Question: Format Painter Clipboard B I U ? H | a . A . Font E 2 0 A B C D E Custom Wrap Text

Format Painter

Clipboard

B

H

a

A

Font

E

A

B

C

D

E

Custom

Wrap Text

Merge & Center

$

o

Conditional Format as

Alignment

Accent

Accent

Formatting Table v Comma

Currency

Styles

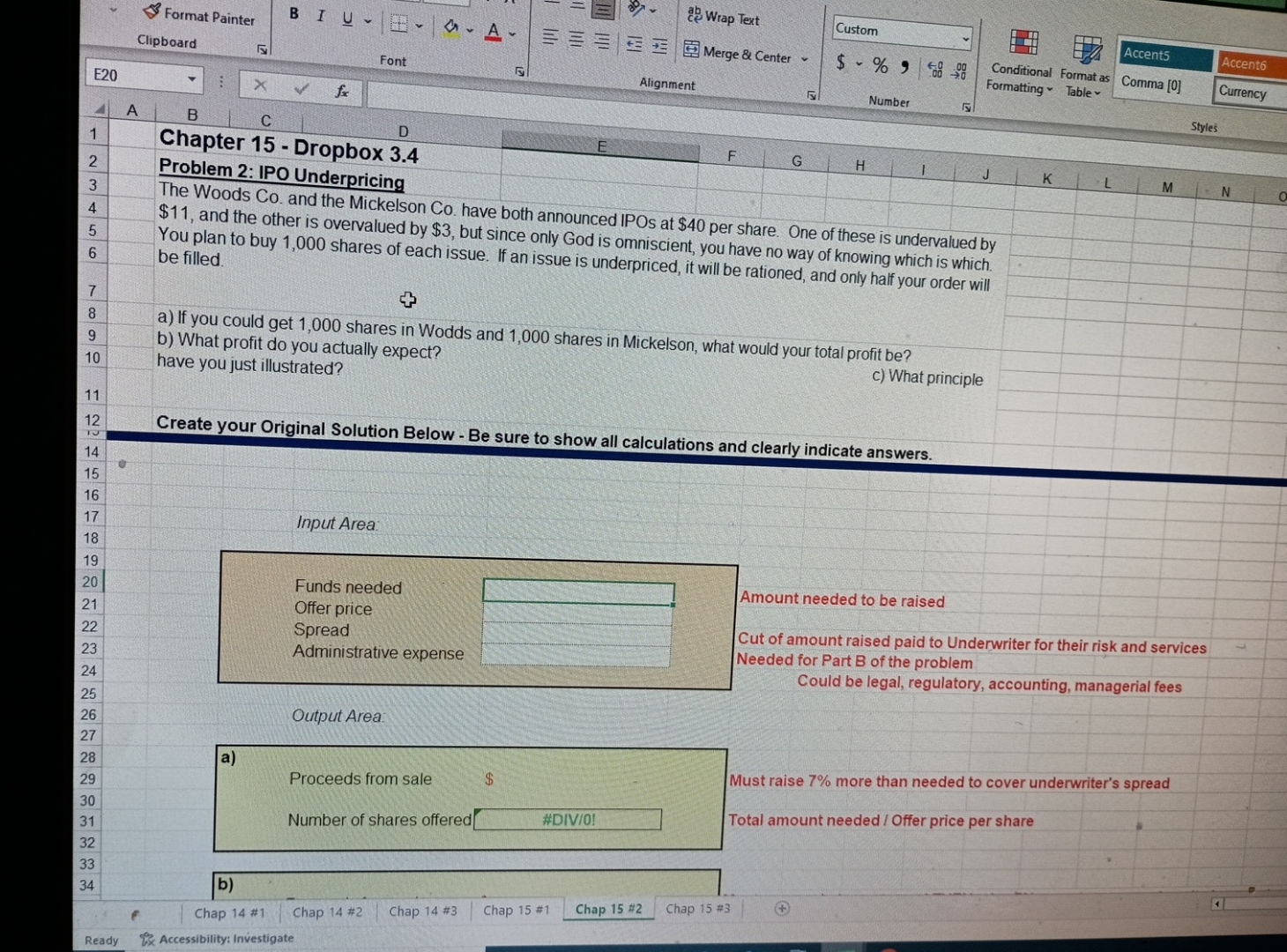

Chapter Dropbox

Problem : IPO Underpricing

The Woods Co and the Mickelson Co have both announced IPOs at $ per share. One of these is undervalued by $ and the other is overvalued by $ but since only God is omniscient, you have no way of knowing which is which. be filled.

a If you could get shares in Wodds and shares in Mickelson, what would your total profit be

b What profit do you actually expect?

c What principle have you just illustrated?

Create your Original Solution Below Be sure to show all calculations and clearly indicate answers.

Input Area:

Amount needed to be raised

Cut of amount raised paid to Underwriter for their risk and services Needed for Part B of the problem

Could be legal, regulatory, accounting, managerial fees

Output Area:

a

Proceeds from sale

$

Number of shares offered

Must raise more than needed to cover underwriter's spread

Total amount neededOffer price per share

b

Chap #

Chap #

Chap #

Chap #

Chap #

Chap #

Ready

Accessibility: Investigate

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock