Question: Format Tools Add-ons Help Last edit was seconds ago E DE 1111 111 - Roboto GE Normal text BIYA 12 3.4. 5 1. 16 LO

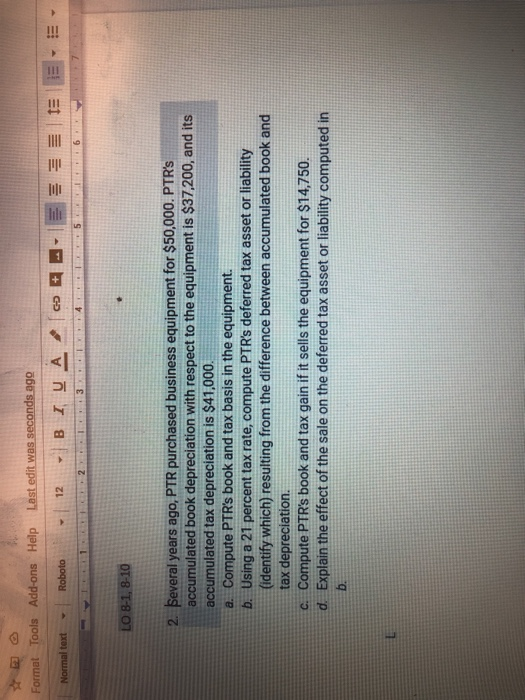

Format Tools Add-ons Help Last edit was seconds ago E DE 1111 111 - Roboto GE Normal text BIYA 12 3.4. 5 1. 16 LO 8-1, 8-10 2. Several years ago, PTR purchased business equipment for $50,000. PTR's accumulated book depreciation with respect to the equipment is $37,200, and its accumulated tax depreciation is $41,000. a. Compute PTR's book and tax basis in the equipment. b. Using a 21 percent tax rate, compute PTR's deferred tax asset or liability (identify which) resulting from the difference between accumulated book and tax depreciation C. Compute PTR's book and tax gain if it sells the equipment for $14,750. d. Explain the effect of the sale on the deferred tax asset or liability computed in b

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts