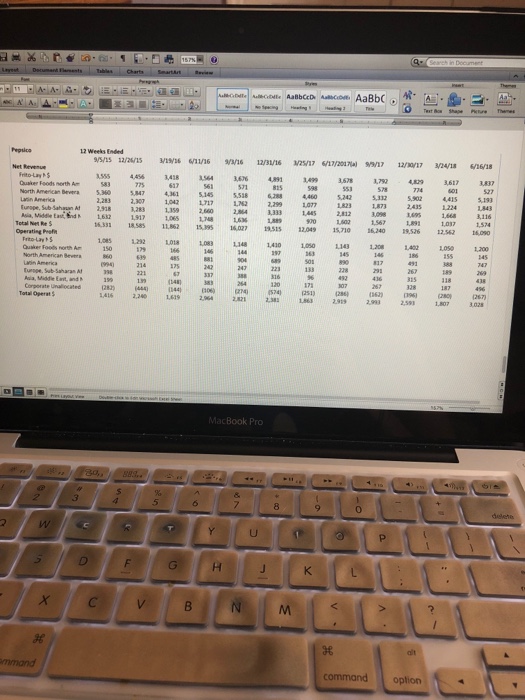

Format Font Tools Table WindowHelp @ 0 ay 96% Rsa, | Pepsico.docx nts Tables Charts SmartArt Review Paragraph Normal No SpacingHeading 1Heading 2 0 1. Compute the five component ratios of a decomposition of ROE for Pepsico's fiscal years 2013-2017 (present your results) 2. What patterns do you see? 3. Compute the year-to-year change in Revenues and Operating profit for each of Pepsico's segments (present your results). 4. What patterns do you see? 5. Compute the operating margin for each of Pepsico's segments (present your results). 6. Compute the year-to-year change in operating margin for each of Pepsico's segments (present your results). 7. What patterns to you see? 8. Which segments) are positively (negatively) influencing Pepsice's recent performance? 9. What does your analysis indicate regarding Pepsico's future performance? Pages 1 of 7 2 MacBook Pro Format Font Tools Table WindowHelp @ 0 ay 96% Rsa, | Pepsico.docx nts Tables Charts SmartArt Review Paragraph Normal No SpacingHeading 1Heading 2 0 1. Compute the five component ratios of a decomposition of ROE for Pepsico's fiscal years 2013-2017 (present your results) 2. What patterns do you see? 3. Compute the year-to-year change in Revenues and Operating profit for each of Pepsico's segments (present your results). 4. What patterns do you see? 5. Compute the operating margin for each of Pepsico's segments (present your results). 6. Compute the year-to-year change in operating margin for each of Pepsico's segments (present your results). 7. What patterns to you see? 8. Which segments) are positively (negatively) influencing Pepsice's recent performance? 9. What does your analysis indicate regarding Pepsico's future performance? Pages 1 of 7 2 MacBook Pro

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts