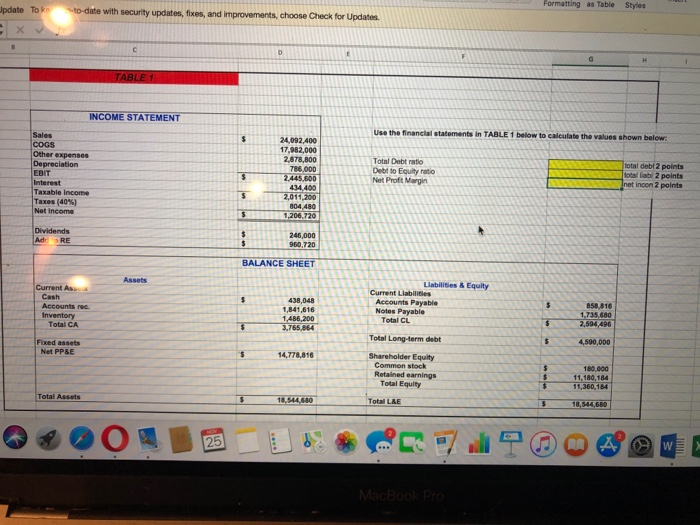

Question: Formatting as Table Styles Update To k to-date with security updates, fixes, and improvements, choose Check for Updates C D E F TABLE 1 INCOME

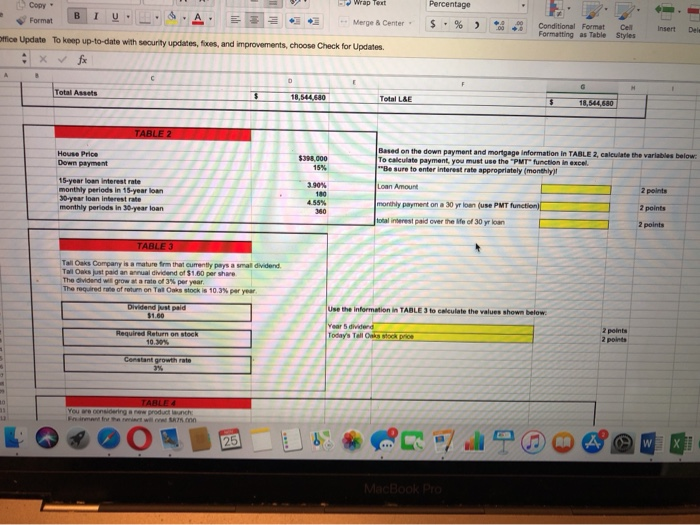

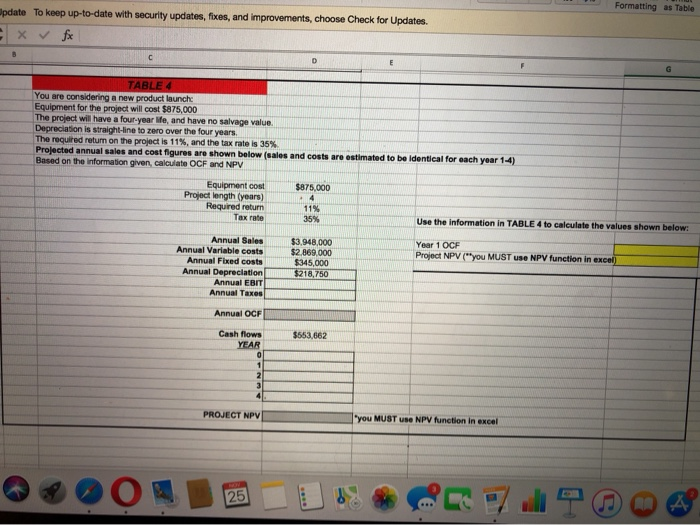

Formatting as Table Styles Update To k to-date with security updates, fixes, and improvements, choose Check for Updates C D E F TABLE 1 INCOME STATEMENT Use the financlal statements in TABLE 1 below to calculate the values shown below: Sales COGS Other expenses Depreciation EBIT Interest Taxable Income Taxes (40 % ) Net income 24,092,400 17,982,000 2,878,800 Total Debt ratio total debf 2 points total liabl 2 points Inet incon 2 points 786,000 2,445,600 434.400 2,011,200 804,480 1,206,720 Debt to Equity ratio Net Proft Margin Dividends AdrRE 246,000 960,720 BALANCE SHEET Assets Liabilities & Equity Current As Current Liabilitles Accounts Payable Notes Payable Total CL Cash Accounts rec. 438,048 1,841,616 1,486,200 3,765,864 858.816 1,735.680 2,594,496 Inventory Total CA $ $ Total Long-term debt Fixed assets 4,590,000 Net PP&E S 14,778,816 Shareholder Equity Common stock Retained earnings Total Equity 180,000 11,180,184 11,360,184 Total Assets 18,544,680 Total L&E 18,544,680 MacBook Pro lil 25 Wrap Text Percentage Copy B I A Format Merge & Center S % Conditional Format Formatting as Table Styles Cell Insert Dele Office Update To keep up-to-date with security updates, fixes, and improvements, choose Check for Updates. x f A G Total Assets $ 18,544,680 Total L&E 18,544,680 TABLE 2 Based on the down payment and mortgage information in TABLE 2, calculate the variabless below: To calculate payment, you must use the "PMT function in excel Be sure to enter interest rate appropriately (monthly) House Price $398.000 15 % |Down payment 15-year loan interest rate monthly periods in 15-year loan 30-year loan interest rate monthly periods in 30-year loan 3.90% 180 Loan Amount 2 points 4.55% monthly payment on a 30 yr loan (use PMT function) 2 points 360 total interest paid over the life of 30 yr loan 2 points TABLE 3 Tall Oaks Company is a mature frm that curently pays a small dividend Tall Oaks just paid an annual dividend of S1.60 per share The dividend will grow at a rate of 3 % per year The required rate of return on Tall Oaks stock is 10.3 % per year Dividend just paid $1.60 Use the information in TABLE 3 to calculate the values shown below Year 5 dividend Today's Tall Oaks stock price 2 points 2 points Required Return on stock 10.30% Constant growth rate 3% TABLE 4 You are considering a new product launch Fninment frr the neminet wil o S75 00n 25 X MacBook Pro Formatting as Table pdate To keep up-to-date with security updates, fixes, and improvements, choose Check for Updates. x f E TABLE 4 You are considering a new product launch: Equipment for the project will cost $875,000 The project will have a four-year Me, and have no salvage value. Depreciation is straight-line to zero over the four years The required return on the project is 11% , and the tax rate is 35%. Projected annual sales and cost figures are shown below (sales and costs are ostimated to be identical for each year 1-4) Based on the information given, calculate OCF and NPV Equipment cost Project length (years) Required return Tax rate $875,000 4 11% 35% Use the information in TABLE 4 to calculate the values shown below: Annual Sales Annual Variable costs Annual Fixed costs Annual Depreciation Annual EBIT Annual Taxes $3,948,000 Year 1 OCF Project NPV ("you MUST use NPV function in excel) $2,869.000 $345,000 $218,750 Annual OCF Cash flows $553,662 YEAR 0 3 4 PROJECT NPV "you MUST use NPV function in excel 25

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts